Stock Market Futures Considerations For December 21, 2017

The S&P 500 (NYSEARCA:SPY) is recovering some of yesterday’s losses with a morning rally to start the day. 2700 is the big round number to watch again today – definitely some psychological trading resistance there. Once again we’ll watch how price reacts to today’s initial move higher. In the commentary below I share my outlook and analysis on key stock index futures, along with crude oil.

You can access today’s economic calendar with a full rundown of releases.

S&P 500 Futures

When uncertainty turns to certainty, markets are usually pleased – but as a tax plan is signed surely to give small business owners a real boost, prices are stagnant. We may be a bit landlocked into the end of the week. As I mentioned yesterday as a likelihood, we did see another dip – and it is that dip that is bouncing once again. Retracements have been shallow, overall, and should continue to be shallow unless profit taking catches hold. The levels near 2689 will be resistance if we have more downside ahead. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2690

- Selling pressure intraday will likely strengthen with a failed retest of 2680.5

- Resistance sits near 2689 to 2697.75, with 2702.75 and 2706.5 above that.

- Support holds between 2688.5 and 2682.5, with 2675.5 and 2671.25 below that.

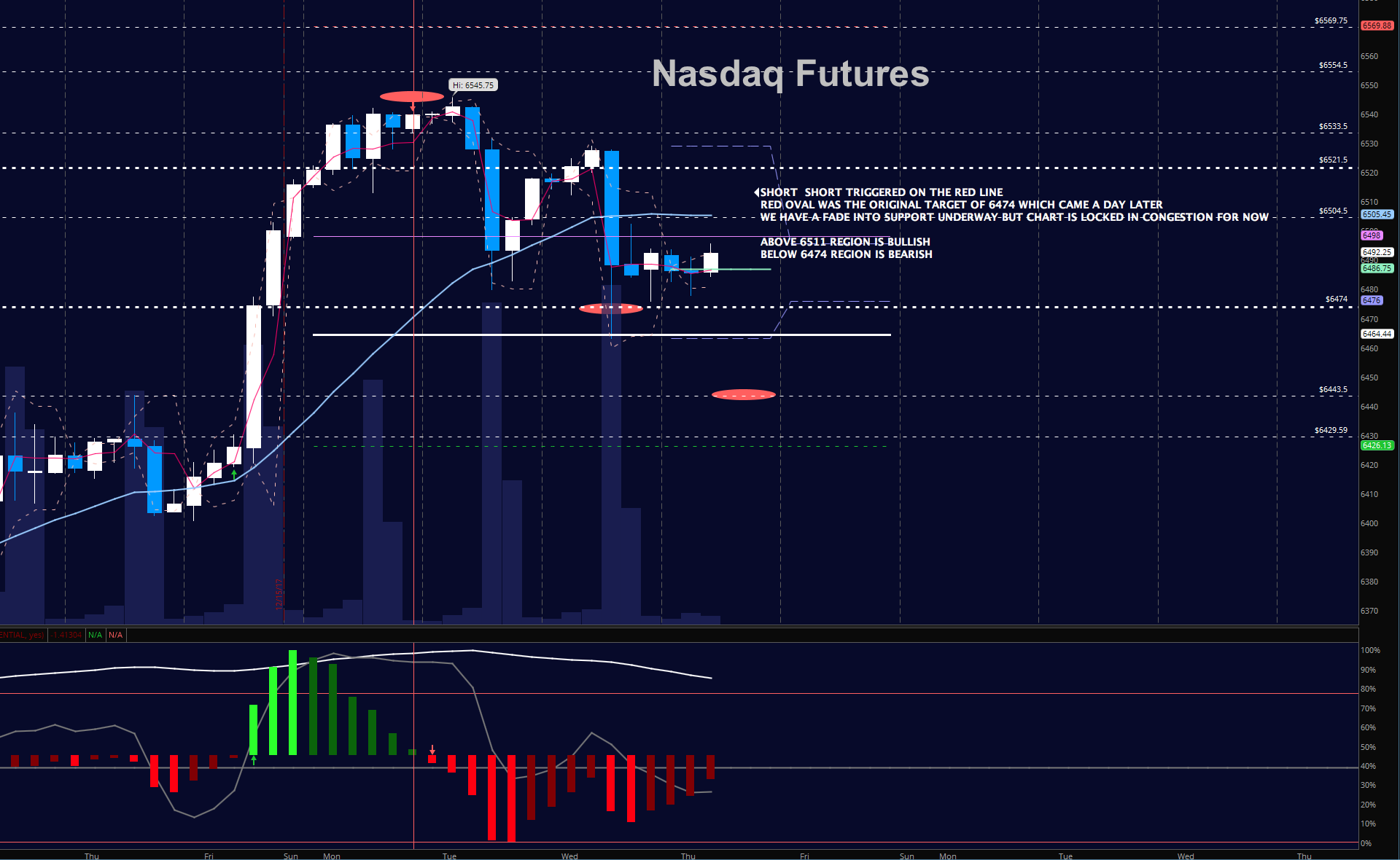

NASDAQ Futures

Lower highs faded yesterday as the highs did the day before suggesting some profit taking and some reversion to the mean behavior. We did find the target at 6474, but we faded into the weekly pivot near 6464 before recovering. The level to breach today is 6511.5 for buyers to command control. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6511.5

- Selling pressure intraday will likely strengthen with a failed retest of 6474.5

- Resistance sits near 6504.5 to 6522.5 with 6534.75 and 6545.75 above that.

- Support holds near 6480.5 and 6464.75, with 6443.75 and 6434.75 below that.

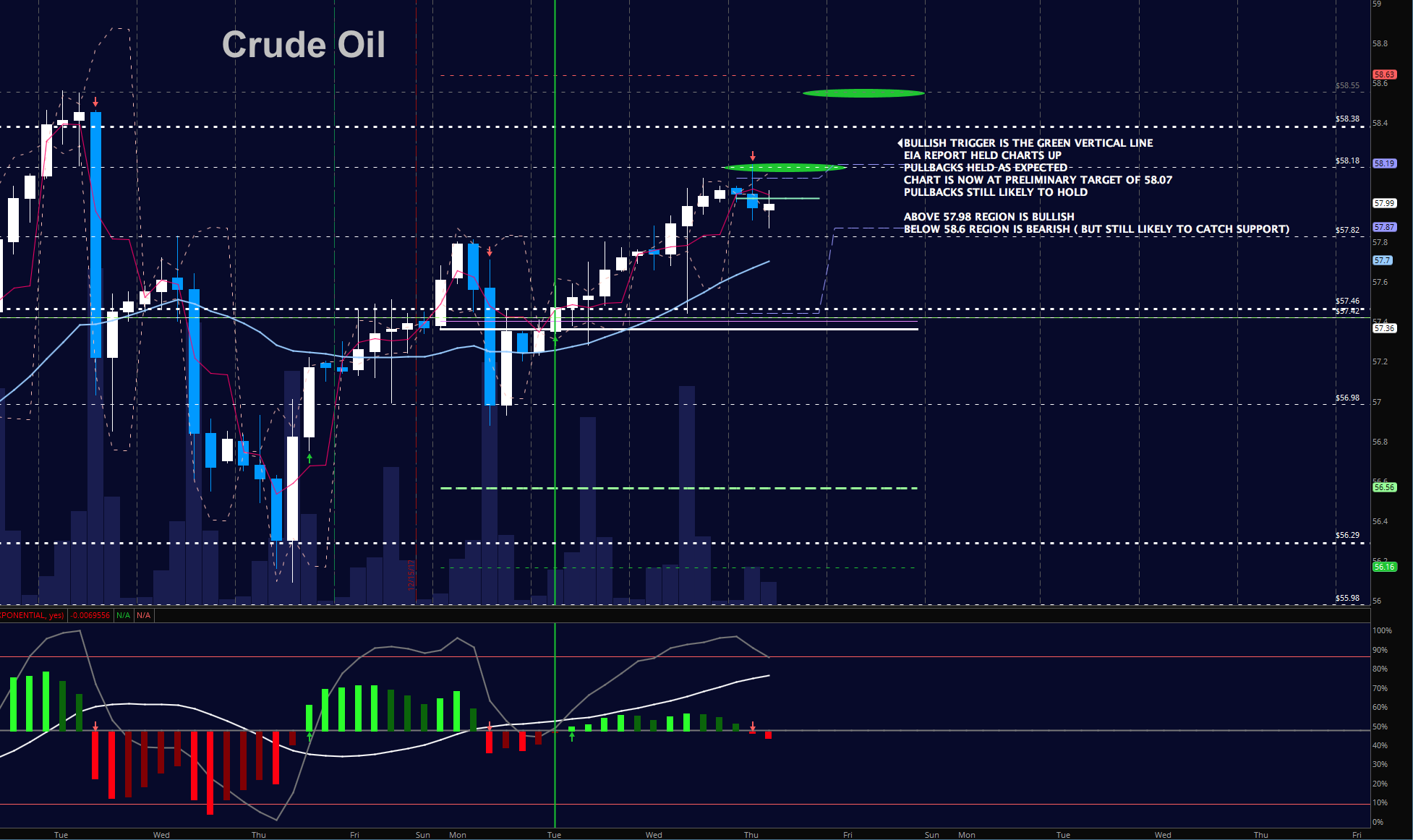

WTI Crude Oil

After a quiet night traders pushed prices into higher support near 57.8. This will be the higher support to watch if prices are to move quickly upward. We are still in a grinding bullish formation, so even if we see deep dips, they will not reverse the upward direction of the chart without a catastrophic news event of some kind. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 58.2

- Selling pressure intraday will strengthen with a failed retest of 57.6

- Resistance sits near 58.16 to 58.43, with 58.65 and 58.89 above that.

- Support holds near 57.8 to 57.57, with 57.12. and 56.6 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.