3. Crude Oil – Consolidation Time

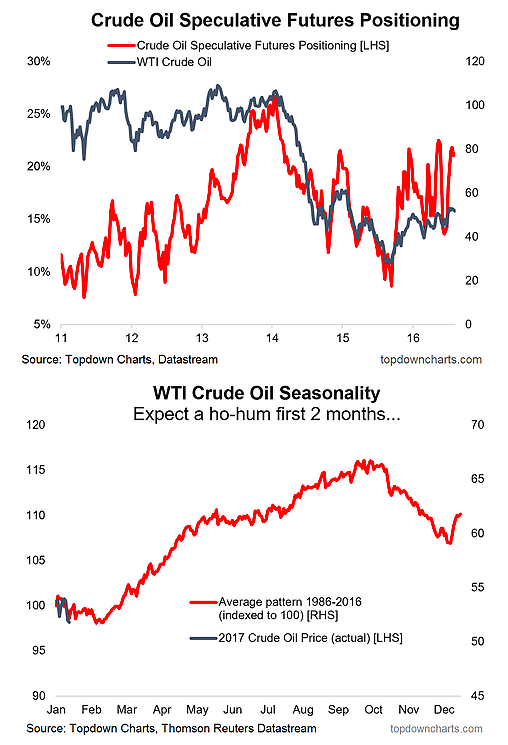

Speculative futures positioning topped out and rolled over at the top of the range (a bearish signal). Seasonality is usually “ho-hum” for the first 2 months of the year before kicking into a strong patch.

Could go as far as a test of support of $49-$50 while a breakout from $55 will be important and probably spell the end of the seasonally soft patch (or an overriding – seasonality doesn’t always work). Overall technical view: Short-term neutral, wait for a better setup (positioning/seasonality/breakout)

Next chart (Mexico ETF)…