The emerging markets are slowly working themselves into the investment conversation.

And although the broader ETF (EEM) or tracking indexes may only be “trading” material currently (beyond that is TBD), it is important to put this area on your radar.

The EM space stumbled badly in 2018 and was an early warning sign for global equities. But the current setup has been working and points to a bit more upside… and an eventual (and important retest).

Today, we’ll look at China and the iShares China ETF (NYSEARCA: FXI). Though it’s more of a developed market by size, it is in the mix and showing some constructive price action.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

I tweeted about this last week:

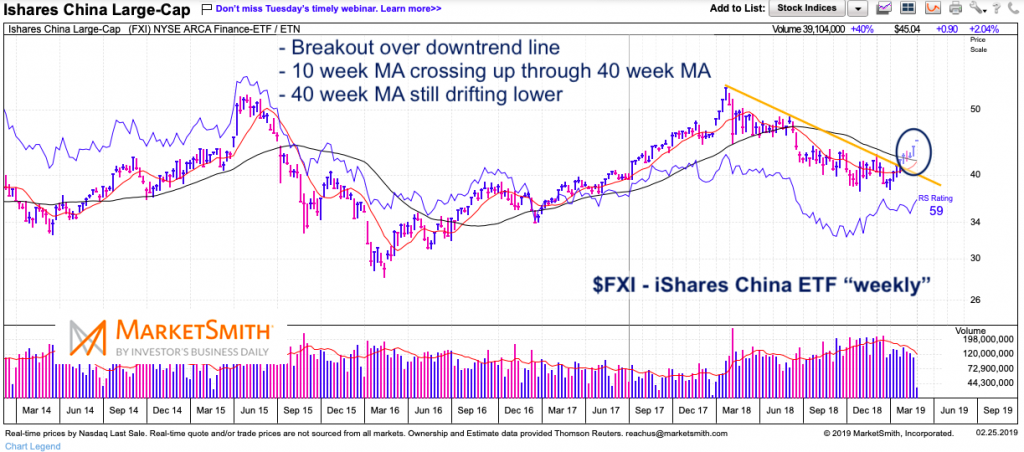

$FXI China ETF breaks out above downtrend line. #IBDpartner

— Andy Nyquist (@andrewnyquist) February 22, 2019

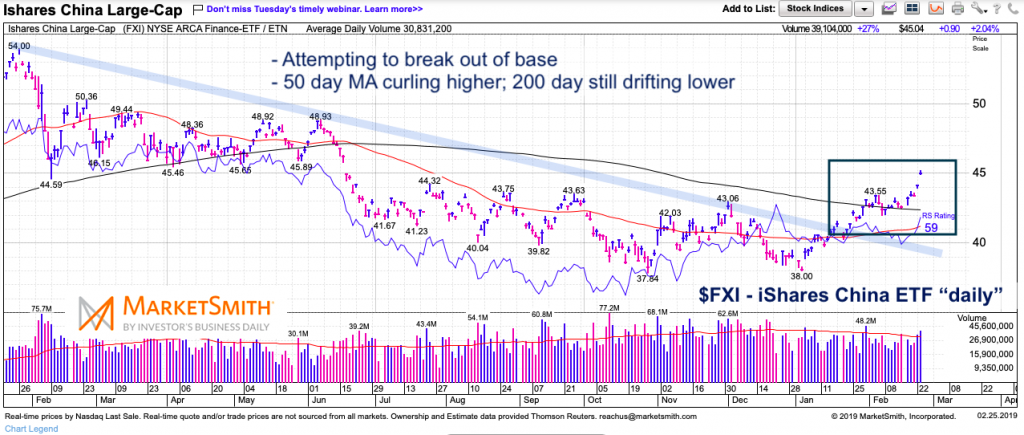

50-day MA curling higher. Constructive. Bulls awaiting volume thrust. @IBDinvestors — https://t.co/D1whPFhlMj pic.twitter.com/mUmksXsBp8

$FXI iShares China ETF “weekly” Chart

A wide angle view of China looks constructive, showing the ETF (FXI) breaking out above its multi-month downtrend line.

The 10 week moving average is turning higher as China attempts to put in a bottom. That said, the longer-term MA (the 40 week) is still drifting lower. This may limit near-term upside ($45-$48) until the 200 day flattens out.

$FXI iShares China ETF “daily” Chart

Zooming in, we can see the rounded bottom/base that is supporting the current rally. $45-$48 should slow the rally. If so, it’s important to monitor the character of the pullback… $42 is initial support while $40 should provide deeper support.

Also good to monitor the strength/weakness of the US Dollar in conjunction with other global and EM fundamentals.

Twitter: @andrewnyquist

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.