The situation is turning into a Catch-22. The U.S. economy is increasingly reliant on debt.

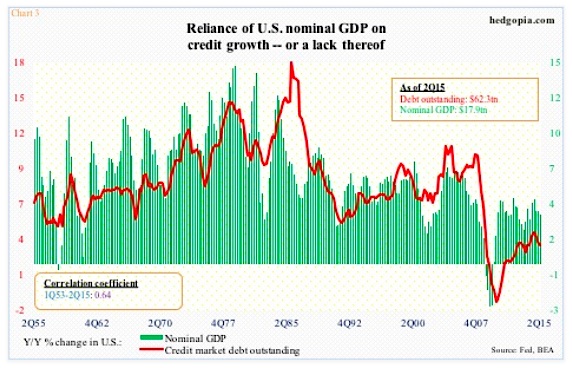

Chart 3 (below) plots year-over-year change in nominal GDP and credit market debt outstanding, with an R of 0.64 between 1Q53 and 2Q15.

As goes the red line, so goes the green bars.

YOY % Change – Nominal GDP vs Credit Debt

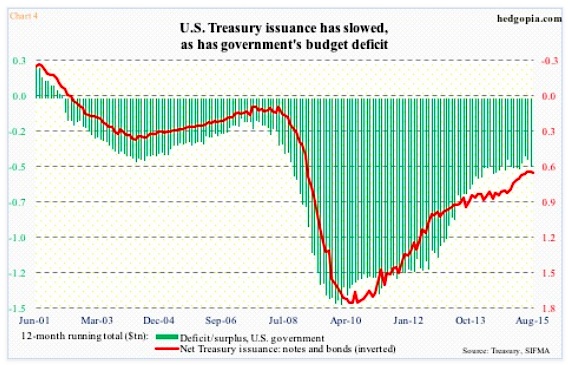

No doubt, there has been improvement in the federal budget deficit. In February 2010, the 12-month running total came in at $1.48 trillion, even as the Treasury issued $1.63 trillion in Treasury notes and bonds; most recently, the former dropped to $488 billion in July and the latter to $622 billion in August (Chart 4). Nonetheless, the nation still runs a deficit. This in the midst of a recovery, no matter how tepid.

Debt continues to grow, and does not look like a trend change is coming any time soon. Come October, the debt ceiling will be raised again.

Hence the importance of Chart 1. In 2Q15, interest payments were 2.52 percent of federal debt. Let us assume for a moment that we do begin a Fed tightening cycle and in due course the red line rises by a full percentage point. Then we are looking at $639 billion in interest payments, versus $457 billion in 2Q15 – for a difference of $182 billion! No chump change. In 2Q15, federal taxes on corporate income were $448 billion (at a seasonally adjusted annual rate).

ZIRP is helping suppress interest payments on government debt – 2Q15 was unchanged from 2Q11, although debt grew by nearly $4 trillion. The Fed would not want to rock this boat.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.