When the terms “growth” or “growing economies” are mentioned, most active investors immediately think of emerging markets, such as the BRIC nations: Brazil, Russia, India, and China. The renowned Jim O’Neill (ret. Goldman Sachs) coined the acronym in 2001 and described those countries as in the stage of advanced economic development. However, before I go deep into economics and turn this into a novel about future growth in emerging markets, I want to preface that this post will be about the performance of ETFs associated with so-called growth economies. And yes, this will go beyond the traditional BRIC nations.

When the terms “growth” or “growing economies” are mentioned, most active investors immediately think of emerging markets, such as the BRIC nations: Brazil, Russia, India, and China. The renowned Jim O’Neill (ret. Goldman Sachs) coined the acronym in 2001 and described those countries as in the stage of advanced economic development. However, before I go deep into economics and turn this into a novel about future growth in emerging markets, I want to preface that this post will be about the performance of ETFs associated with so-called growth economies. And yes, this will go beyond the traditional BRIC nations.

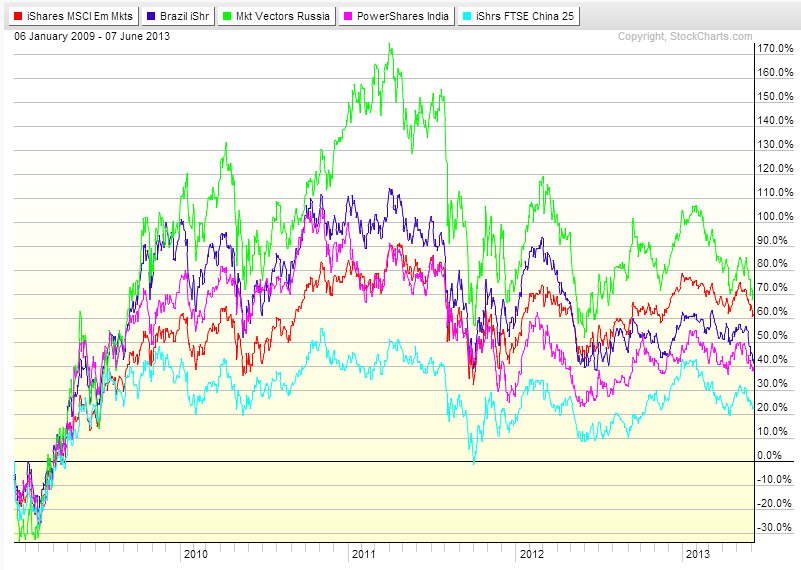

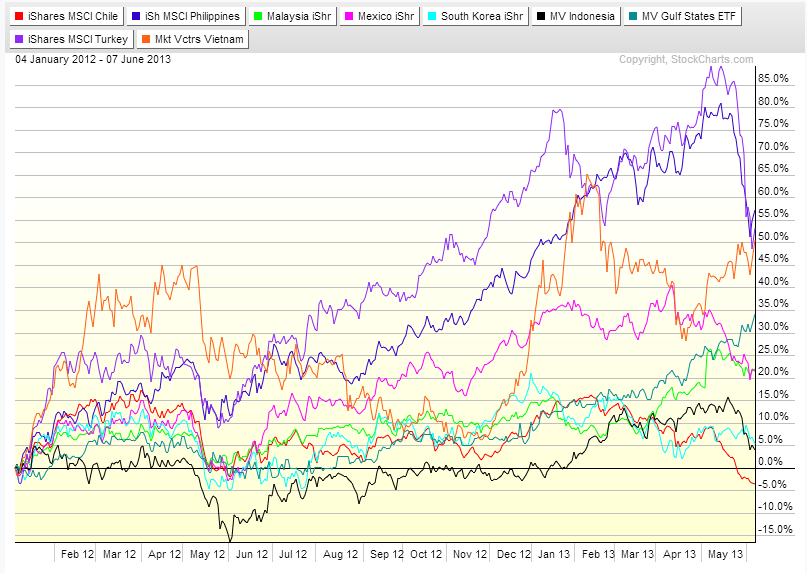

Here’s a side by side comparison of performance since 2009 of the BRIC nation ETFs along with the Emerging Markets ETF (EEM) and the other growth economy ETFs of countries such as Mexico, South Korea, Chile, and Indonesia. One can see that while the Ex BRIC growth economy ETFs have outperformed those of the BRIC ETFs, the BRIC ETF performance is nothing to be ashamed of. Click chart images to enlarge.

Emerging Markets Chart (BRIC, 2009-Current)

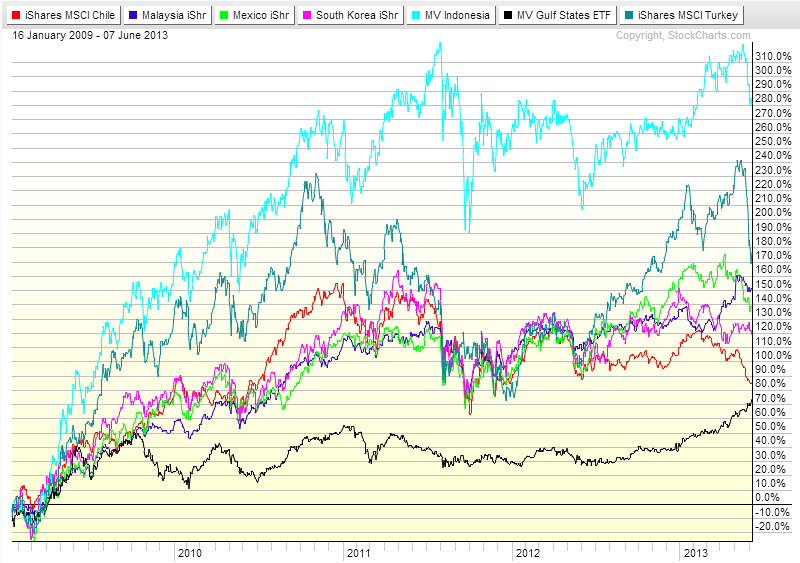

Emerging Markets Chart (Ex BRIC, 2009-Current)

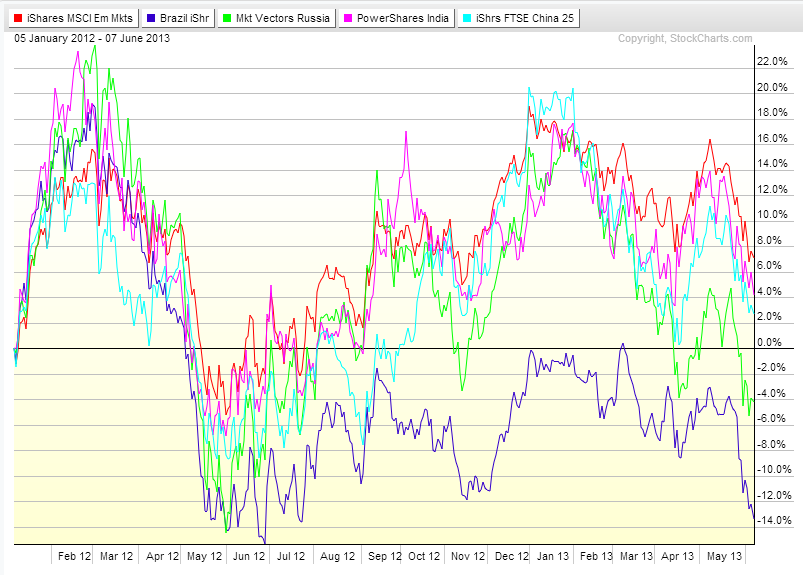

However, since 2012 the outperformance has become more glaring. I’ve added the performance of EPHE (Philippines) and VNM (Vietnam) to the EX BRIC growth economy ETFs as those were introduced past 2009.

Emerging Markets Chart (BRIC, 2012-Current)

Emerging Markets Chart (Ex BRIC, 2012-Current)

It’s glaring that outside of Chile (ECH), Indonesia (IDX) and South Korea (EWY), the Ex BRIC ETFs have outperformed their larger economy counterparts.

Does this mean that the magic of the BRIC nations has dissipated and been replaced by these new economic growth kids on the block? If we’re discussing market performance, it’s plausible. Economic growth in BRIC countries outside of China lags most of the smaller growth economies. With low rates of return from presumably “risk free assets,” the chase for capital appreciation and yield will lead money flows into these new growth engines that the world isn’t quite used to yet–the Mexico (EWW), Indonesia, Oil rich and politically quiet Gulf States such as the UAE and Qatar (MES). These fast growing economy ETFs also have charts that are momo-ish. And while the growth forecasts might support such equity index moves, the moves can be as volatile to the opposite side. One doesn’t need to stare at the charts to see that those moves can be wilder than those famous roller coaster rides.

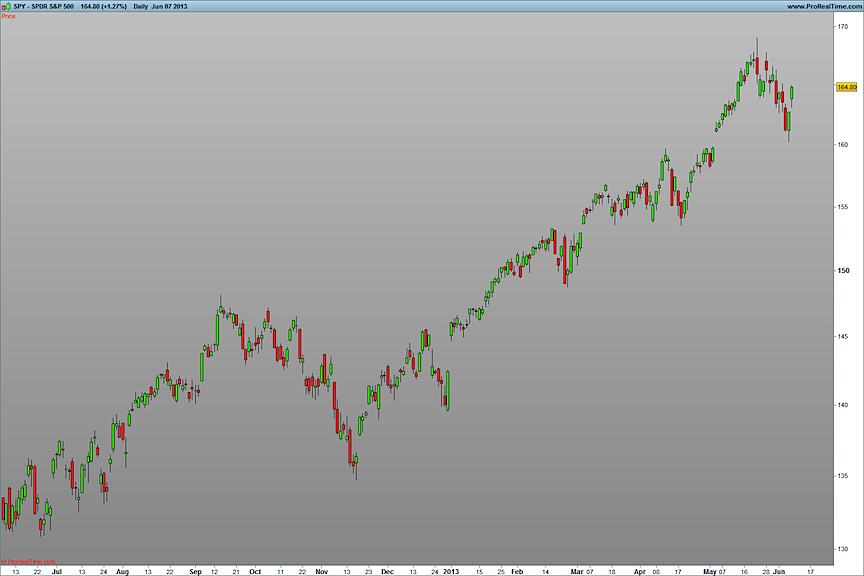

As with any emerging markets nation, the road to growth will most likely be bumpy. Brazil (EWZ) and India (PIN) are excellent manifestations of this fact. Economic growth requires policy formulation and implementation. However, policies from one administration can be vastly different from future administrations. Furthermore, economic advancement doesn’t necessarily relate to equity performance. One just needs to look at the 52 week charts of the FXI (FTSE China 25 Index Fund) and the SPY (SPDR S&P 500).

FXI Stock Chart (China ETF)

SPY Stock Chart (S&P 500 ETF)

So while I believe that the future is bright for these growth economies, BRIC and EX BRIC, any investor must be willing to accept the volatility ride that comes investing in non-developed country ETFs.

Twitter: @cerebraltrades and @seeitmarket

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.