However, the fact that the positioning was so skewed, far beyond any levels previously seen, we wondered if there was something that had structurally changed in the market. This was a source of great debate at the time, even among our firm. From the 2014 post:

Is this extreme positioning a sign that oil prices are about to nosedive? We’re not so sure. Oil prices, while at the upper end of the range of the past few years, have not experienced a rise anywhere commensurate with the rise in Large Specs’ long positioning. Therefore, perhaps there is a structural change in the data that we are not aware of. We do know that long-only commodity funds and ETF’s may be distorting the COT figures a bit. Regardless, on a short-term momentum and rate-of-change basis, the data still appears relevant. And based on those metrics, Large Spec positions are elevated to an extreme.

The one catch regarding the structural change argument is that we don’t observe the same behavior in other futures’ COT data. If, for example, long-only funds were distorting the net-long positioning of Large Speculators, we would expect to see the same types of extreme COT readings across other futures contracts that we see in Crude. That is not the case. Therefore, it is possible that Large Specs, aside from some structural change, really are extremely off-sides to the long side of crude. That would be a foreboding sign for the price of oil. While it is close to breaking out above 3-year highs, we would be on the lookout for a failed breakout if a new high does materialize. Given their historical track record at extremes, Large Speculators are not likely to be big beneficiaries in the long-run from an impending rise in crude prices.

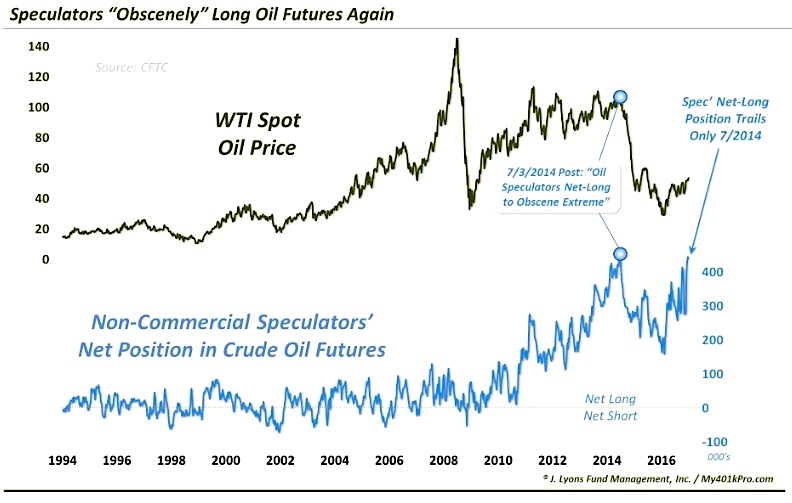

Thus, while we were open to the possibility of a structural shift in the data, our hunch was that Speculators were indeed overloaded to the bullish side of the boat. As we wrote on the chart, “it strains credulity that they will be right to that extreme”. As luck would have it, oil prices topped out that very week. They would go on to drop 50% by the end of the year, and 75% by early 2016.

We say “luck” because, in actuality, we could have posted a chart of record Speculator net-long positions at several points during the previous 3 years. It just wasn’t until June-July 2014 that it mattered. Thus, identifying an extreme is not difficult – identifying when it will make a difference is. So, it was certainly a bit of luck that we posted that chart when we did, “calling” the top in oil.

We bring up this episode and lesson now because of our present circumstances. Specifically, after a substantial unwinding of the Speculators’ long position during the July 2014-2016 rout in oil prices, the bounce in oil over the past 12 months has seen them rebuild their position. And as of last week, they were net-long over 440,000 contracts, 2nd only to June-July 2014.

Will this “obscene” net-long position result in the severe headwind for oil prices as it did last time? Again, we can see that the position is extreme, but we don’t know when that extreme will hit the tipping point. Crude oil futures speculative positions could continue getting more extreme, indefinitely. However, we will say that these are not the conditions that oil bulls want to see when considering the prospects for another sustainable run higher.

We can’t predict for sure when the next shoe will drop in the oil market. These Speculators may continue to be correct in their bullish posture for awhile. However, given their obscene position, you can bet that eventually they’re going to get lit up again.

Twitter: @JLyonsFundMgmt

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.