The iShares Gold Trust (NYSEARCA:GLD) continues to oscillate around its flattish 200-day average, frustrating bulls and bear alike.

Gold prices and the Gold ETF (GLD) are most likely being held hostage by the action in Treasuries and the U.S. Dollar.

Treasuries via TLT (NASDAQ:TLT) have rebounded after what looked like a false breakout, but still sit below the falling 200-day average and recent high. I doubt GLD gets much help from a falling currency as the U.S. Dollar Index is pulling back in what appears to be an bullish wedge. The US Dollar has dropped back into an area of strong chart support that runs down to 24 area.

In addition, commercial hedgers are slowly getting more bullish on the dollar while large speculators are slowly doing the opposite. The COT data (Commitment of Traders) on gold remains neutral. I’m still neutral on GLD.

CHART: Gold (GLD) vs 20 Year+ Treasury Bond ETF (TLT) vs US Dollar ETF (UUP)

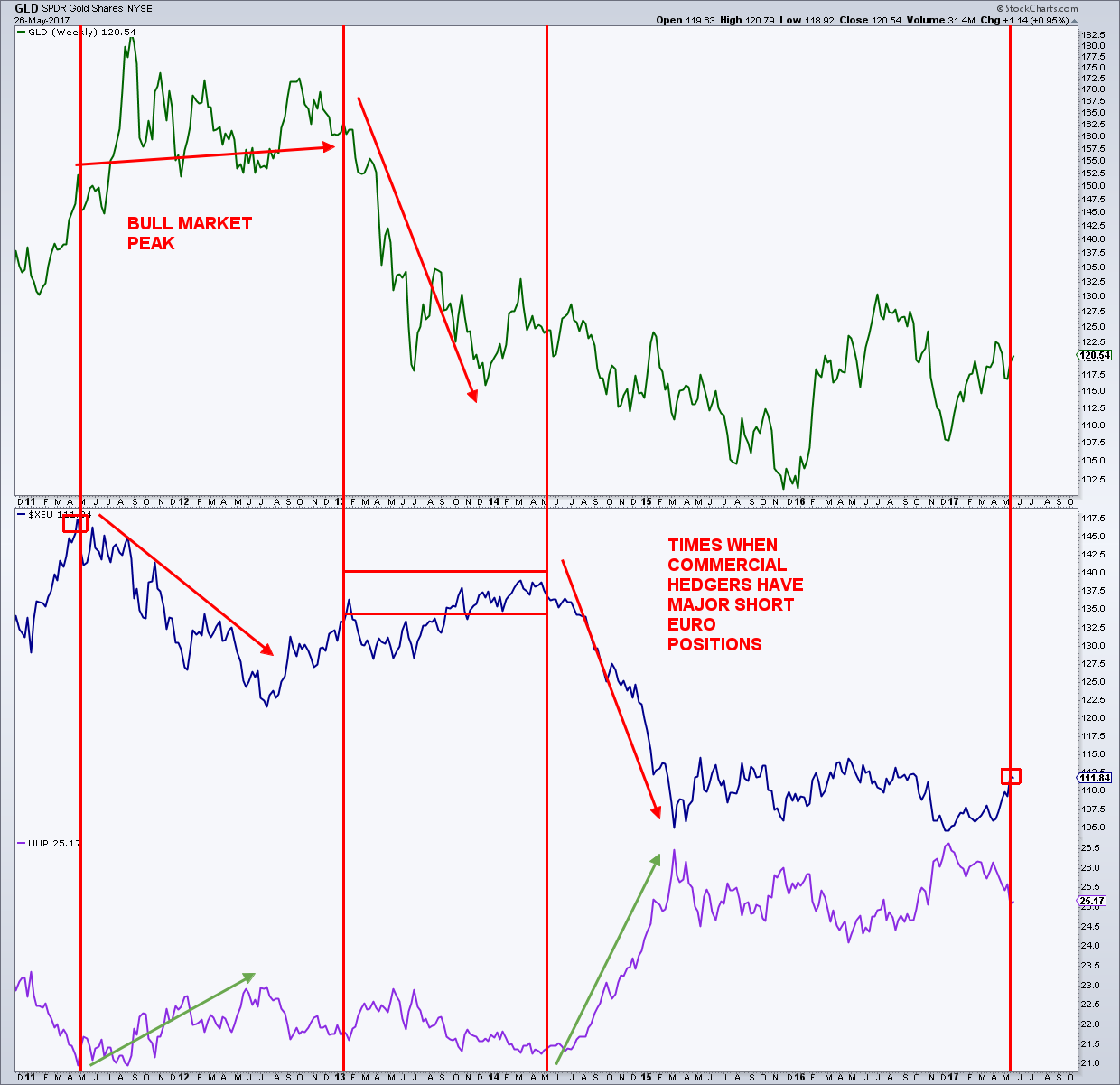

Is there a potential tell in some market for gold for the intermediate- to longer-term? Possibly, and it comes from the Euro and how players are positioned in the Commitment of Trader’s report.

The Euro is a big part (around 60%) of the U.S. Dollar Index so if the smart money hedgers have large short positions in the Euro, that eventually should be dollar bullish, and therefore, bearish on the yellow metal. The last couple of times commercials were this bearish on the Euro, and large speculators were this bullish on the Euro, the currency eventually fell and the dollar rose. I am very early here, but this has the potential to be quite bearish for gold and the metals market looking out into the second half of 2017 and into 2018.

CHART: Gold (GLD) vs The Euro vs US Dollar ETF (UUP

The other potential issue for gold is the treasury market and about face by the major market players. Smart money commercial hedgers have done a 360 degree turn from an extreme bullish position in the 10-year to fairly bearish position over the past couple of months.

Large speculators have done the opposite, reversing their bearish position back to bullish. Lower yields help gold prices, higher yields hurt gold prices. The price pattern does not look particularly bearish here for the 10-year, but this is also something to keep an eye with respect to the gold market.

CHART: 10 Year Treasury Note

Feel free to reach out to me at arbetermark@gmail.com for inquiries about my newsletter “On The Mark”.

Thanks for reading.

Twitter: @MarkArbeter

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.