Calls of capitulation in European bank stocks this summer appear to have been premature.

Last Friday, I mentioned the potential “false breakout” in the broad European stock market. This looks like yet another troubling development in the perpetual under-performance on the part of the continent’s equities. And one major contributor to that under-performance, European banks, continues to be a thorn in the side of the continent.

We last mentioned the sector back in late June in the lead-up to Brexit. At the time, the Dow Jones STOXX 600 Bank Index was threatening to break down below its post-2009 Up trendline. And indeed, the market rout in the aftermath of Brexit did push the index below its long trendline. However, as often happens at long-term support, the index quickly regained the line after a temporary flush below it. This move had the makings of a “false breakdown”… that is, a temporary breakdown of a level that is quickly recovered.

A false breakdown can lead to just as explosive a move to the upside as a breakdown might to the downside, especially if an index is extremely washed out as was the case with European bank stocks. Add to it the high-profile status of the sector in the financial media and the record-setting volume in some of the individual stocks and there was a compelling capitulation case to be made.

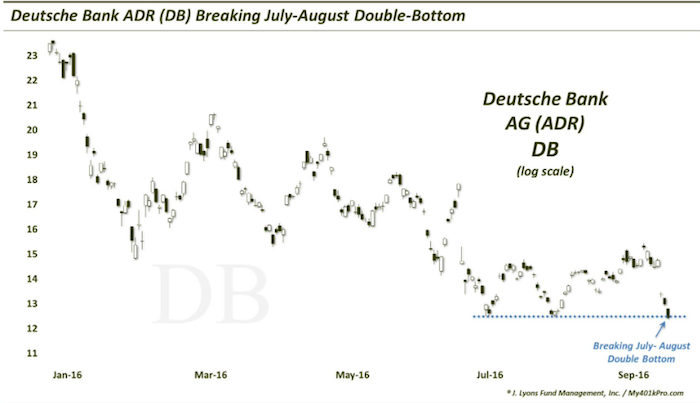

Well, thanks to the action in one bank stock in particular – Deutsche Bank (NYSE:DB) – that case may have to be put on hold. That’s because after bouncing in early July following Brexit, and testing that low in early August, DB has failed to follow through on its attempted false breakdown. And, as of today, the stock has broken below its potential double-bottom, hitting a new low for this move.

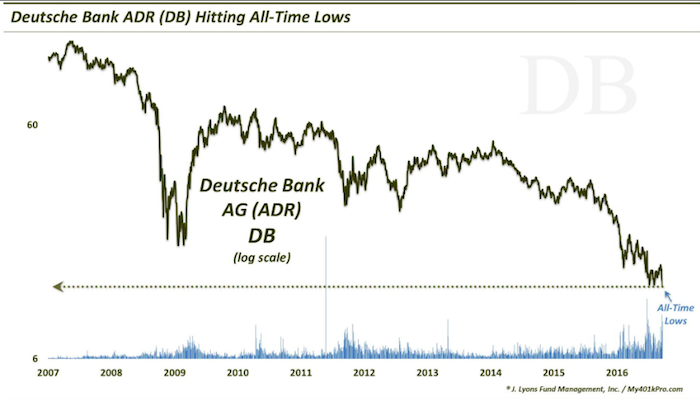

Of course, this is not only a negative development in the short-term, but the long-term as well. That’s because a new low below the summer’s attempted double-bottom also signifies a new all-time low for Deutsche Bank stock (see chart below).

Could this be another test in a complex bottoming process? Anything is possible. The problem is, “triple bottoms” are few and far between in this business. Furthermore, following the potential “false breakdown” in June, the sector and its stocks should be leading the way higher, as its U.S. counterparts have been attempting to do of late. Outside of a few quick bursts, European banks have continued to languish for the most part.

More From Dana: Bank Stocks Struggling At Stiff Resistance

In addition, a false breakdown, capitulation or any other type of bottoming action is much more likely when the broader market has also been beaten down. Post-Brexit, the global equity market got slammed and created at least a short-term washed-out condition. In that case, once the market turned back around, there was a considerable tailwind aiding the bounce in European bank stocks. At this point, that is hardly the case as most markets remain reasonably close to their recent highs, despite a few weak days over the past few weeks. Thus, another tailwind should not be relied upon here, outside of potential exogenous, short-term events (e.g., the BOJ, Fed meetings).

Could this simply be a single stock issue, allowing for the false breakdown possibility to remain in place for the STOXX 600 Bank Index? It’s possible. The 600 Bank index has not suffered nearly the sort of breakdown this month that we see in DB and is holding back above its post-2009 Up trendline. However, it too has begun to falter. And considering the fact that DB is the 4th largest bank in Europe (according to Statista), and considering the challenging fundamental similarities among other European banks, it is difficult to believe this is a one-off.

Therefore, don’t expect Europe’s banking woes to heal any time soon – in fact they may be about to get much worse.

Thanks for reading.

Twitter: @JLyonsFundMgmt

Read more from Dana’s Tumblr Blog

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.