6. Utilities Catch a Bid

After getting ahead of itself in early 2015, the Dow Jones Utility Average spent the majority of the year consolidating above the uptrend line from the April 2009 lows, as well as the ’07 highs. This remains one of the few sectors above its primary uptrend line from the 2009 lows and momentum managed to stay in a bullish range throughout the duration of this correction.

Additionally, on a relative basis, DJU / SPX continues to hold above multi-year lows and remains above the downtrend line from 2011.

If price action can continue to improve on an absolute basis to allow the 200 day moving average to begin sloping higher, this market can go substantially higher in 2016. What would confirm this thesis is a breakout above resistance at 610, which would open the door to new all-time highs. And that makes the Utilities one of the more interesting market themes to watch in 2016.

7. Ireland Will Be a Leading Equity Market

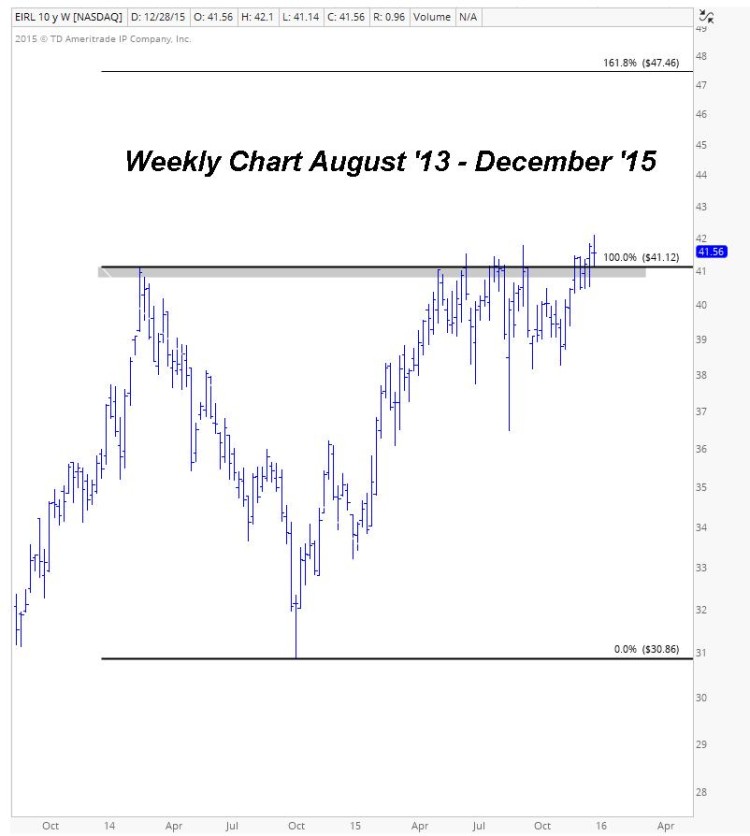

Perhaps this is one of the market themes that that sounds a bit obscure, but it makes sense when looking around the world for relative strength leaders. Only 8 of the 43 Foreign Equity market ETFs I track were up on the year in 2015, with Ireland (EIRL) leading the charge, gaining 21%.

Fortunately, much of those gains took place within the first half of the year, which allowed this market to consolidate near all-time highs before breaking out in the last two weeks of 2015. From a structural perspective the next price target is at the 161.8% extension of the 2014 decline, which represents 15% upside from current prices. The best part about this is the simplicity of the risk management in that we only want to be long this market above the top of the 2015 range at 41.

There are short-term concerns about a failed breakout on the daily chart given the momentum divergence and bullish consolidation pattern resolving to the downside, but from a structural perspective, I think it’s clear that the uptrend and relative strength in EIRL remains intact.

8. NZD/USD Will Have a Tough Year

As I reviewed all of the global markets I follow, I noticed that NZD/USD looks like one of the most well defined risk/reward setups in the world right now. Prices have been in a structural downtrend for 1 1/2 years now and recently mean reverted back toward the downtrend line from the 2014 highs. From a structural perspective, this looks like a perfect spot to get short versus.

On the daily chart it’s even more clear why this market is a fade, as prices run into a confluence of resistance at prior support, the downtrend line from the ’14 highs, and the downward sloping 200 day moving average. Combine that with a negative momentum divergence, and I think the weight of evidence clearly suggests fading this market aggressively.

There will be tactical downside targets along the way, but the structural target for NZD/USD remains near the ’09 lows at the 161.8% extension of the 2010-2011 rally. Will this be one of the currency market themes during 2016? Time will tell.

9. The Grains (Wheat, Corn, Soybeans, and Oats) Due For More Downside

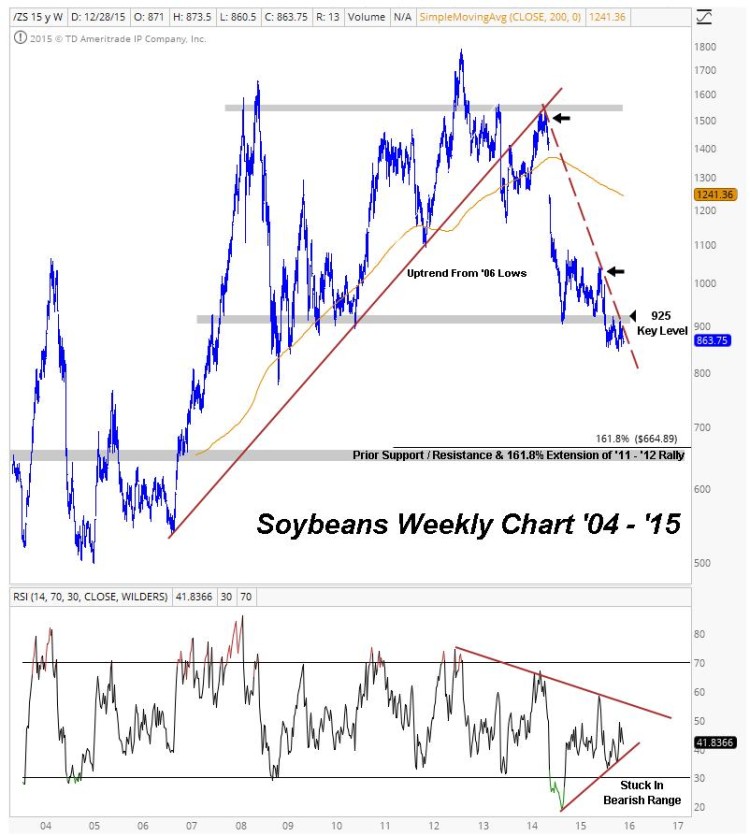

One common market theme across these ag commodities is that they all experienced some consolidation / mean reversion throughout 2015 to allow sentiment to reset, but now look like they’re ready to continue lower within their structural downtrends.

Oats failed to get back above broken support near 280 in the middle of 2015 and have been moving lower ever since. With momentum in a bearish range and prices below downward sloping 200 week and day moving averages, the bias remains to the downside. The next structural downside target lies at the 161.8% extension of the 2013-2014 rally, which corresponds nicely with prior support / resistance near 175-180.

Soybeans spent a good portion of 2015 trying to regain broken support and clear the downtrend line from the 2014 highs by getting above 925. Unfortunately, prices failed to do that and remain below downward sloping 200 week and day moving averages with momentum in a bearish range. As long as prices are below 925, they remain vulnerable and open to testing their next structural downside target near 665, which represents the 161.8% extension of the 2011-2012 rally, as well as prior support / resistance.

Wheat has tested the 460 level multiple times during 2015, with each successive rally being weaker and weaker. With prices below their downward sloping 200 week and day moving averages and, momentum in a bearish range, Wheat looks like it will test long term support / resistance in the low 400s at some point.

Corn experienced some mean reversion in mid-2015 after breaking above the downtrend line that’s been intact since 2013, but quickly stalled above prior support and put in a failed breakout in July. With prices below their downward sloping 200 week and day moving averages, and momentum in a bearish range, it looks like Corn will likely test long term support / resistance in the low 300s in 2016.

As I stated at the top of the post, I’m not in the prediction business. These are simply some of the market themes that I’ll be looking to take advantage of in 2016 should they play out as the weight of evidence suggests they might.

As always, if you have any questions feel free to reach out and I’ll get back to you as soon as I can.

Twitter: @BruniCharting

The author does not have a position in any of mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.