By Jeff Wilson

By Jeff Wilson

Thank you for returning to Part 2 of our 3 part series on Southeast Asia. We spent most of Part 1 (“A Macro Economic Look at Southeast Asia”} building a high level, macro case for considering the region as a developing power play. In Part 2, I am going to dig deeper into certain economic, political and social factors that paint a picture of a region on the cusp of something larger.

Consumer-Centric Focus. This is the straw that stirs the drink. And by many measures, Southeast Asia is starting to grasp the importance of the consumer and technology. Most, if not all, countries in Southeast Asia have policies in place that attempt to increase local consumer demand as a way to develop local industries, while protecting their respective economies from a continued slowdown in the Western Hemisphere.

This transition into a consumer “value” driven economy will continue to further diversify the region’s economy and is precisely the reason I am so excited about its prospects. Furthermore, with an ever-increasing focus on the consumer, and developing consumer-driven niche industries, the region is developing character and a bit of charm.

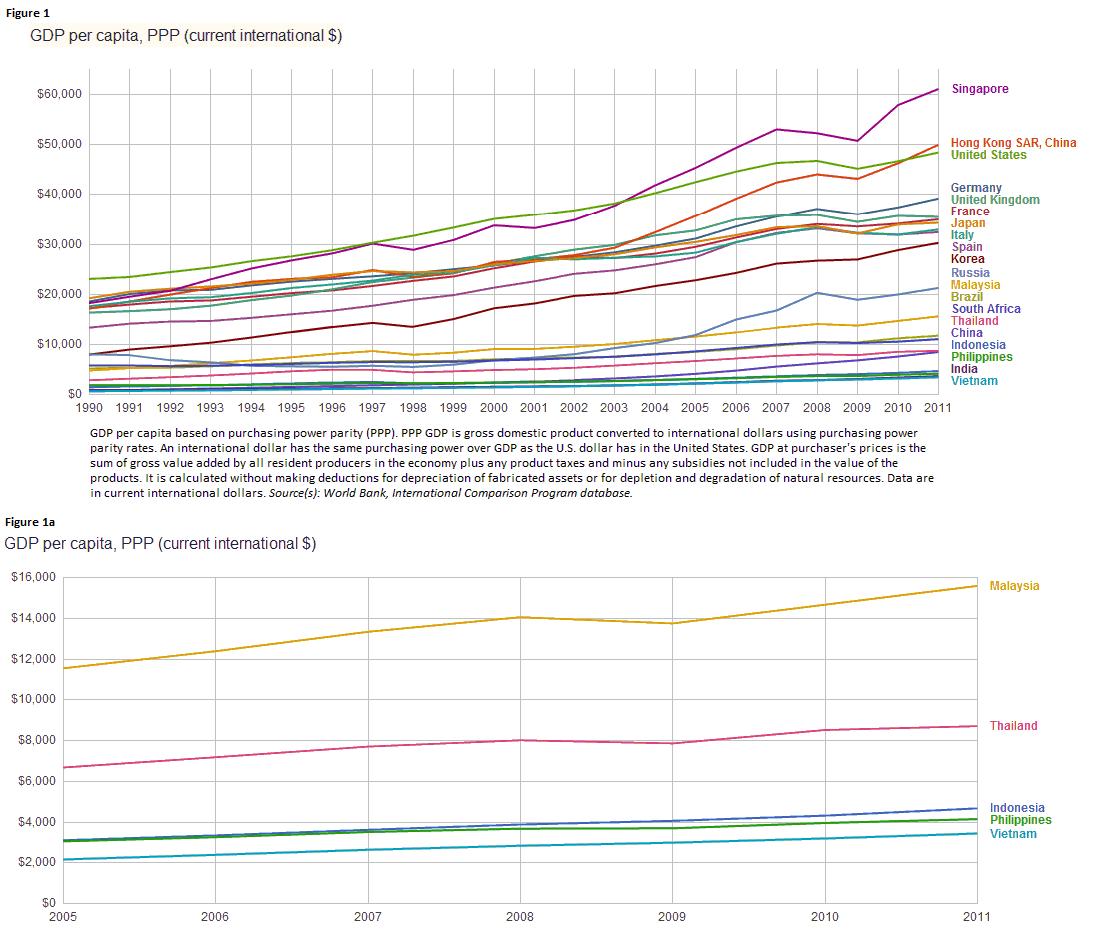

Thanks to Google’s public data explorer, I can create charts to help visualize what I’ve been talking about above. As you can see, the sub region’s economy as measured by GDP per capita has steadily increased over the past 20 years. While this is the general trend among the countries included in the chart, there are some interesting takeaways worth mentioning:

1) As of the end of 2011, GDP per capita in Singapore and Hong Kong was higher vs the US and a few other advanced economies of Western Europe. (Figure 1)

2) Malaysia has a higher GDP than 4 of the 5 BRICS countries (only Russia has a higher GDP per capita). (Figure 1)

3) Unlike other advanced and emerging economies, Malaysia, Indonesia, Vietnam and the Philippines did not experience a dip in GDP per capita during the latest global recession (Figure 1a)

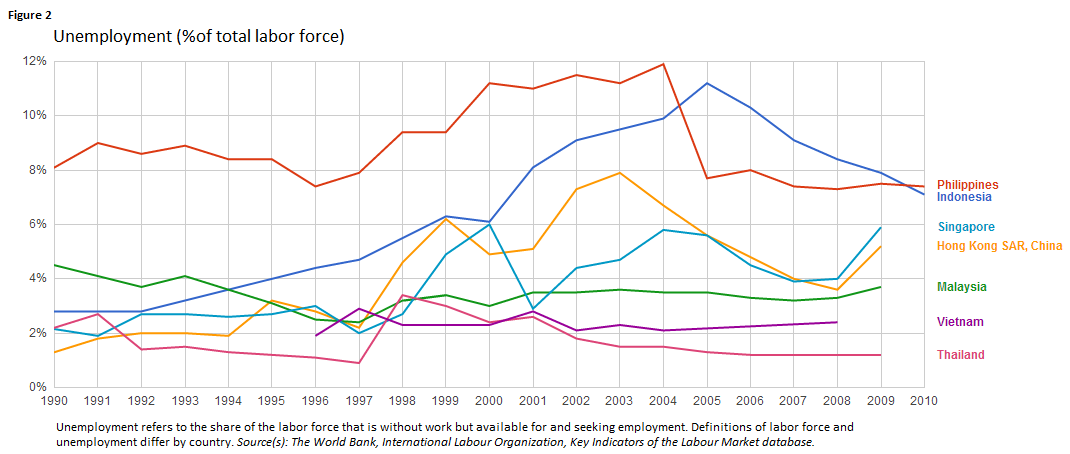

Indonesia and the Philippines are the only countries that have unemployment rates north of 6%. Along with Thailand however, these countries are also the only countries whose unemployment rates have improved. Singapore and Hong Kong’s unemployment rates have increased from 2008 partly due to their reliance on the finance and service industries, both highly impacted by the recession.

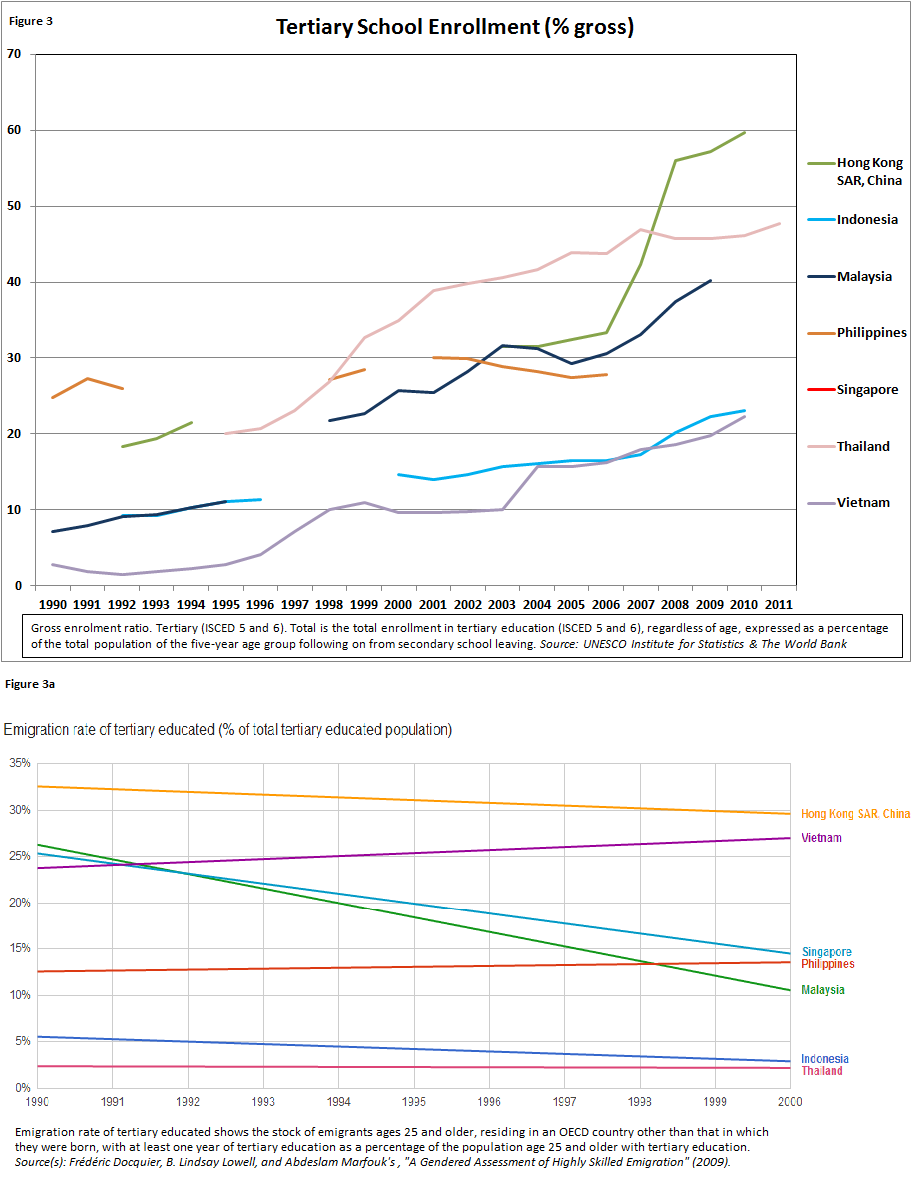

As with any successful economy, a healthy growth of educated and skilled population is required in order to fill the needs of hiring companies and institutions whose products and services provide for the needs and wants of a growing economy. Figure 3 shows the trend of increasing tertiary school enrollment within the sub region.

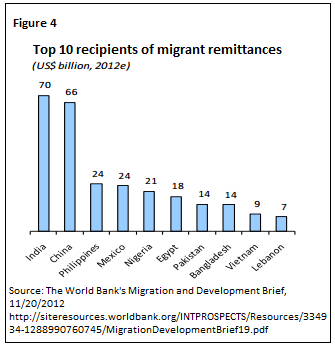

There is of course no guarantee that graduates of the tertiary level will stay at home. In fact, as hiring demand increases, many may take their skills to other countries whose greener pastures provide a better financial future for them. Figure 3a illustrates this where the net emigration of tertiary educated individuals continues to increase in Vietnam and the Philippines. Note, however, that this isn’t necessarily a negative, as overseas workers send remittances to family members for their daily expenditures in the form of foreign exchange. Figure 4 shows that in 2012, it’s estimated that migrant remittance to the Philippines is about $24B (roughly 13% of GDP) and about $9B for Vietnam (roughly 7.5% of GDP).

I hope you enjoyed reading parts 1 & 2. At this point, I believe that I have laid the groundwork for a fundamental argument to proactively review investment opportunities in the region. In the final part of the series, I will use a macro lens to analyze longer-term investment charts for the ETFs/ETNs of each of the regions countries. Thanks for reading. See you next week.

Additional Sources: Individual country data source: CIA World Factbook.

Twitter: @cerebraltrades and @seeitmarket Facebook: See It Market

Author holds positions in iShares MSCI Hong Kong Index (EWH), iShares MSCI Philippines Invstb Mkt Idx (EPHE), iShares MSCI Singapore Index (EWS), iShares MSCI Taiwan Index (EWT), iShares MSCI Malaysia Index (EWM), iShares MSCI Thailand Invest Mkt Index (THD), Abereen Indonesia Fund (IF) at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.