The following is a recap of the April 15 COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at COT report data and futures positions of non-commercial holdings as of April 12. Note that the change in COT report data is week-over-week. This blog post originally appeared on Hedgopia – Paban’s blog.

Is the glass half full or half empty?

Yet again, the IMF issued a downward revision to its prediction for global GDP growth, cutting 2016 forecast to 3.2 percent from forecast of 3.4 percent in January. This comes on the heels of a similar reduction in its projection in July and October last year.

The U.S.’s was reduced from 2.6 percent to 2.4 percent, matching 2.4 percent (actual) in 2015. The Street, however, is at 2.1 percent this year. Looking at how things are shaping up, the IMF may still have to reduce its forecast in the months to come.

As of April 13th, the Atlanta Fed’s GDPNow model is forecasting real GDP growth of 0.3 percent in the first quarter. TheStreet is at 1.3 percent. With the 10-year yield persistently under two percent, the bond market probably agrees with GDPNow.

This is a glass half empty scenario.

Here is glass half full.

In a rather surprise move, the IMF slightly nudged higher China’s growth this year from 6.3 percent to 6.5 percent. Of the major economies, China is the only one to see upward revision.

Back in January, one primary reason behind global equity sell-off was investor fears over yuan devaluation and hard-landing in China. The IMF is essentially saying the economy will do just fine.

Major economic releases next week are as follows.

On Monday, April’s NAHB/Wells Fargo housing market index comes out. March was unchanged at 58. The cycle peaked at 65 in October last year, which was at a 10-year high.

Housing starts for March are published on Tuesday. February was up 5.2 percent month-over-month to a seasonally adjusted annual rate of 1.18 million units. This was the 11th consecutive month of one-plus million units, with the 12-month rolling average of 1.13 million – the highest since June 2008.

On Wednesday, March’s existing home sales are printed. February was down 7.1 percent m/m to 5.08 million (SAAR). The cycle peaked at 5.48 million last July, which was the highest since 5.79 million in February 2007.

Three FOMC members are scheduled to speak during weekdays.

Here’s a look at the 10 Year U.S. Treasury Note:

April 15 COT Report Data: Currently net short 24.4k, down 92.9k.

COMMODITIES

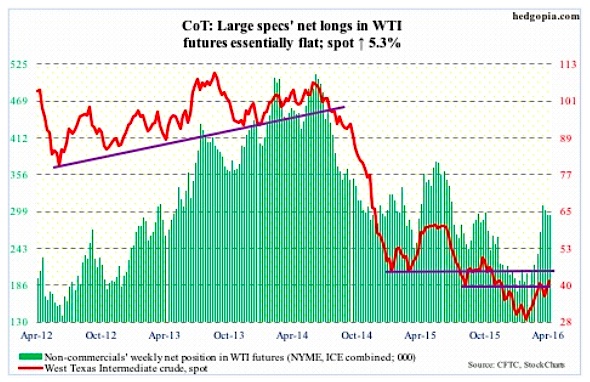

Crude Oil: Will Sunday’s Doha talks live up to expectations? Likely not. An agreement that solidifies on earlier output-cut proposals probably ends up raising risks that a lot of shale oil that was at risk of being cut – a Saudi goal all along – would be profitable again. The glut remains in this scenario.

In the meantime, the International Energy Agency says global oil demand will grow by around 1.2 million barrels per day this year, below 2015’s 1.8 mb/d.

For the week ended last Friday, U.S. crude oil stocks rose by 6.6 million barrels to 536.5 million barrels – the highest since the all-time high of 545 million barrels in 1929. In the past 14 weeks, stocks have gone up by 54.2 million barrels!

Crude oil imports, too, rose, but by only 686,000 b/d to 7.94 mb/d – a three-week high.

Refinery utilization fell 2.2 percentage points to 89.2.

The good news came in the way of crude oil production and gasoline stocks. The former fell by 31,000 b/d to 8.98 mb/d. This was the first time oil production fell below nine mb/d since October 2014.

Gasoline stocks dropped 4.2 million barrels to 239.8 million barrels. Stocks have fallen by 18.9 million barrels in the past eight weeks. Distillate stocks, however, rose by 505,000 barrels to 163.5 million barrels.

Spot West Texas Intermediate crude oil rallied strongly after crucial support at $34.50-$35 held on April 5th. Subsequently, it ran past its 200-day moving average, and has retreated since Tuesday after hitting the upper Bollinger Band.

Conditions are grossly overbought. Should there be a post-Doha rally on Monday, that likely gets sold.

April 15 COT Report Data: Currently net long 293.6k, up 257.

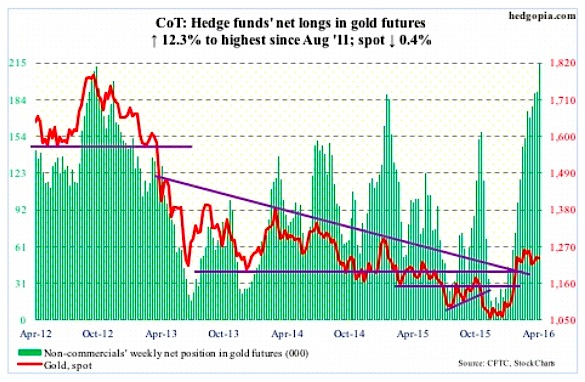

Gold: Last week, gold bugs fought off a bearish descending triangle pattern on spot gold, but were unable to build on it this week.

The metal peaked at 1287.8 on March 11th, and has essentially gone sideways since a month prior to that.

On a weekly chart – overbought – gold has tons of unwinding left. That process has begun on a daily chart. And flows are not cooperating. In the week ended Wednesday, GLD, the SPDR gold ETF, lost $381 million (courtesy of Lipper).

The lower end of the two-month range lies at 1200-plus, with the lower Bollinger Band at 1210. If and when these levels are tested, gold would have already lost its 50-day moving average (1231).

Underneath, there is six-plus year support at 1180 – a must-hold.

Importantly, non-commercials’ net longs jumped 12 percent to the highest since August 2011. At least going back to 2012, these are levels that have marked major peaks – in both net longs and spot gold.

April 15 COT Report Data: Currently net long 213.8k, up 23.4k.

EQUITIES

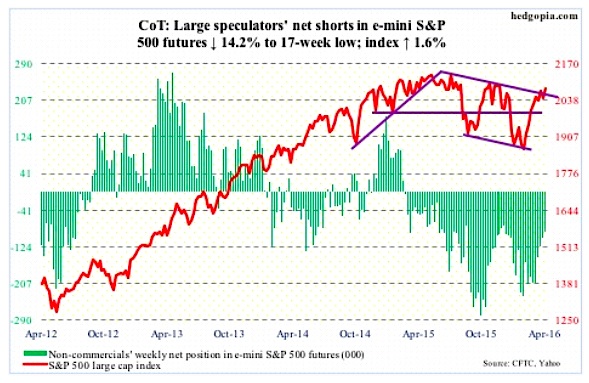

E-mini S&P 500: We are in the midst of earnings, and buybacks are missing in action. Flows continue to disappoint.

In the week ended Wednesday, $4.8 billion came out of U.S.-based equity funds (courtesy of Lipper). Since February 10th, $12.1 billion has been withdrawn; stocks bottomed on the 11th.

The S&P 500 has gone on to rally 15 percent since that low.

Inflows into SPY, the SPDR S&P 500 ETF, have helped. Since February 11th, just shy of $2 billion has moved into the ETF, with the week ended Wednesday pulling in $1.3 billion (courtesy of ETF.com). This was preceded by $1 billion in inflows in the prior week.

Should equity bulls rejoice this latest inflows? Without a doubt, particularly if Lipper data follows suit.

Short interest remains high on an index level – both the NYSE composite and Nasdaq composite. Although SPY shorts have already been taken to the cleaners. In the middle of September last year, short interest on the ETF was 436.7 million shares. By the end of March, this had dropped to 254.1 million – a one-year low.

Bulls should also take heart from the fact that 2040 support has been defended. Last week, this was tested in four out of five sessions, followed by two more sessions this week.

Daily conditions are insanely overbought for stocks, but that has not mattered much – yet.

April 15 COT Report Data: Currently net short 89.5k, down 14.7k.

continue reading on the next page…