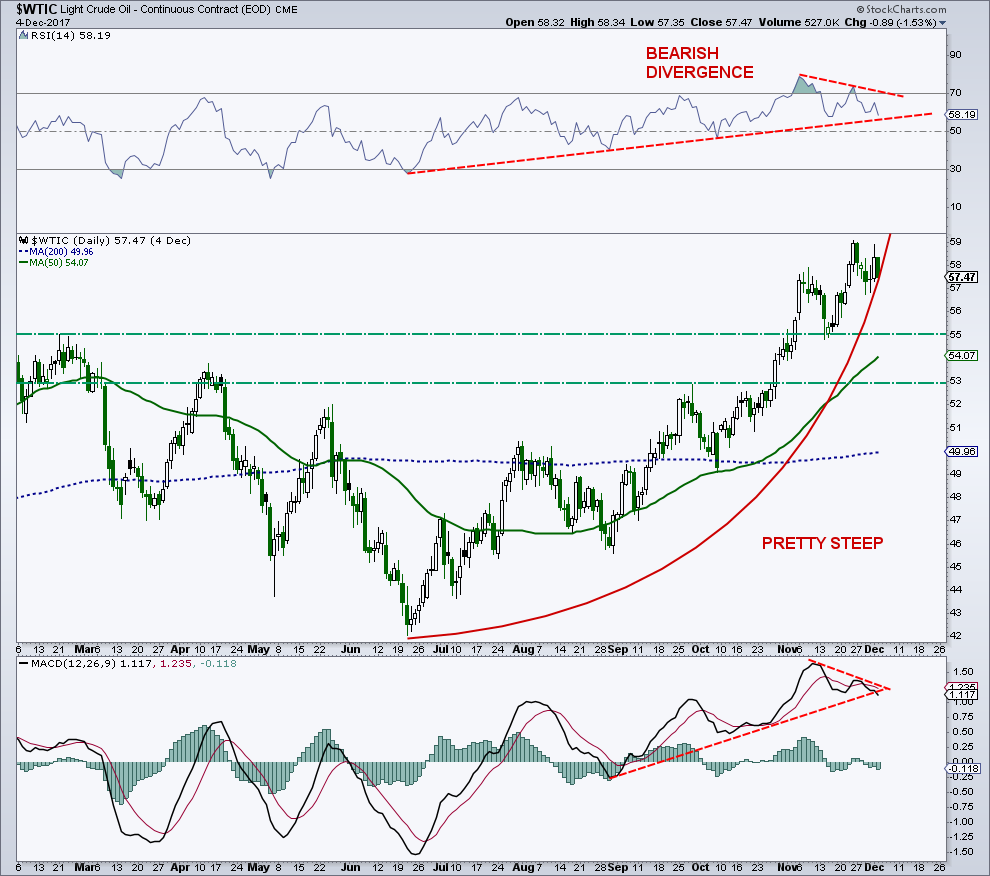

West Texas Crude Oil (WTI) is currently trading just above $57/barrel, after pulling back from the $59 level.

The recent highs mark the highest level for WTI crude oil prices since way back in July 2015.

On a daily basis, the 14D RSI recently hit extremely overbought territory, also for the first time in many years. We now have one bearish divergence on the 14-day RSI as well as the daily MACD. This could cause some backing and filling short-term.

As long as any pullback holds the 53/55 region, crude oil looks like it will make new highs.

Longer term, I’m still worried by the extremely bearish COT data and the excessive speculation in the market, but so far, this rally has ignored this data. Sentiment is fairly bullish for the first time since January, which was not a good time to initiate positions. However, sentiment has room to get even more bullish. As long as support holds, I will stay moderately bullish here.

WTI Crude Oil Chart

Thanks for reading.

Feel free to reach out to me at arbetermark@gmail.com for inquiries about my newsletter “On The Mark”. Thanks for reading.

Twitter: @MarkArbeter

The author is short gold via a position in DUST at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.