Last month we posted an analysis of the United States Oil Fund (NYSEArca: USO) to show how the year-long rally in crude oil was probably nearing an end.

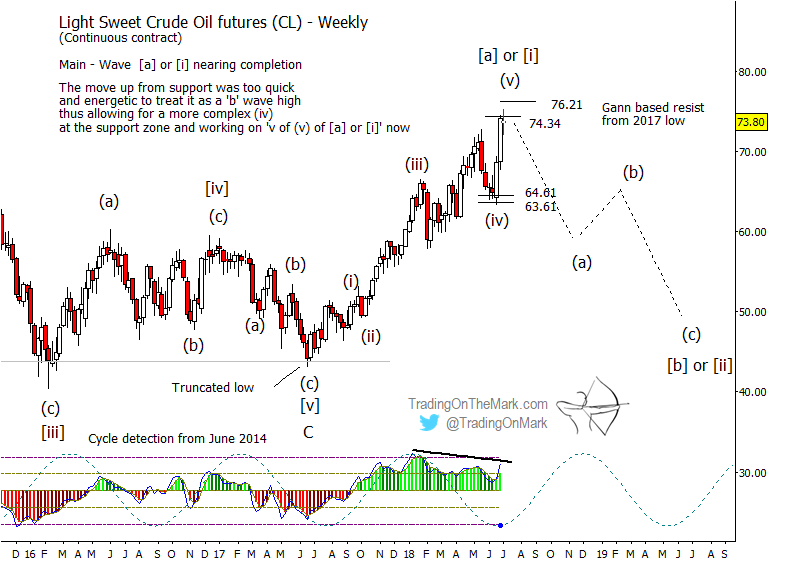

In today’s post we offer a chart of crude oil futures to show how the upward pattern might be complete, setting the stage for a downward turn.

Price is testing some Gann-based resistance levels after having completed what appears to be a five-wave move up from last summer.

One scenario would have the past year of rallying prices be the first part – wave [a] – of a large correction.

An alternative scenario is that the year-long rally might have been the first part – wave [i] – of a multi-year impulsive move upward.

Crude Oil Futures Chart with Elliott Wave/Gann Overlay

Regardless of which scenario prevails, the near-term forecast is downward from approximately the current area unless the resistance levels shown at 74.34 and 76.21 are breached. At the very least, traders who are currently in long positions should update their stops and profit-taking.

Note how the 47-week cycle is currently at a low while the momentum indicator shows negative divergence versus price. That suggests the cycle may have inverted. Even though the timing predicts a cyclic trough right now, the presence of a cycle inflectioncan mark a price high.

With morning and evening updates every trading day, Trading On The Mark offers charts and analysis on time frames ranging from weekly to intraday for the S&P 500, crude oil, the Euro, Dollar Index, treasury bonds, and gold.

This summer, we’re making a special offer available for extra savings. Take out a year-long subscription to our Daily Analysis service and we’ll deduct the cost of three months of service. Basically you get a whole summer of charts for free! The coupon code to take advantage of this offer is “summer”.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.