Information presented to us is quite often biased in some way shape or form. And we are seeing a lot more of it these days. Thankfully, we can still dig deeper to find and use quality data and information.

In this week’s Top Trading Links there’s an abundance of awesome research and market insights. Enjoy.

MARKET INSIGHTS – Sentiment

@ZorTrades sums up the current US equity market sentiment well:

“Either a whole bunch of market participants will be right about a possible correction or a bunch of market participants will eventually have to chase price if the market continues to climb the wall of worry.”

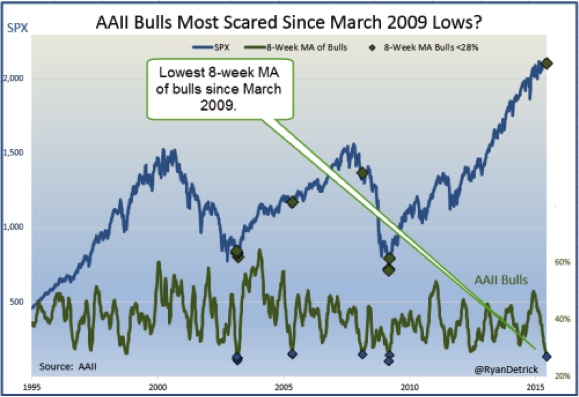

”Neutral is the new bearish” via @RyanDetrick. Let’s see how quickly AAII bulls come off this highly fearful level.

@andrewnyquist explains the correct way to approach in-our-face macro issues like the Greece crisis.

“Rather than making large bets on the outcome or what one thinks the situation means, it’s probably better to simply stay attuned to the situation and monitor risk a bit more closely.”

BAML Fund Manager Survey highlights. Noteworthy consensus views: China is in a bubble, rates are expected to rise, the dollar is expected to rise vs the euro

@MktAnthropology on the bullish bearish sentiment towards China.

Podcast: @ritholtz chats with Behavioral Finance pioneer Richard Thaler.

MARKET INSIGHTS – Charting & Data

Are Financials the new Defensive Sector? via @awealthofcs

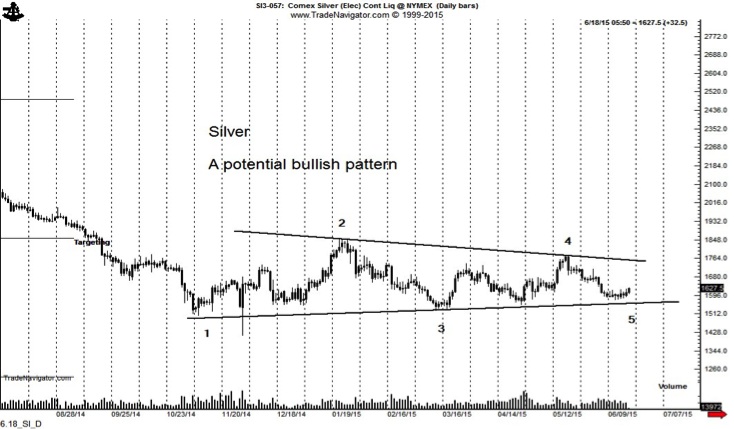

@PeterLBrandt on Silver:

@equityclock notes bullish seasonality for biotech kicks in gear NOW.

‘Tis the season for the Biotech sector to move higher!

— Tech Talk (@EquityClock) Jun. 18 at 10:25 AM

We know numerous equity valuation measures are stretched. @hedgopia digs into a few of them.

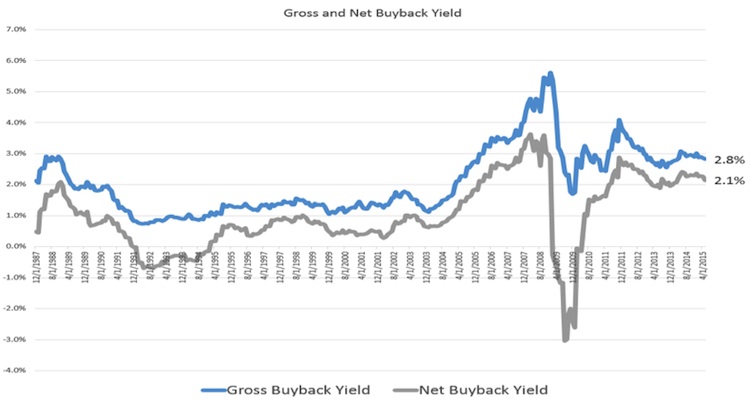

Share repurchases de-mystified by @millennial_inv. “The net yield of 2.1% is high but well below the early 2008 high of 3.6%”

@TradingOnMark suggests it’s time to look for a reversal lower in treasury yields.

INVESTOR INSIGHTS

“It’s a thought-provoking exercise to try to forecast the next catalyst that will move the market one way or another, but it’s not useful.” via @awealthofcs

David Stockman shares many great statistics on the market’s monstrous rise over the last 30 years.

“The idea that there’s any meaningful signal contained in this diagram of Fed governors’ own expectations of where rates will be in the future is laughable” Preach, @ReformedBroker, preach

@hedgopia looks at how higher rates could affect the home builders.

How emotions get in the way of smart investing via @WSJ

Say what?!

The P/B ratio of the: Largest dividend ETF: 4.0 S&P 500 = 2.6 That is going to be $20 billion in disappointment. All for div yield < S&P — Meb Faber (@MebFaber) June 17, 2015

HAPPENINGS & RESEARCH

Cyber Security ETF (HACK) has obtained 1 billion dollars in AUM in just seven months.

Potential specs on the second edition of the Apple Watch.

Uber lost a minor court ruling this week. Here’s how it can get worse.

AI outperforms a human on an IQ test.

Pro Tip: Technological failure is code for hacked.

A mock up of the perfect Formula 1 car.

Main details from Business Insider’s self driving cars report.

Bloomberg on the sharing economy:

“Nowadays, it’s hard to find more exuberant sharing-economy enthusiasts than investors. Uber, the ride-hailing company, is raising $1.5 billion at a valuation of $50 billion — theoretically making the six-year-old business the equal of Target and Kraft Foods.”

@a16z makes the case for no venture capital/tech bubble.

FUNNY OF THE WEEK – via @michaelbatnick

A who’s who of lolz. I think “Market Neutral Anti-Beta” wins. pic.twitter.com/PYDRYcFBpr

— Irrelevant Investor (@michaelbatnick) June 16, 2015

Thanks for reading! Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.