It’s time to review several stocks that had unusual options activity over the last week. Although traders can never be sure why these trades take place (and who’s making them), I believe it’s important to be aware of notable options activity as an indicator for directional bias.

Here’s a weekly recap of 10 stocks that had unusual options activity and what, if any, significance these trades may have.

Unusual Options Activity: 10 Stocks With Notable Trades

TUESDAY

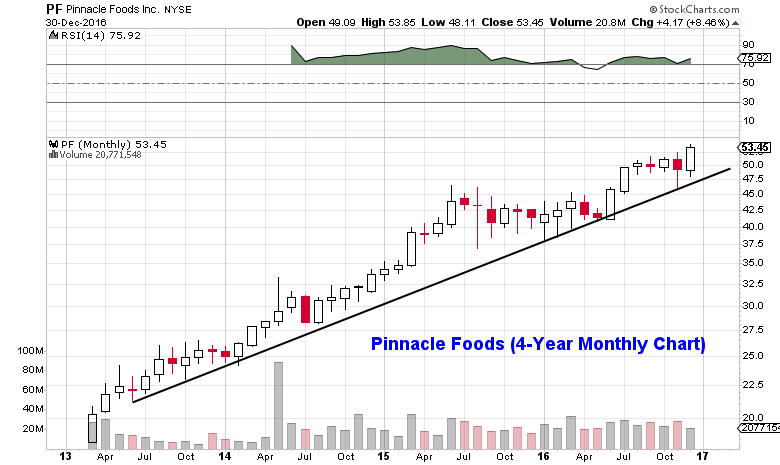

Pinnacle Foods (NYSE:PF) – 1,300+ Feb 17 2017 $57.50 calls traded with the majority being bought for $0.55. Last January, Pinnacle acquired the health food company, Boulder Brands, for $975M. The deal has not just contributed to top line results, but is likely to add $0.08-$0.10 per share to FY 2016 earnings.

PF shares have steadily been trending upward since going public in 2013. Following a few months of consolidation around the $50 level, Pinnacle retested the uptrend line and are now rallying to new highs.

Nordstrom (NYSE:JWN) – The Feb 17 2017 $42.50/$50/$55 bull call spread risk reversal was put on 4,000 times for a $0.87 debit. He/she bought the $50 calls and sold the $42.50 puts and $55 calls to help finance the trade, offering upside potential above $50.87 and additional downside risk (beyond the $0.87 debit) below $42.50. The $8B fashion retailer, Nordstrom’s stock has struggled on overall sector weakness to close out 2016, down more than 22% from the December high. However, EPS projections for FY 2016 and 2017 have been on rise in recent months as shares of Nordstrom now trade at a P/E ratio of 15.22x (2017 estimates) and 0.57x sales.

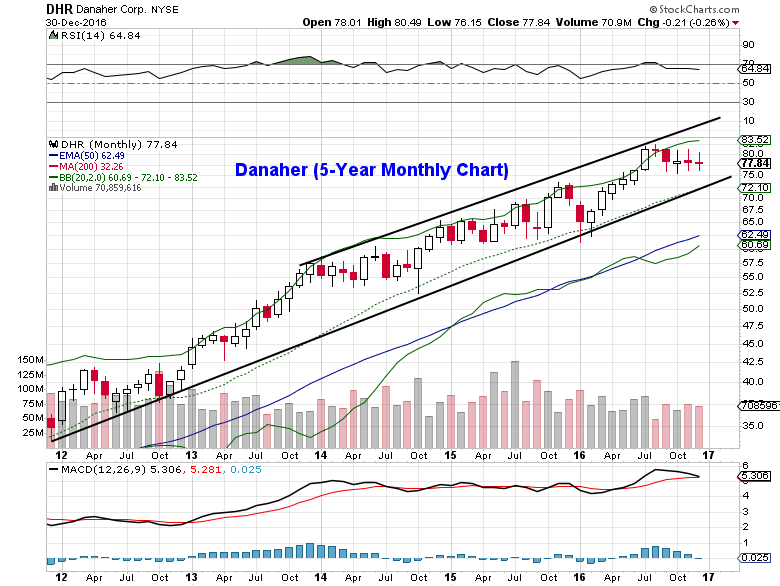

Danaher (NYSE:DHR) – 3,000 Jan 20 2017 $77.50 puts were bought for $0.80-$0.82. This was followed up with a purchase of 1,000 for $1.00 each on Wednesday. Earnings are due out on January 24th. On December 15th, the company forecast 2017 EPS of $3.85-$3.95 per share vs the Wall Street consensus of $3.97 per share.

Looking at the 5-year chart above, the stock has been trading in a well defined uptrend for several years now, but has begun to pullback from the recent highs. If history repeats itself then DHR shares could return to the low to mid $70’s before the uptrend resumes.

WEDNESDAY

BlackBerry (NASDAQ:BBRY) – 10,000 Feb 17 2017 $7 calls were bought for $0.33-$0.35. This was just the first of three consecutive days of accumulation in these Blackberry calls to finish out the year. Another 15,000+ combined were purchased on December 29th and 30th for $0.33-$0.36. Shares of the software and mobile security provider fell 25% in 2016, dropping on 7 of the last 8 trading sessions in December. Despite all of the negative sentiment around the former cell phone juggernaut, January has historically been one of the strongest months for Blackberry stock with a median return of +6.4% since 2009.

E*Trade Financial (NASDAQ:ETFC) – There was a closing seller of 2,919 Jan 19 2018 $35 calls for $4.70. He/she then sold to open 3,008 Jan 19 2018 $35 puts for $4.20. Several of these January 2018 call/put sales occurred in financials such as Fifth Third Bancorp, CIT Group, State Street, KeyCorp, and Charles Schwab on Wednesday, Thursday, and Friday. These traders are taking profits on long call positions, but remain bullish into the new year on the sector with longer-term opening put sales.

PC TEL (NASDAQ:PCTI) – 2,000 July 21 2017 $5 puts were bought for $0.40. On December 27th, 1,148 were bought for $0.40. Prior to these trades, fewer than 18 option contracts traded per day. PC TEL, a $93M a global provider of RF expertise, delivers performance critical telecom solutions to the wireless industry (exposure to the energy, aerospace & defense, healthcare sectors).

Synchrony Financial (NYSE:SYF) – There was a closing seller of 3,542 Jan 19 2018 $35 calls for $5.20. He/she then sold to open 2,954 Jan 19 2018 $35 puts for $4.00. Along with being one of the many financial option trade adjustments, more than 5,300 June 16 2017 $37 calls traded with the majority being bought for $2.85 in the $30B consumer lender.

THURSDAY

JetBlue Airways (NASDAQ:JBLU) – There was a rollout from 21,609 Jan 20 2017 $22 calls ($0.85 credit) into 21,609 Feb 17 2017 $23 calls ($0.90-$0.95 debit). On December 2nd and 6th, there was sizable buying in the JetBlue Jan 20 2017 $22 calls for $0.60-$0.73. On December 30th, another 5,600+ Feb 17 2017 $23 calls traded with the majority being bought for $0.94-$1.15. JetBlue is scheduled to report Q4 earnings on January 26th.

FRIDAY

Buffalo Wild Wings (NASDAQ:BWLD) – The Mar 17 2017 $140/$145 bear put spread was put on 1,700 times for a $1.20 debit. Shares of restaurant operator have dropped in January 5 of the previous 6 years.

Cognizant Technology Solutions (NASDAQ:CTSH) – There was a rollout from 2,885 Jan 20 2017 $55 calls ($2.22-$2.23 credit) into 2,885 Feb 17 2017 $57.50/$62.50 bull call spreads ($1.57-$1.58 debit). On December 21st, there was a rollout from 10,000 Jan 20 2017 $55 calls ($2.30 credit) into 10,000 Feb 17 2017 $57.50 calls ($2.10-$2.15 debit).

Thanks for reading and have a great week!

Twitter: @MitchellKWarren

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.