It’s time to review several stocks that had unusual options activity over the last week. Although traders can never be sure why these trades take place (and who’s making them), I believe it’s important to be aware of notable options activity as an indicator for directional bias.

Here’s a weekly recap of 10 stocks that had unusual options activity and what, if any, significance these trades may have.

Unusual Options Activity: 10 Stocks With Notable Trades

Monday

BioCryst Pharmaceuticals (NASDAQ:BCRX) – 5,000 Mar 17 2017 $10 calls were bought for $2.00. The $472M biotech company is expected to have Phase 2 data results on BCX7353 – APeX-1 (used to reduce or eliminate attacks in HAE patients) due out in the first quarter of 2017. On December 16th, JMP Securities upgraded the stock to outperform with a $10 price target.

Grupo Televisa (NYSE:TV) – Roughly 16,000 Jan 20 2017 $20 puts were sold for $0.35-$0.45. Prior to this trade, total put open interest was 10,083 contracts. More of these puts were opened for $0.15-$0.20 later in the week with open interest now at 31,367 contracts. After shares have nearly been cut in half from the 2015 highs, traders are betting on limited downside through at least the January options expiration.

Tuesday

Tesoro (NYSE:TSO) – 12,000 Jan 20 2017 $85 puts were purchased for $1.34-$1.49, making it the largest options position in the oil refiner. Shares have rallied more than $20 from the summer lows and are now retesting the March highs in the low $90’s. He/she could be making an outright bearish bet or hedging an existing long stock position into the new year.

Wednesday

Cognizant Technology Solutions (NASDAQ:CTSH) – There was a rollout from 10,000 Jan 20 2017 $55 calls ($2.30 credit) into 10,000 Feb 17 2017 $57.50 calls ($2.10-$2.15 debit). On November 11th, the Jan 20 2017 $55 calls were bought as part of a bull risk reversal for $1.87-$1.88. The IT services company trades at a P/E ratio of 15.43x (2017 estimates), 2.59x sales, and 3.33x book value. They recently acquired Adaptra, a Sydney-based insurance consulting company, for an undisclosed amount.

New York Community Bancorp (NYSE:NYCB) – There was a rollout from 2,000 Jan 20 2017 $17 puts ($0.93 credit) into 2,000 Jan 20 2017 $16 puts ($0.33 debit). This trader bought the $17 puts for $0.48 the day before as part of a rollout from the Jan 20 2017 $18 puts ($1.10-$1.11 credit). Last week, the company announced they were terminating their merger agreement with Astoria Financial, which was likely due to the regulatory hurdles the M&A deal would face.

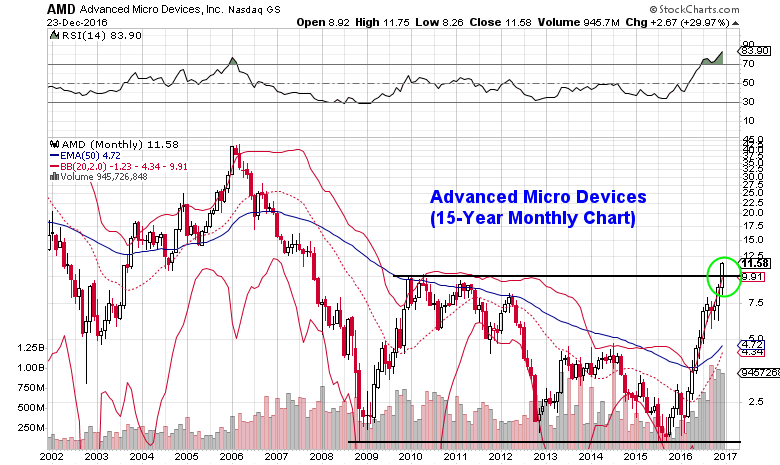

Advanced Micro Devices (NASDAQ:AMD) – There was a rollout from 28,973 Apr 21 2017 $10 calls ($2.44 credit) into 28,973 July 21 2017 $14 calls ($1.36 debit). On November 22nd, the Apr 21 2017 $10 calls were bought for $1.09 as part of a rollout from the same amount of Apr 21 2017 $7 calls ($2.47 credit). Earnings are due out on January 17th (shares moved higher on 2 out of the last 3 reports).

On a monthly basis, AMD shares are on pace to close above the $10 resistance level for the first time since October of 2007. Following the Great Recession, the stock traded in a wide range between the $1.60’s on the low end to $9-$10 on the high end earlier this decade.

Thursday

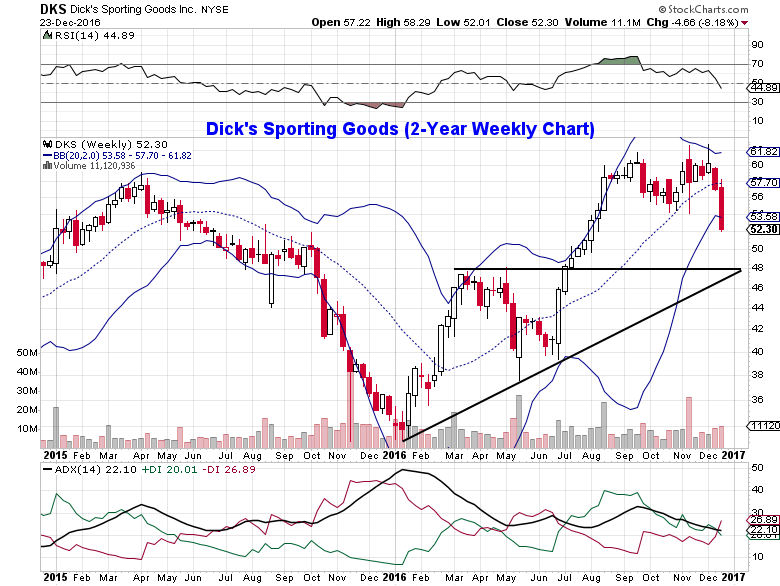

Dick’s Sporting Goods (NYSE:DKS) – 26,000+ Mar 17 2017 $44 puts traded with the majority being bought for $0.95-$1.15. Put activity was 22x the average daily volume. On December 12th and 13th, nearly 20,000 Mar 17 $48 puts were bought for $0.90-$1.00. Thursday’s action was followed up with a sizable buyer of 1,500 Jan 20 2017 $50 puts for $1.10. The retail sector has been under pressure in the last couple of weeks on concerns of weaker than expected sales and heavy discounting during the holiday season.

Given the fall out in the stock price last week, shares of DKS could revisit the two major support levels (both near $48) in the intermediate-term.

Delta Air Lines (NYSE:DAL) – 10,000 Jan 20 2017 $52 calls were bought for $0.76-$0.79. On December 16th, there was a rollout from 4,000 Dec 16 2016 $49.50 calls ($0.65 credit) into 9,741 Jan 13 2017 $51 calls ($1.22 debit). Earnings are due out on January 19th (shares closed higher after earnings on 6 out of the last 7 reports).

Friday

MiMedx Group (NASDAQ:MDXG) – There was a rollout from 2,000 Mar 17 2017 $10 puts ($1.55 credit) into 5,000 June 16 2017 $10 puts ($2.20-$2.30 debit). On November 16th, there was sizable buying in the Mar 17 2017 $10 puts (2,100+ traded) and $12.50 puts (700+ traded). The $970M surgical and medical equipment maker has recently been accused of inflating quarterly revenue numbers over several years. Short interest is north of 23% of the float, but management reaffirmed their Q4 guidance and increased their share repurchase program on December 16th.

Western Digital (NASDAQ:WDC) – There was a rollout from 4,830 Apr 21 2017 $67.50 calls ($7.10 credit) into 4,830 Apr 21 2017 $77.50 calls ($3.00 debit). On November 30th, the Apr 21 2017 $67.50 calls were bought for $4.05 as part of a rollout from the Jan 20 2017 $57.50/$62.50 bull call spread (9,660x for a $3.22-$3.23 credit). Shares of the $20B data storage device maker trade at a P/E ratio of 9.96x (2017 estimates), 1.40x sales, and 1.65x book value. They signed an extension of their cross licensing agreement with Samsung on December 6th. Sales of 64-layer 3D NAND chips (begin shipping in the first half of 2017) are likely to help management maintain their long-term goal of 33-38% gross margins.

Thanks for reading and have a great week!

Twitter: @MitchellKWarren

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.