When markets peak, it speaks to a changing of the guard.

During the bullish phase, the conviction to own growth-oriented stocks is greater than the conviction to own defensive-oriented bonds.

During the bearish phase, the conviction to own defensive-oriented bonds is greater than the conviction to own growth-oriented stocks.

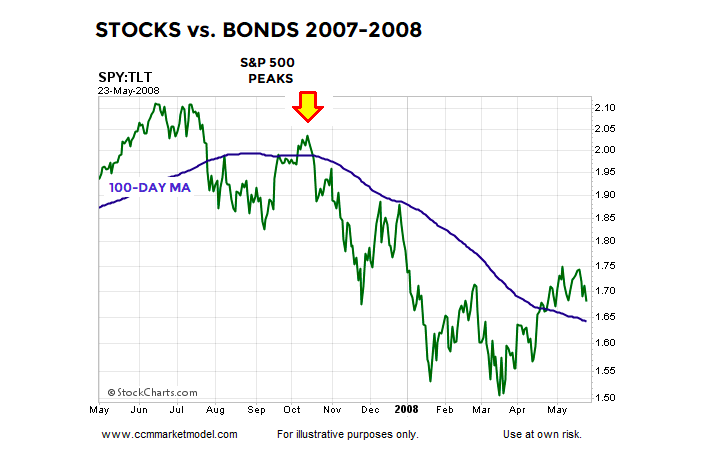

The stock/bond ratio (see chart below) peaked several months before the major stock market peak that occurred in October 2007. We use the S&P 500 ETF (NYSEARCA: SPY) and the 20+ Year Treasury Bond ETF (NASDAQ: TLT).

The blue 100-day moving average helps us visualize the changing of the guard.

A NEW GUARD IN TOWN?

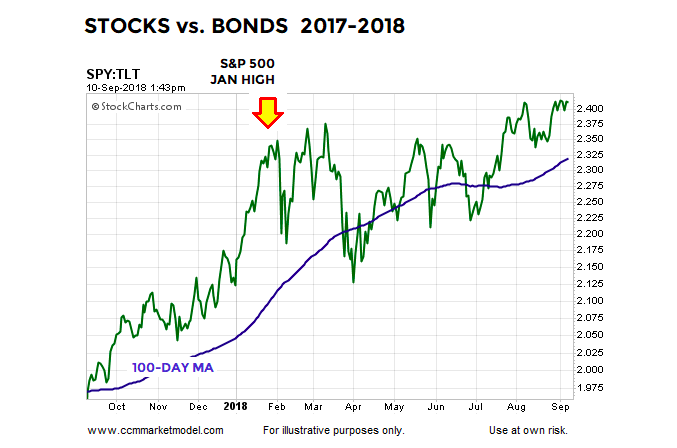

Thus, if the January 26, 2018 peak in the stock market was part of a major-topping process, we would expect to see the conviction to own defensive-oriented ETFs increase relative to the conviction to own growth-oriented ETFs, which is not the case as of September 10.

We could have made the same argument using numerous risk-on/risk-off ratios. Broad asset class behavior continues to side with the bullish case.

A STRONG VISUAL STATEMENT

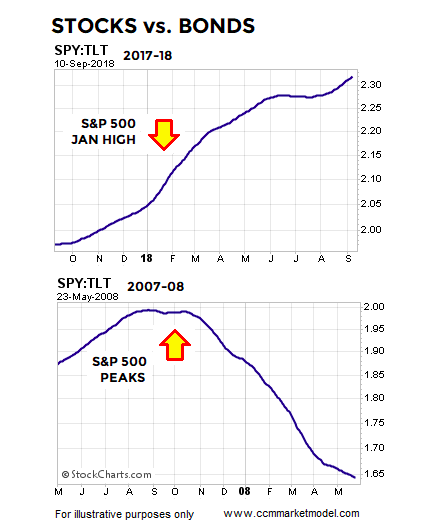

If we remove volatile price from the equation and focus solely on the stock/bond trend, we see a stark contrast between investor conviction in 2007-08 and 2017-18.

CHARTS HELP US ASSESS ODDS

Present-day charts tell us to remain open to better than expected stock market outcomes. If the charts deteriorate in a meaningful way, we must be flexible enough to reassess the odds of good things happening relative to the odds of bad things happening. We will continue to take it day by day.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.