With stocks trading near all-time highs yet again investors are continuously nervous about the potential for a correction. In the past, many investors would be looking to rotate out of the more cyclical sectors (materials, financials, energy, consumer discretionary and industrials) into the more defensive sectors (healthcare, utilities and consumer staples).

With stocks trading near all-time highs yet again investors are continuously nervous about the potential for a correction. In the past, many investors would be looking to rotate out of the more cyclical sectors (materials, financials, energy, consumer discretionary and industrials) into the more defensive sectors (healthcare, utilities and consumer staples).

There’s a good possibility that the past decade has altered the typical nature of the defensive sectors. Not only was there a rush to safety following the financial crisis, but with a low interest rate environment, investors have been piling into dividend stocks, which are typically those in the defensive sectors. The chase for yield has meant healthcare, utilities and consumer staples stocks have been the big winners over the past decade, while financials have basically gone nowhere.

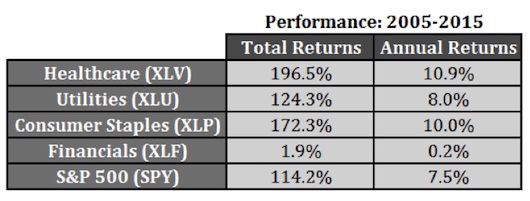

Take a look at the performance numbers on the defensive sectors as well as the returns for financial stocks and the S&P 500 since 2005:

Since the beginning of 2005, financials have a total return of 1.9%. That’s 0.2% per year in ten-and-a-half years. Financial have been dead money, to say the least. Obviously, financials were extremely overvalued heading into the financial crisis, so maybe the fact that they haven’t gone anywhere for ten years shouldn’t be a huge surprise, but at this point it’s reasonable to assume that financials remain one of the most hated sectors by investors. Nine of the top twenty holdings in the Financial Sector SPDR ETF (XLF) – including BAC, C, AIG, GS, MET, MS, COF, PRU & BK – are still trading below their pre-crisis peak prices. Even after losing close to 80% of their value during the crisis, financials have lagged in the recovery. The S&P 500 is up close to 16% per year over the past 5 years, while financials are only up 12.9% annually.

The reason for market volatility is never the same in any cycle, but at this point it’s fair to say that most are pointing to a rise in rates as a possible catalyst for a market disruption in the future.

When interest rates do eventually rise, the banks should be one of the biggest beneficiaries because their interest rate margins will increase as they’re able to charge more to lend, thus increasing the spread between borrowing and lending. There’s also the potential for an increase in loan demand as a rise in rates could spur people to borrow as they become worried about the prospect for higher lending rates in the future. Insurers can also benefit as they can earn higher returns on the premiums they’re taking in. The reason for a potential interest rate hike has to be taken into account, as well. If they’re rising from an improving economy then it’s also likely that loan delinquencies would be falling as borrowers are more likely to pay back their loans.

It’s possible we’ll see volatility in the markets for a reason beyond rising rates. Interest rates don’t have to rise from here. But it’s worth considering how things have changed during the past cycle in terms of what constitutes a defensive sector going forward. Your father’s defensive stocks may not protect you on the downside as much as they have in the past from today’s levels.

Twitter: @awealthofcs

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.