Oil makes a reversal pattern and rejects its 80-month moving average; however, will the overall trend stay intact, or has Wednesday signified an end to the crazy oil rally?

Looking at the above chart of the United States Oil Fund (USO), we can see a large amount of volume on Tuesday and Wednesday.

Both days have similar volume levels around 29 million shares traded. This shows that Tuesday’s price move has been completely flipped not only in price but also in volume.

It’s important to note because it makes the price move much more meaningful than if we had a breakdown on low volume.

Compared to the 50-day volume average which is around 8 million shares traded, watching the volume progress from here can tell us if large amounts of selling (backed by volume) continue through the week.

If so, this will make Tuesday’s high at $87.84 a much stronger resistance level to clear.

Having said that, uncertainty about where/how the current administration will secure enough oil for the U.S means we could see even more volatility ahead.

From a daily technical side, the most obvious price level USO has closed over is the 10-Day moving average at $74.41 (magenta line).

If USO makes a close under the 10-DMA it can easily breakdown further as there are no obvious support levels nearby.

If that is the case, waiting for USO to consolidate more is a good plan for anyone looking to buy.

So far, the oils price drop has helped the major indices out of the danger zone near their recent lows dating back to 2/24.

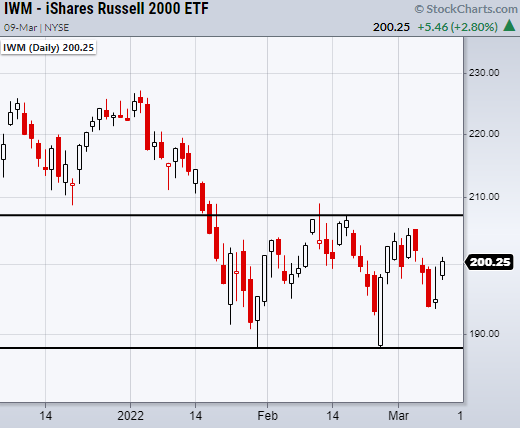

Specifically looking at the small-cap index Russell 2000 (IWM), we can see that while a rally is encouraging, we have pushed right back into a very choppy zone.

With IWM sitting at $200 it’s only back in the middle of its range as seen in the above chart.

The bottom and top of its current range are shown with black lines.

While we can watch for trading opportunities in equities, we must be very careful when looking to place longer-term trades since IWM is stuck within its range.

Nonetheless, if IWM continues upwards, watch for the high of the range to clear near $208.

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) 415 is price support.

Russell 2000 (IWM) 193 is price support.

Dow Jones Industrials (DIA) 326 is price support.

Nasdaq (QQQ) 318 is price support.

KRE (Regional Banks) Needs to hold over 69 the 200-day moving average.

SMH (Semiconductors) 246 is pivotal.

IYT (Transportation) 243-245 is price support area and 273 is price resistance.

IBB (Biotechnology) 118 is price support.

XRT (Retail) 78 is price resistance.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.