Speculators in crude oil futures are back near their “obscene” record net-long position set just prior to the 2014 collapse in oil prices.

Here’s why oil bulls should be worried about current crude oil futures speculative positions…

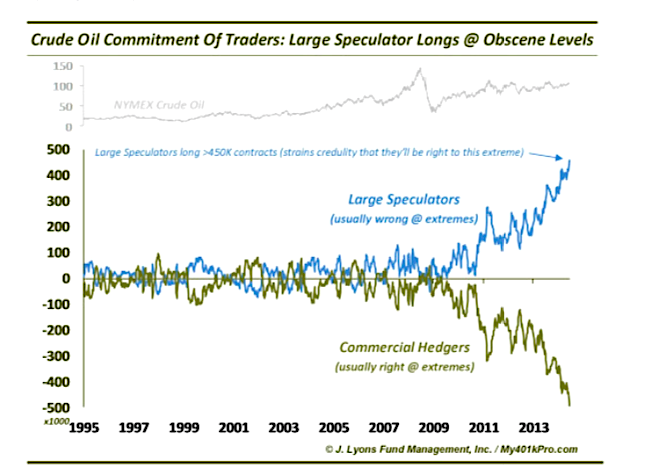

When we started posting our charts on social media and writing this blog some three years ago, one of the most popular early posts dealt with trader positioning in crude oil futures. That was at the beginning of July 2014, and to this day it remains one of our most popular posts. The title of the post was “Large Speculators Net-Long To Obscene Extreme”. And to look at the chart was to instantly understand the impetus behind the title.

Chart from July 3, 2014 post:

At the time, the trajectory of the record net-long position in crude oil futures by Non-Commercial Speculators (and by extension, the record net-short position by Commercial Hedgers) had gone fully parabolic. In the case of the Speculators, prior to 2013, their largest ever net-long position in crude oil futures was 276,000 contracts, and prior to 2011, the record was 176,000 contracts. At the end of June 2014, their net-long position was a record-smashing 459,000 contracts. On the flip side, Hedgers’ net-short position had grown to a record 492,000 contracts.

Why was that important? As we have explained on many occasions in these pages, this data from the CFTC’s Commitment Of Traders (COT) report provides a very useful look at the positioning of various groups of traders. The 2 biggest groups are Non-Commercial Speculators and Commercial Hedgers:

- Non-Commercial Speculators are by and large commodity pools and hedge funds that exist mainly to trade the market long and short. These funds are normally trend-following entities. And while they can be on the correct side of a long trend, at extremes they are considered “dumb money” as they are typically “off-sides”.

- Commercial Hedgers are typically financial firms and institutions involved directly in an industry reliant upon a particular commodity. Most of the time, they are truly “hedging” within the commodity market, primarily taking the other side of the Speculators’ trades. Therefore, at extremes and key turning points, they are most often correctly positioned. For that reason, and partly because they are more often intimately familiar with the commodity in question, they are considered the “smart money”,

Given the above primer, the Speculators’ record long position back in early July 2014 naturally had us concerned about a potentially significant drop in oil. Should oil prices begin to turn down, the record long Speculator position represented a massive amount of money at risk of exiting the market.

continue reading on the next page…