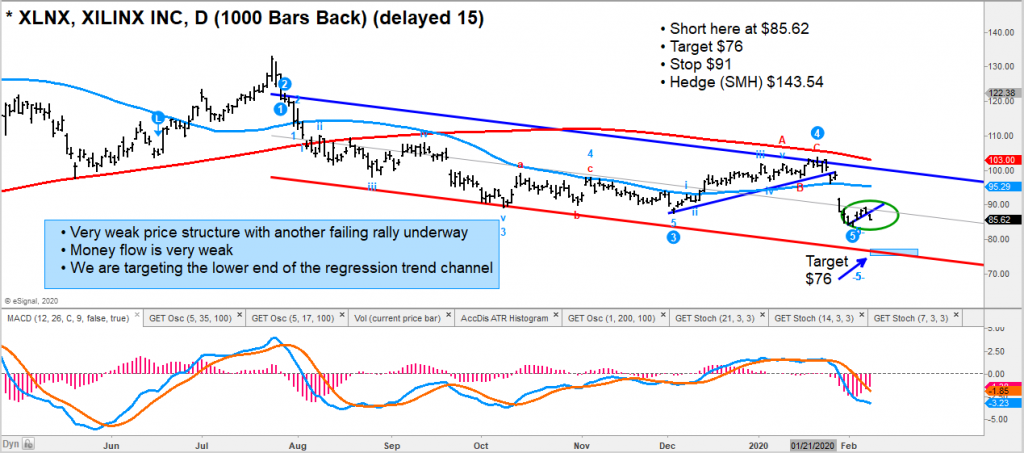

$XLNX Xilinx Chart

Xilinx stock (XLNX) has not been keeping up with its fellow semiconductors stocks.

Not even close.

That said, this stock is a potential trading short idea as a hedge against a long Semiconductors Sector ETF (SMH) trade.

XLNX has a very weak composite score of -2.30, and I think it can be used as a “short” hedge vs SMH. We have a downside target of $76 for XLNX.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.