Will the FED raise interest rates? I have no clue.

Will the FED NOT raise interest rates? I have no clue.

What do I know? I “think” I know chart patterns … and in the sandbox that I play, that’s all that matters.

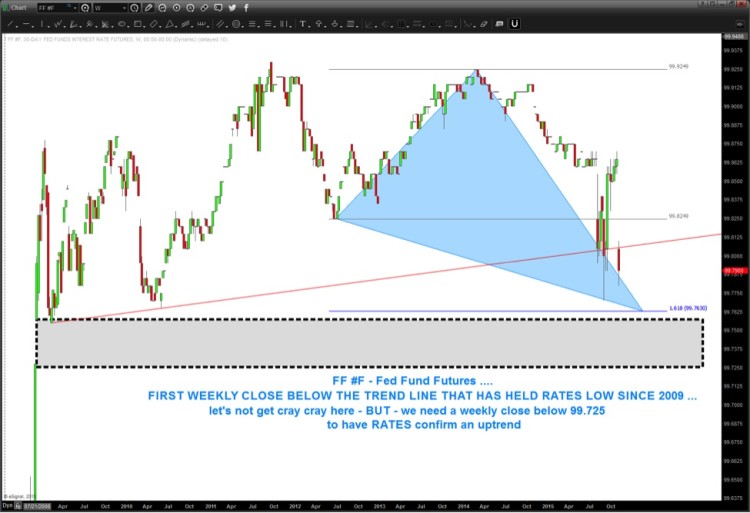

I pay attention to the 30 day Fed Funds Futures (FF #F). I’ve blogged about it a bunch but wanted to show @seeitmarket readers something very important. Again, see above. I honestly don’t care and am not married to a bear or bull outlook on interest rates. Just bringing to light (cue the Big Lebowski – “new S*&^ has come to light”) some very “interesting” developments in what traders are doing with regards to rates.

First off – what is the 30 day Fed Funds Futures Contract? Here’s the link to the contracts right from the CME:

- Here’s a link to the contracts right from the CME

- Summary:

- The 30-Day Fed Funds futures and options contracts are important risk management tools for anyone who wants to hedge against, or speculate on changes, in short-term interest rates brought about by changes in Federal Reserve monetary policy.

So why am I blogging about it now?

Well, long before China became a “big deal” with regard to their currency policy, I shared a very important chart in the following blog post (as the end of 2014): “The Most Important Chart To End 2014“. What you’ll find in that post, “if you decide to defy human nature and do the work” (Jimmy Twentyman), is that PATTERNS give you a forward looking ability to make IF-THEN statements about market trends. When China became big news… we were almost a year in front of it. PATTERNS do not lie… when they work, it’s a big deal and when they don’t it’s a big deal. They are demarcation points that allow you to position accordingly with proper risk management.

So what’s happening in Fixed income… ?

As Bill and Ted philosophically said – “strange things are afoot at the Circle K”.

Let’s take a purely technical look at the Fed Funds Futures

- This week we just completed the largest gap down in the contract since 2009.

- We have CLOSED at the lower end of the range “weekly” below the red trend line

Folks, the market is telling us we are entering a higher rate environment… UNLESS

- The “blue shaded” triangle (1.618 extension pattern) holds as strong support or

- The dashed black lines and grey filled regions – a big and open window (gap) hold as support

CONCLUSION: Let’s never use anything in isolation but we have in the long term Fed Funds Futures chart a very defined base. If we close (weekly) below the lower dashed black line then higher interest rates are a fact of life and, no matter what the FED does, they are likely here to stay.

I have told many friends that the “trade” of our life time is to be “long rates.” Perhaps the time is approaching. Personally, this thought won’t materialize until the above levels discussed are taken out on a weekly close.

Thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.