The dollar is currently trading around the 101.50 level, a 14 year high, and poised to break higher out of short term and longer term bull flags.

The market is ignoring the implications of more dollar strength, choosing to focus instead on stimulus and policy euphoria that hasn’t occurred yet and seems already priced in.

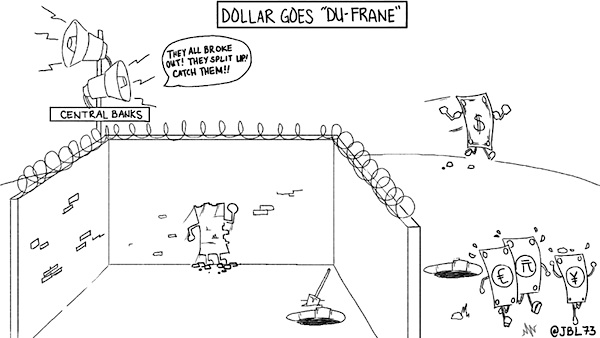

Now, while Andy the greenback has surged out of resistance on his way to Zihuatanejo, the Euro, and especially the Japanese Yen and Chinese Yuan have “broken out” to the downside.

The Chinese Yuan weakness is interesting in that the last two major Yuan devaluations in August of 2015 and January 2016 contributed to big sell offs in U.S. equities. But Yuan weakness since May of 2016 has decoupled from U.S. markets for now. The same can’t be said of Yen weakness.

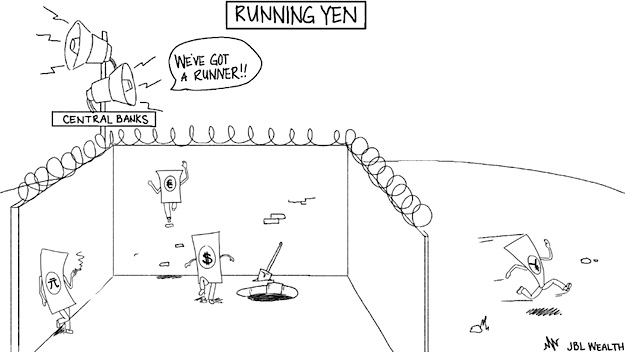

Earlier in 2016 the Yen was the one breaking out. It staged its first rally in years on the back of Bank of Japan negative interest rate policy, but by mid-summer the Yen halted its advance on BOJ hesitance to enhance zero interest rate policy, then completely fell apart when the BOJ embraced yield targeting in September – the implication being potential unlimited bond buying and thus potential unlimited digital Yen printing.

This last piece of information is key as the drastically weakening Yen is a boost to U.S. equities. As Ms. Watanabe, the archetypical Japanese housewife and retail trader looks to get a higher return on her savings than she can in negative interest rate Japan, she showers Wall Street with money. She can get a better rate of return in rising rate America and what’s more she and others can borrow cheaply in Japan and leverage up on U.S. equities. And it’s happening folks. It’s not just infrastructure and taxes. It’s not just rotation. It’s raining yen.

But before you say “hallelujah”, keep an eye on the Fed, and any rapid rise in the U.S. dollar as it could quickly put a damper on things no matter what policies are coming.

Important Note:

I’ve started a new venture, Fusion Point Capital, LLC, with Arun Chopra CFA CMT focusing on broad market communication, unique single stock strategies, and important trading opportunities. Inside the Market Intelligence Product on the site, Arun focused on timing the exact Yen top in the Summer of 2016 on numerous time frames. This led to major moves in related intra-market assets, including the breakout in risk assets. The following is an inside look at the chart communication. Members had access to real time videos as well.

Check out the site. It is useful for individual retail investors up to professional money managers.

Twitter: @JBL73

The authors may have positions in mentioned securities by the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.