Tariffs Take a Toll: What to Expect from Interim Auto Reports Next Week

It’s not quite the second quarter earnings season yet; that kicks off on July 15 with some of the big banks. In the meantime, investors will...

Archer Daniels Midland Stock (ADM): Base / Breakout Pattern In Play?

The commodities complex is mixed but still showing some inflationary pressures. Sure oil has rallied on Iran war fears, but it's still off its...

Which Q2 Earnings Reports Could Have Biggest Impact On Markets?

The unofficial start of the next earnings season is still roughly a month away, but recent research out of the University of California, San...

Stock Market Sector Insights: Energy, Bitcoin, and Retail

On Monday, I sat down with the incomparable Maggie Lake.

As she posts on her Substack page, “As ever with Mish, we got through a...

Bitcoin Trading Breakout Points To Higher Prices

Bitcoin bulls are ready to ride again.

After pulling back to an important price support zone and getting oversold, Bitcoin has hooked up and triggered...

Small Cap Stocks, Retail, Transports Provide Glimpse At Economy

Considering how much the market has absorbed and yet keeps on ticking, I thought we should look at what Druckenmiller calls the “inside” sectors...

S&P 500 Index Reaches Upper Price Resistance Band

The S&P 500 Index has rallied sharply off the April low.

That said, it has reached an important short-term price resistance area at its MOB...

Is Russell 2000 Building Bullish Base?

It's been some time since the Russell 2000 has been an out-performer.

And, although we propose a potential bullish pattern on the small cap Russell...

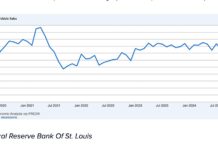

US Dollar Breaks Down; New Lows Forecast

The US Dollar currency has come under pressure lately and it isn't showing any signs of abating.

The dollar broke its uptrend line this week...

Magnificent 7 Shareholder Meetings to Provide Glimpse of Economy

Major tech-related companies host Annual General Meetings in the weeks ahead

Q1 earnings season was strong, but the collective macro outlook remains murky

AI is back...