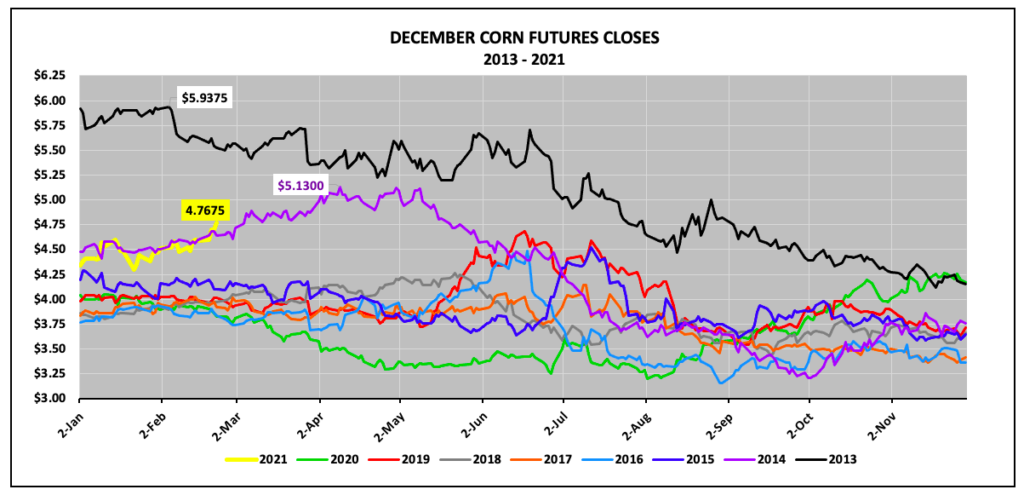

New-crop December Corn futures (CZ21) have been on a historic run early in the 2021 calendar year.

CZ21 traded up to a day high of $4.79 per bushel on February 25th with the current high close for the December contract coming a day earlier at $4.76 ¾. This marks the highest level new-crop December corn futures have traded in February since 2013. At that time the market was pricing in projected 2013/14 U.S. corn carryin stocks of just 632 million bushels via the February 2013 WASDE report, which resulted in December 2013 corn futures trading at an average of $5.62 per bushel January through April 2013.

Comparatively, as of the USDA’s most recent February 2021 WASDE report, 2021/22 U.S. corn carryin stocks were estimated at 1.502 billion bushels. If sustained (and/or unchanged) in future WASDE reports this would be 27% below the 5-year average; however still well above 2013/14 and even slightly better than 2014/15’s beginning stocks forecast as of the February 2014 WASDE report of 1.481 billion bushels.

As an additional point of reference, December corn futures averaged $4.75 ½ from January through April 2014, with the high close for that period (and also the entire calendar year) coming on April 8th at $5.13.

That specific close on April 8th and the continuation of the rally that spring was pricing in revised 2014/15 U.S. corn carryin stocks of 1.331 billion bushels as of the April 2014 WASDE report and a March 2014 Prospective U.S. corn plantings forecast of 91.7 million acres.

In my opinion 2014 continues to offer the stronger analogous comparison to 2021 from purely a U.S. corn balance sheet perspective with the USDA’s recent Ag Outlook 2021 U.S. corn planted acreage estimate of 92.0 million acres also in-line with 2014. The December corn futures high close in February 2014 was $4.71 ½, just 5 ¼-cents per bushel lower than the close in CZ21 this past Wednesday.

Why do carryin stocks matter as it relates to new-crop December corn futures? U.S. corn carryin stocks represent the supply cushion heading into the upcoming growing season. The tighter carryin stocks are, the more a premium is placed on adding acres, as well as, securing a “trendline” or better yield. When carryin stocks are considered “tight” the market is much more sensitive to the pace of spring planting; wanting to see the acres seeded on time such that acreage and yield can both be optimized.

That said with the USDA recently issuing a 2021/22 U.S. corn ending stocks estimate of 1.552 billion bushels, which included a record yield assumption of 179.5 bpa, 92 million corn acres and carryin stocks of 1.502 billion bushels, I have no argument with current price support in December 2021 corn futures above $4.50 per bushel. However as a point of caution to Corn Bulls (or those producers still waiting on making initial new-crop corn sales for 2021) keep in mind the following:

- Last year the USDA estimated 2020 U.S. corn planted acreage at 94 million acres at the February Ag Outlook Forum only to then raise its acreage forecast 3 million acres on March 31st, 2020 (approximately 6-weeks later) via the March Prospective Plantings report. The acreage adjustment alone increased projected U.S. corn supplies 535 million bushels.

- In 2014, December corn futures traded up to a day high and calendar year high of $5.17 per bushel on April 9th. However by June 30thDecember corn futures had fallen to $4.25 ¼. One month later, on July 31st December corn futures closed at $3.67 per bushel. The market completely collapsed in June, July, and August following what proved to be a then record corn yield in 2014 of 171 bpa. December 2014 corn futures eventually drifted down to a contract low of $3.18 ¼ on October 1st.

Right now corn “analysts” remain fixated on China-U.S. corn sales, planting delays with regard to Brazil’s winter corn crop, and an ole-fashioned U.S. corn/soybean acreage battle with both crops needing additional acres this spring. That said this seemingly pervasive, invincible “Bullish” view on corn futures (and soybeans) could look entirely different 3 to 4-months from now. Today…the trend is your friend…until it’s not. Markets cycle. Therefore scaling into rallies via short hedges at historic (and highly profitable levels) in February should not be discouraged.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.