US Dollar Index: At long last, resistance at 97 was won over. But non-commercials continue to act as party poopers.

Net longs in the US Dollar Index continue to shrink – now at 18-week low.

February 26 COT Report Data: Currently net long 29.4k, down 1.9k.

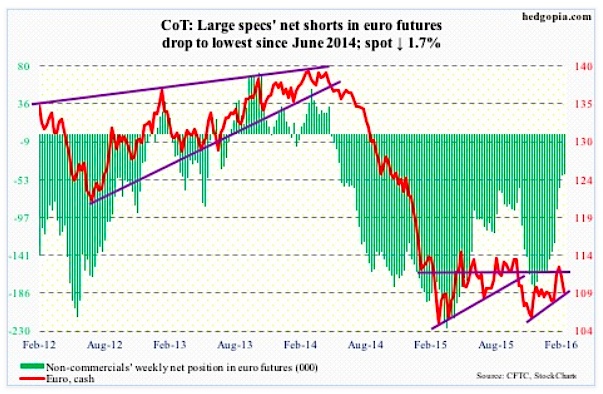

Euro: January’s final reading of Eurozone inflation was revised lower. The annual inflation rate was originally estimated at 0.4 percent, which has now been revised lower to 0.3 percent, although higher than 0.2 percent in December.

This probably gives more fodder for ECB doves that continue to press for more stimulus. In the January meeting, the governing council unanimously concluded that their policy needed to be reviewed and possibly reconsidered in March.

The week brought some goodies for hawks as well. Household borrowing climbed 1.4 percent year-over-year in January, and the M3 money supply rose five percent, to €10.9 trillion.

The Euro has lost 111 support, as well as its slightly declining 200-day moving average. Intermediate-term, it can come under pressure. Weekly momentum indicators have just turned lower.

That is not what non-commercials seem to be expecting, though. Net shorts are the lowest since June 2014.

February 26 COT Report Data: Currently net short 46.9k, down 1.3k.

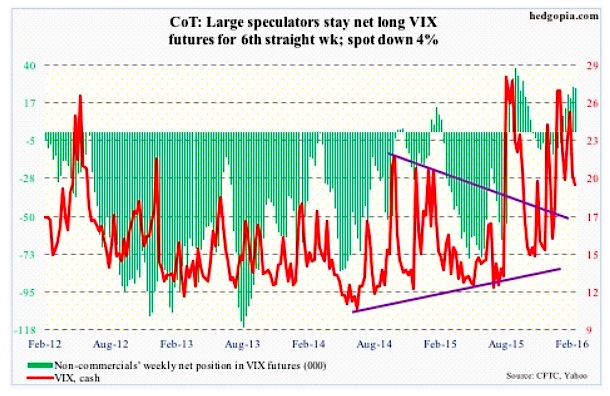

VIX: Stock market bulls should like the fact that the spot VIX Volatility Index just had a weekly bearish MACD crossover, and it has tons of room to go lower still on a weekly basis.

They wouldn’t like this, however. Daily momentum indicators are grossly oversold, with the now slightly rising 200-day moving average providing support on Friday. The spot VIX Volatility Index has not traded below that average since December 29th.

Near-term, daily should win.

February 26 COT Report Data: Currently net long 25.9k, down 805.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.