Corn news and market analysis for the week of September 16, 2019.

September 2019 WASDE Corn Data Highlights:

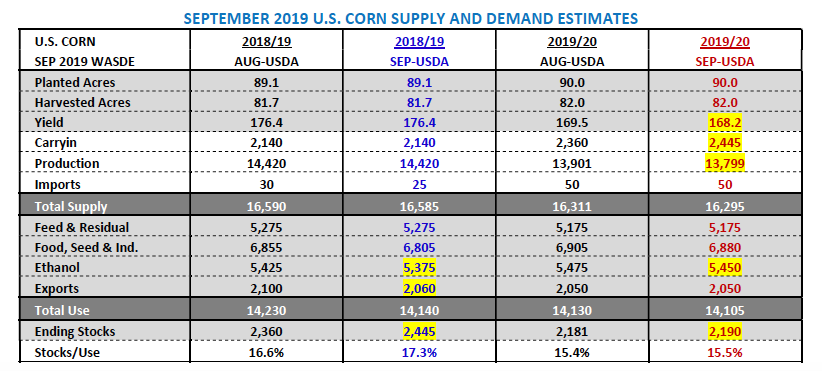

U.S. CORN S&D ADJUSTMENTS: On Thursday the USDA released its September 2019 WASDE report. In that report the USDA lowered the 2019/20 U.S. corn yield 1.3 bushels per acre to 168.2 bpa.

As a result total 2019/20 U.S. corn production fell to 13.799 billion bushels, down 102 million bushels versus a month ago. However…despite the yield and production declines both figures still proved higher than the average trade guesses of 167.2 bpa and 13.672 billion bushels.

Furthermore the entire supply-side reduction was once again undone by additional decreases to U.S. corn demand.

2019/20 U.S. corn carryin stocks moved up 85 million bushels due to cuts to 2018/19 U.S. corn ethanol demand (down 50 million bushels) and exports (down 40 million bushels). The USDA also lowered 2019/20 U.S. corn ethanol demand an additional 25 million bushels to 5.450 billion bushels. The net impact of the USDA’s September adjustments was a revised 2019/20 U.S. corn ending stocks estimate of 2.190 billion bushels versus 2.181 billion in August and the average trade guess of 2.002 billion.

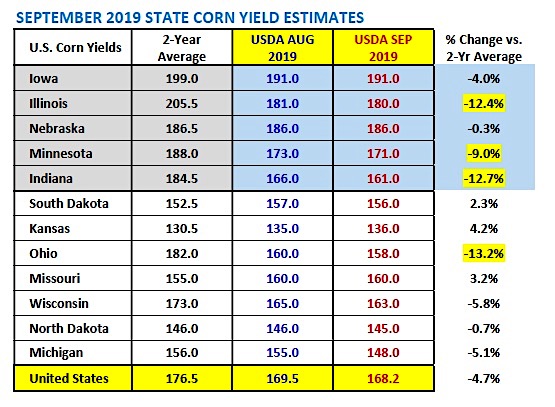

SEPTEMBER STATE CORN YIELD ADJUSTMENTS: The USDA made only minor adjustments to their September state corn yield estimates relative to a month ago.

A summary of the top 5 U.S. corn production states is as follows: Iowa’s corn yield was changed at 191 bpa versus 196 bpa in 2018 (-2.6%). Illinois’s corn yield was lowered 1 bpa to 180 bpa versus 210 bpa in 2018 (-14.3%). Nebraska’s corn yield was unchanged at 186 bpa versus 192 bpa in 2018 (-3.1%). Minnesota’s corn was down 2 bpa to 171 bpa versus 182 bpa in 2018 (-6%). And finally, Indiana’s corn yield was lowered 5 bpa to 161 bpa versus 189 bpa in 2018 (-14.8%).

CORN BULL WISH LIST: If you’re a Corn Bull you’re now hoping for a 2018 or 2010 type yield reduction, September to Final (January).

In 2018 the U.S. corn yield fell 4.9 bpa from September to Final, resulting in a total U.S corn production decline of 407 million bushels. In 2010 the yield decrease from September to Final was even more exaggerated totaling 9.9 bpa. That equated to total U.S. corn production falling 735 million bushels.

Is that type of yield reduction possible this year? I would say yes, absolutely.

More often than not I defer to the USDA estimate, especially this late in the growing season. That said 2019 has been anything but normal given the unprecedented planting delays and excessive moisture this past spring/early summer.

The reality is there has been so much variability this growing cycle with respect to large areas of drown out and uneven crop maturities, that I don’t believe the USDA can accurately assess “yield” at this time.

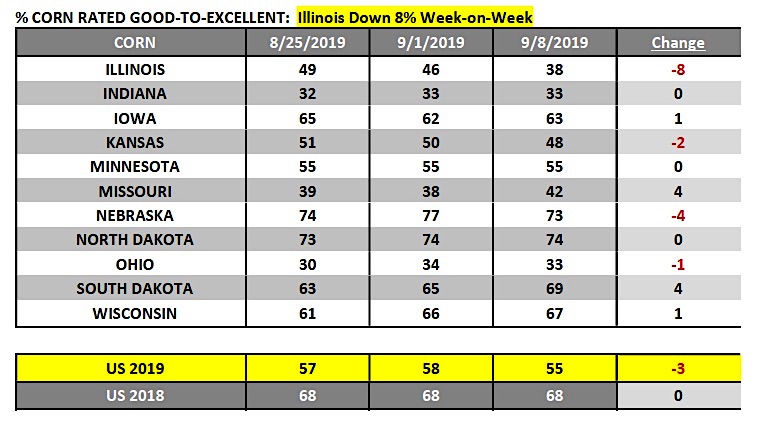

Consider just this past Monday, Illinois’s good-to-excellent rating in corn was reported down 8% from the pervious week. Ratings adjustments of that size and consequence just don’t happen during the first week of September. However this year’s an outlier, and for that reason, I’m of the strong opinion that a large percentage of the U.S. corn crop remains vulnerable to further deterioration even at this late date. Conversely the market keeps looking at the extended forecast and dismissing any weather concerns due to the absence of a major frost-freeze event.

However, what’s being overlooked is that both U.S. corn and soybean crops still need heat units and while temperatures have been and will largely remain “above-normal,” they’re above-normal for September. Meaning these aren’t late July/early August heat units. There is still a substantial amount of corn in the Upper Midwest that likely won’t black layer until mid-to-late October. And that means this year’s U.S. corn yield could still dip 5 to 6 bpa in proceeding WASDE reports, which equates to a potential production decline ranging from 420 to 500 million bushels.

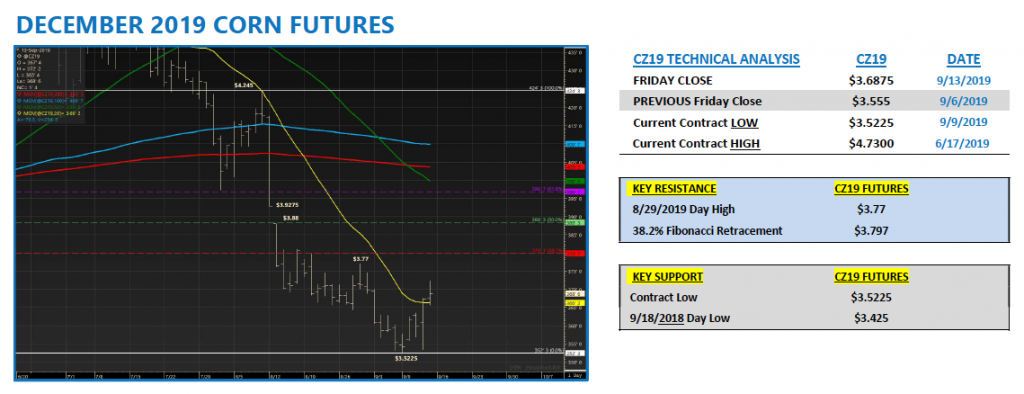

US CORN FUTURES PRICE OUTLOOK – Week of September 16

What provided the “bullish” spark? Believe it or not, CZ19 seemed to find its footing after the release of the September 2019 WASDE report on Thursday morning; even though the report on nearly every account was considered “bearish” corn prices with respect to the USDA’s adjustments to its U.S. corn yield, production, and ending stocks estimates, all of which exceeded the average trade guesses. What then pushed corn futures higher? I believe it was due to a combination of factors:

- Soybeans took off to the upside with November soybeans closing up 29-cents per bushel on Thursday afternoon. Soybean futures benefited from a larger than expected cut to 2019/20 U.S. soybean ending stocks, as well as, a fairly significant U.S. soybean purchase from China. Rumors then immediately followed that China could be in the process of lifting or eliminating a percentage of their current tariff on U.S. soybeans. That story remains in flux… I’m not holding my breath however.

- As it relates to corn specifically I think traders were simply waiting for the USDA’s September corn yield, production, and carryin estimates to post. Most were expecting an increase to carryin stocks, as well as, only a limited yield decline due to the USDA’s inherent inability to truly quantify the impact of this year’s delayed crop maturities on U.S. corn yield potential in the September report. The market has known for quite some time the October 2019 WASDE report should offer a much better story for Corn Bulls. For one, traders won’t have to worry about another increase to carryin stocks (that figure is essentially fixed now at 2.445 billion bushels). Therefore “IF” the USDA lowers the U.S. corn yield and harvested acreage in October, U.S. corn ending stocks should drop below 2.0 billion bushels.

As I said last week…I have no desire to short CZ19 under $3.55. That said I want to own CZ19 at those levels.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.