Recently, I have partnered with Arun Chopra on a new research business called Fusion Point Capital (read more on our offering below). We fuse together longer-term fundamental indicators with technical indicators to do historical studies. Today I want to look at the Federal Reserve (central banks) and the increasingly volatile currency markets. We’ll look at the Japanese Yen and US Dollar in light of today’s Federal Reserve meeting.

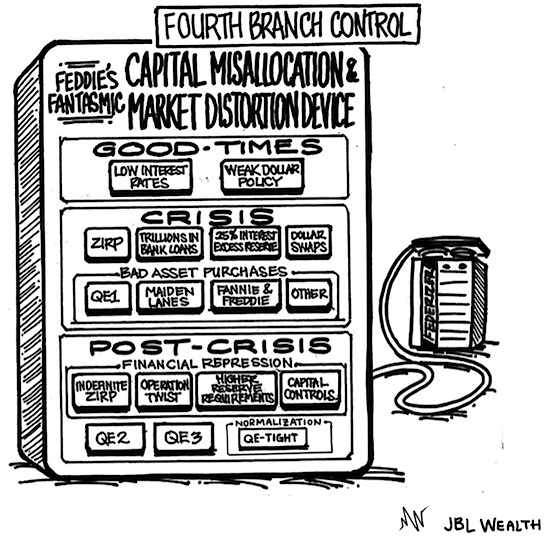

The Federal Reserve – the “Fourth Branch of Government” – meets today

There is a very high likelihood that they are going to double-down on “QE-Tight”, my term for the Fed raising the Fed Funds target rate for the second time in nine years (another 25 bps like last December), while maintaining its $4.5 Trillion QE-laden balance sheet (reinvesting interest and principal payments on maturing bonds).

The Fed has lost a lot of credibility over the last year, waffling and seeming lost, and it has to do with their policy divergence (i.e., raising rates when others aren’t). In Summer 2016, Vice Chairman Fischer and others repeatedly talked strongly about needing to raise rates, then alternatively Chair Yellen and others would say the “evidence” is not supportive of rate hikes (sometimes within minutes of each other as happened at the Jackson Hole meeting in August).

It became a daily case of Good Fed, Bad Cred with as many as 14 different Federal Reserve speeches in a week with mixed messages on the most important rate and currency in the world. The Fed is in a box, and it comes down to global implications of their actions.

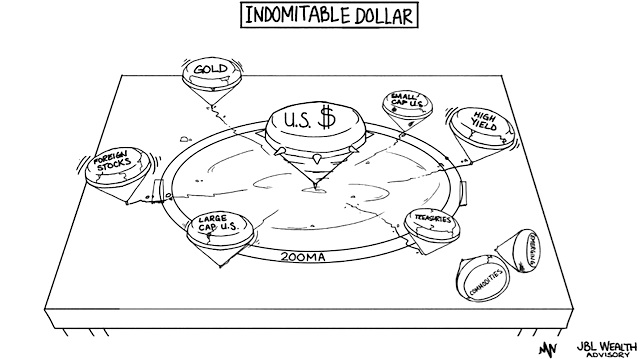

One of the main reasons the Federal Reserve has not hiked yet this year, is the continued strength of the U.S. dollar.

In 2014 and into early 2016, the U.S. dollar rose 25%, decimating oil, industrials, transports and sending the U.S. into an earnings recession. And, after the December 2015 rate hike, dollar strength in January put pressure on U.S. markets (remember the 10%+ fall – the worst ever start to a year). The Fed then met with its counterparts in Shanghai in February coming to the alleged “Shanghai Accord” to weaken the U.S. dollar and the Fed punted on anticipated rate hikes for 2016, cutting them from 4 to 2 and now to just this 1. At Shanghai and before, it seems the bogey for when the dollar becomes a Fed target is when the dollar index reaches the 100 level.

Another way to look at dollar strength is the “Dollar as Fed Funds Rate”. Fed Governor Lael Brainard described this in a September speech, saying that every 20% increase in the dollar is equivalent to a 2% increase in the Fed Funds rate. Considering the dollar is up 25% since 2014, the back of the envelope view of Brainard’s current “Dollar as Fed Funds Rate” is roughly 2.625% instead of the actual 0.375%.

That means if the Fed does tighten 25 basis points Wednesday, the implied rate would be 2.875% or close to 3% (again this is basic back of the envelope). Compare that to -0.4% in Europe. And, that doesn’t include further dollar appreciation that may soon come.

Things to consider going into this Fed meeting: (i) the Fed is the only major central bank raising rates (the ECB and BOJ are negative), (ii) there is a worsening global shortage of dollars and heightened credit risk due to the divergence in Fed policy, the Yuan devaluation, ongoing European bank stress, and carry trades (below), (iii) there is ~$10 trillion in new foreign dollar-denominated debt since 2008., $3 trillion of it in emerging markets susceptible to dollar strength, (iv) there is looming potential negative impact of another dollar surge on global growth and trade just as we are starting to overcome the downturn of 2014-2015, (v) the ongoing dollar drag on U.S. multinational earnings, and (vi) the potential for a surging dollar to damage oil pricing and the high yield market as it did from late 2014-early 2016. This full spectrum view of the implications week’s Fed meeting and potential dollar reaction is very important.

continue reading on the next page…