It has been more than 18 months since the stock market experienced a pullback that exceeded 10%. The last one was April to June of 2012. At that time, the long-term bond market was peaking, the Euro Summit was in full swing, and the Euro Debt Crisis was peaking. It’s wild to think that only months later, the “Great Rotation” from bonds to stocks began taking shape, hitting its stride in 2013 amidst plenty of disbelief.

It has been more than 18 months since the stock market experienced a pullback that exceeded 10%. The last one was April to June of 2012. At that time, the long-term bond market was peaking, the Euro Summit was in full swing, and the Euro Debt Crisis was peaking. It’s wild to think that only months later, the “Great Rotation” from bonds to stocks began taking shape, hitting its stride in 2013 amidst plenty of disbelief.

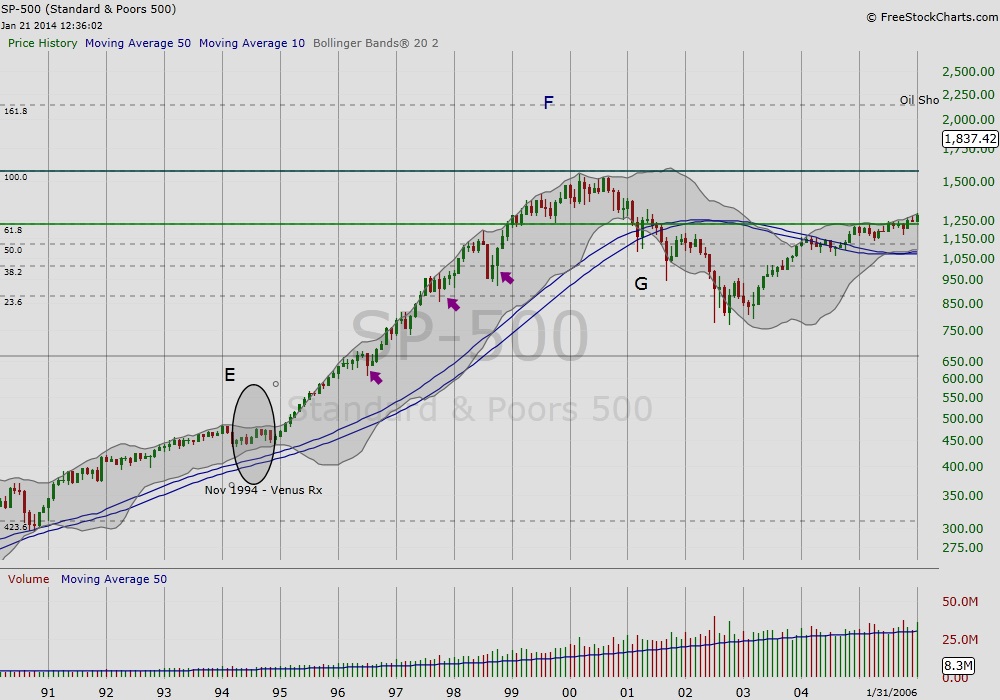

Today, the naysayers are fewer compared to a year ago, a sign that this stock market is moving into the middle stages of its cyclical advance. However, as we can see from the S&P 500 monthly chart below, even the great bull market of the 1990’s took a few rests. The first substantial stock market pullback following the recovery of the early 1990’s recession occurred around the 18 to 20 month marker (the first arrow). While history doesn’t always repeat, it often offers guideposts. Based on this time metric, a stock market pullback is likely on the horizon.

Figure 1, Monthly Chart of S&P500 in the 1990’s

Whether the stock market pulls back soon or just keeps trucking along (or even trades sideways), it’s important to note that the economy is improving. With this in mind, it is a good time to follow money flows, as this will provide clues where the best opportunities are. Also be aware that the middle stages of a bull market are much less straight-forward to read. Many winners are well above visible supports and the market can go side-ways for months before continuing with the trend. This will offer opportunities to those that are aware of the “next stage,” as the cycle continues to unfold. Thanks for reading.

Twitter: @RinehartMaria

Charts courtesy of FreeStockCharts.com

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.