Today we take a look at a broad swath of economic data, from technology numbers to apartment rent costs.

Below is a summary of our 3 data points for today’s discussion:

- Snapchat subscriber revenues are becoming meaningful

- Google Gemini beats Chats GPT , GPT-4.

- Apartment rent growth YTD lowest in 5 years.

Overall

There are so many things to bring up this week that incorporate data. Yesterday, in our communication with investors, we delved into our perspectives on the Consumer Price Index (CPI) and the recent decisions made by the Federal Reserve (FED). Our annual letter is set to be released next week, addressing key aspects of our outlook. What we know so far is that Inflation is dead and the Federal Reserve is done.

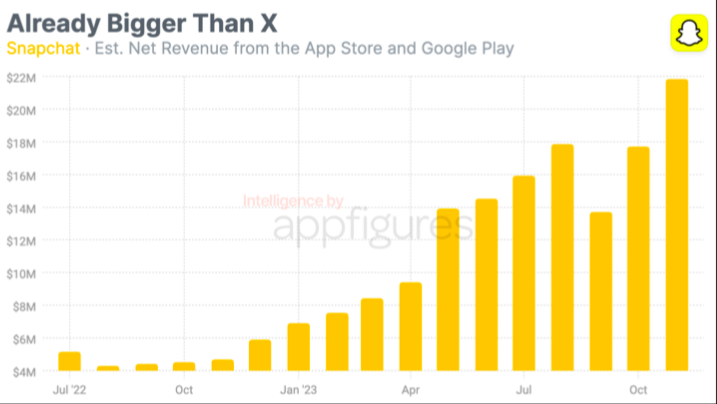

Snap Seeing Success in Subscription Product. Now: $22m Monthly Revenue.

Snapchat launched its Subscription product over a year ago and to be honest, I had little hope. The value of the subscription seemed limited. You had early access to filters and other less meaningful offers. Regardless of what I think the data says people are buying into the idea. Snap does not publish this data, it is app store data.

Snap either has a brilliant conversion mechanism, or people truly see value. At $22m monthly revenue and growing, this will certainly help the bottom line.

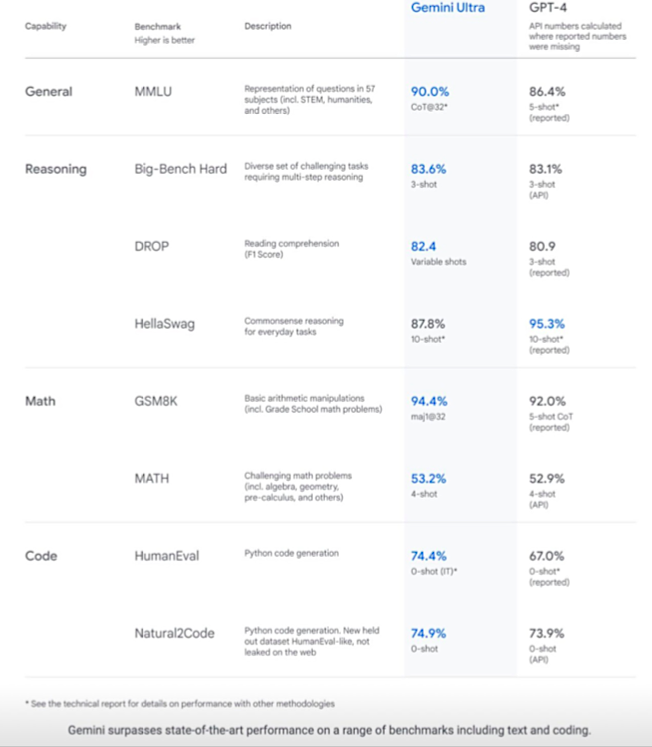

Google Catches Up to GPT-4 Which Signals that LLM’s are Commodities.

Google launched Bard’s Gemini which was the competitor to GPT-4. The data suggests that it has surpassed it using industry benchmarks. This marks an interesting turning point given that OpenAi was so far ahead at the launch. To us, this likely means that these LLMs are easier to build than once thought. From a business perspective, this could mean that these are becoming somewhat commoditized and suggests that the value is likely to accrue towards the application layers once again. We share this view in our annual letter which goes out next week!

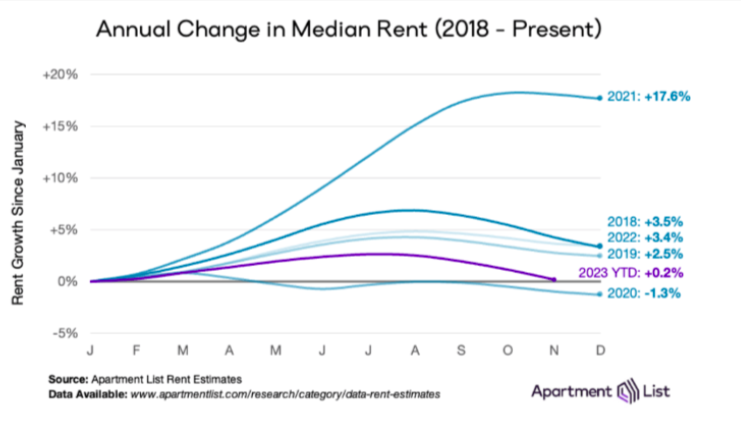

Rental Prices in the US are Coming Down and Lowest Growth in 5 Years.

Rental prices in the US soared during 2021 and moderated in 2022. 2023 is setting up to be the lowest growth in a single year over the last 5 years, if not more. This is further evidence that not only is CPI overstating rental inflation, but it is on the brink of deflation.

Twitter: @_SeanDavid

The author and/or his firm may have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.