One of the hottest investments over the past few months has been anything related to climate change.

The WilderHill New Energy Global Innovation index (NEX) is up 28.3% since the start of October.

It’s no coincidence that the rally heated up as devastating fires ripped across the Australian continent.

Further highlighting the significance of climate change as a trend and theme is Time magazine’s choice for Person of the Year – Greta Thunberg, the Swedish teen who inspired a global climate change movement.

If this is why anybody invested in the space, one could argue that it is a demonstration of first-level thinking, which is simplistic and superficial.

But support for the thesis mounts when you consider that Blackrock CEO Larry Fink announced last week that the firm is joining Climate Action 100+, an investor initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. Fink pledged the firm’s roughly $7 trillion in assets to be more climate aware.

Additionally, Microsoft CEO Satya Nadella stated, “This is the decade for urgent action for Microsoft and all of us,” and unveiled a plan to invest $1 billion to back companies working on technology to remove carbon from the earth’s atmosphere, a first step to becoming a carbon-negative company.

Climate Change Investing Options and Analysis

The conflict between these transitory and seemingly secular forces has us thinking more deeply about whether this is the start of a longer-term trend or another ‘inferno’ in the sector that, if extinguished, will leave nothing but ashes in investor portfolios.

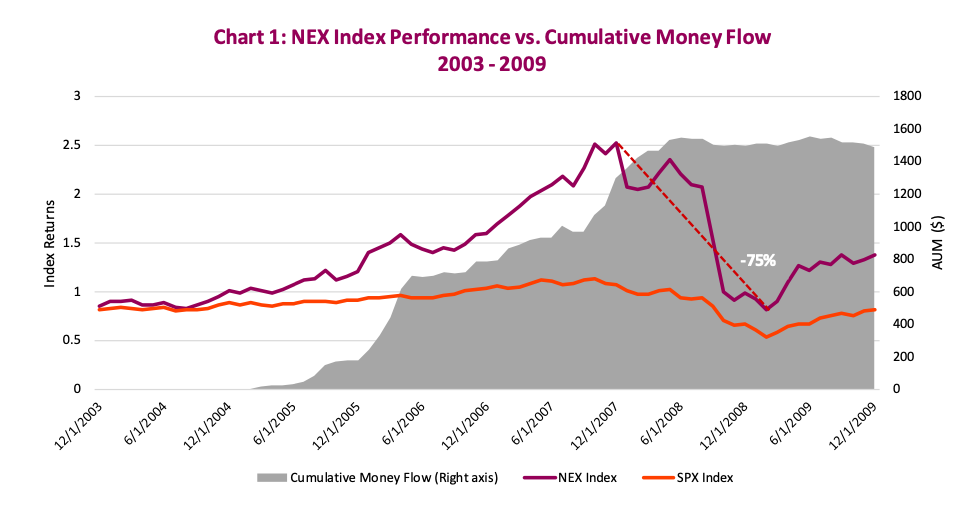

This isn’t the first time climate change investing and investments were in vogue. In 2007 the sector had a run and outperformed the broader market by more than 250% over a five-year period (Chart 1). Investors flocked to the space, pouring money into the ETF tracking the NEX index.

Then the great financial crisis happened and NEX fell by 75% (Table 1). Most of that money was late entering the rally, missing most of the gains and riding the index all the way down, as you can tell by the cumulative money detailed in Chart 1. Human behavior is somewhat predictable and, once again following the prolific run, we are currently seeing investors piling money into the space. For the past five years, that same ETF has been in net redemptions, but in April that changed and now money is once again pouring in.

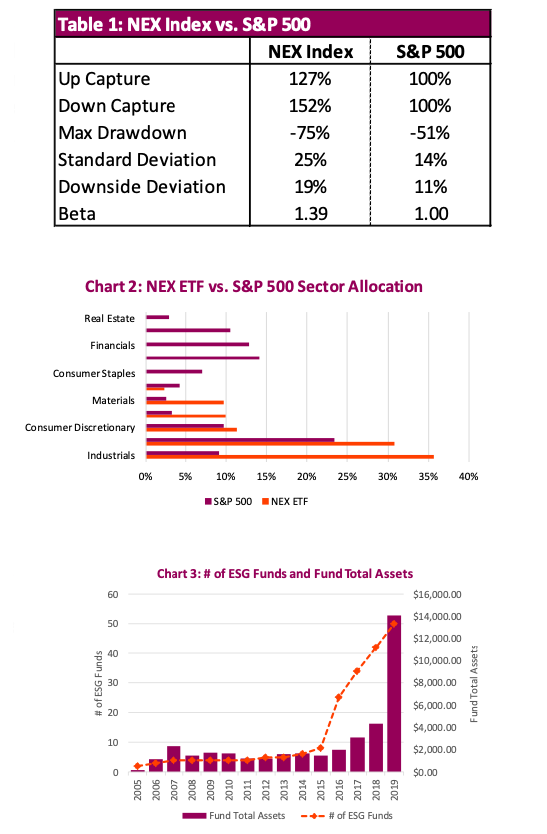

The NEX ETF does have more inherent risk than the broad market. There is a large concentration in Industrials and Technology (Chart 2) coupled with the fact that many of the holdings have low or no cash flow or earnings. This has led to a historical down capture of more than 1.5x the S&P 500 and the losses experienced during the crisis are still yet to be recovered.

Is this just another bull market trend and will it survive?

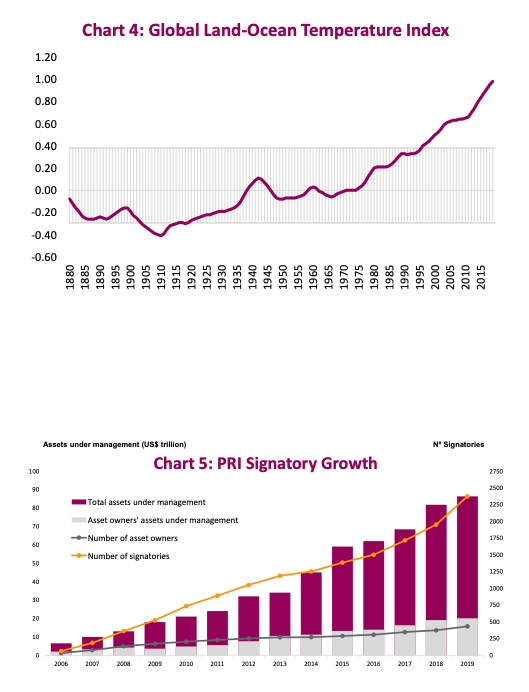

The frenzy in the space has caused inflated valuations and a surge not only in climate change but the whole Environmental, Social and Governance (ESG) space. The number of ESG ETFs and total assets surged in 2019 (Chart 3).

Some of these ETFs are investing in genuine climate-changing investments, but some appear be more of a marketing gimmick to take advantage of the hype. A lot of the new ESG products are probably closer to factor ETFs, overweighting and underweighting certain sectors and investments. This isn’t exactly impact investment that invokes the type of change that buyers might be looking for. The sentiment certainly draws parallels between recent booms and busts in cryptocurrency and cannabis, and the influx of investments that came to market during their peak valuations.

Why is this time different?

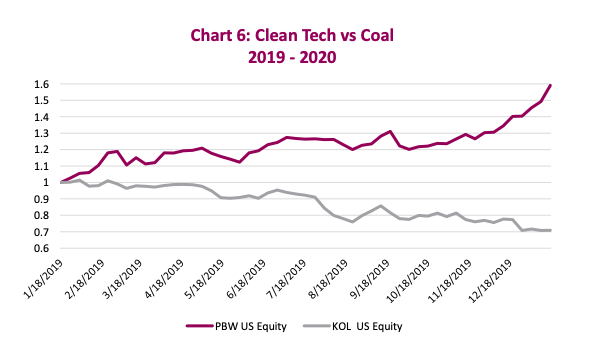

The much-anticipated climate crisis talked about in the early 2000s, sparking the prior rally, is no longer a theory—it is happening There’s no argument against ocean and atmospheric temperatures that continue to rise (Chart 4), despite big promises from countries around the world in the Paris Accord that was signed in 2016.

According to the Intergovernmental Panel on Climate Change (IPCC) – the United Nations body for assessing the science related to climate change – if emissions do not decline before 2030 and marked reductions are not achieved, by 2040 the atmosphere’s temperature will have risen by more than 1.5°C. This will produce rising sea levels, which will inundate coastlines, as well as intensify drought, fire, poverty and subsequent migration.

The desire for climate change has been a mainstream desire for years – even decades – but for investors it has always come with the prospect of sacrificing returns. That paradigm seems to be changing as we move into the second decade of this millennium.

The world is a different place now. Population growth and years of excessive use of fossil fuel have added to the fact that 21 of the hottest years on record have occurred in the past 23 years. That is why governments and major investors, like Blackrock, are putting their money where their mouth is. CEO Fink said, “The top issue that clients around the world raise with Blackrock is climate change.” He followed that up by stating the company will eliminate all coal investments throughout the firm’s $1.7 trillion in active products. Blackrock is not alone.

The UN-supported Principles for Responsible Investment (PRI) has grown rapidly since 2006. Its signatories – including asset owners, investment managers and service providers – oversaw US$90 trillion in assets under management in 2019 (Chart 5). This group also negatively screens for polluters and actively screens for investments that positively impact the environment.

Access to capital directly impacts the weight average cost of capital (WACC) for any company. When the WACC increases for a company, the present value of future profits is lower; conversely, when the WACC falls, the present value of that cash flow increases. Put another way, when it is easy and cheap for a company to raise money, the stock is worth more; the opposite is also true. This is part of the reason we are seeing a rise in the stock price of NEX constituent companies versus the Coal ETF (Chart 6).

Demand for climate change investments is clearly on the rise from both the public and private sector, and the supply of true-impact climate investments can not keep up. While that disequilibrium is aiding the rally in the near term, it should also support future valuations. The flood of capital is motivating entrepreneurs to innovate and design truly disruptive solutions. Unfortunately for the mass public, those private- venture deals are challenging to access.

If you are looking to re-allocate your portfolios to accommodate for climate-friendly strategies, regardless of which side of the argument resonates with you, you can incorporate either an active or passive investment strategy. If you want to actively invest in climate-change solutions, look for first movers in the space and companies that are embracing change and poised to grow to capitalize on the increasing shift in demand. Alternatively, if you’re considering climate change as a risk mitigation strategy, consider the downside risks of holding an asset that may lose value in an economy that is less carbon intensive. Building a portfolio that considers the question of climate can reflect diverse intents.

Climate change is at the forefront as a risk in terms of geopolitical tensions, consumer behavior, investors, and world business leaders. Climate change is not solely an environmental issue, but also now a global economics or world health issue. In fact, in the World Economic Forum’s Global Risk Report, all top 5 global economic risks are correlated to climate change. Although environmental risks have been on the radar in the past, 2020 marks the first time that it has taken up all five top spots.

However, the reality today is that a sustainable business is truly difficult to pull off. The greatest flaw of the sustainable business movement is that very few participants and adherents are willing to admit that achieving sustainability is difficult, without big changes in investment strategies. It is important to be wary of the sustainable investment sector—as money floods into the space, there is not enough real product.

Businesses are recognizing first-movers advantage and may be quick to exploit the trend for a blanket “sustainable” solution. Be cautious however; while the packaging may say “100% recyclable,” the contents may not be. For investors who want exposure to the space, there may be money to be made given the right investment opportunities. If you want to truly make an impact with your investments, however, some of the best impact-based opportunities are still likely through private capital market deals and probably easiest to access through a registered Investment Advisor.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.