When crude oil prices rise, investors typically think of an improving global economy.

But when crude oil price rise sharply (by a large amount over a short duration), investors worry about supply issues and/or inflation. Today, both concerns are becoming more and more evident by the day. Just last week, I highlighted growing concerns about an energy crisis do to rising oil and natural gas prices.

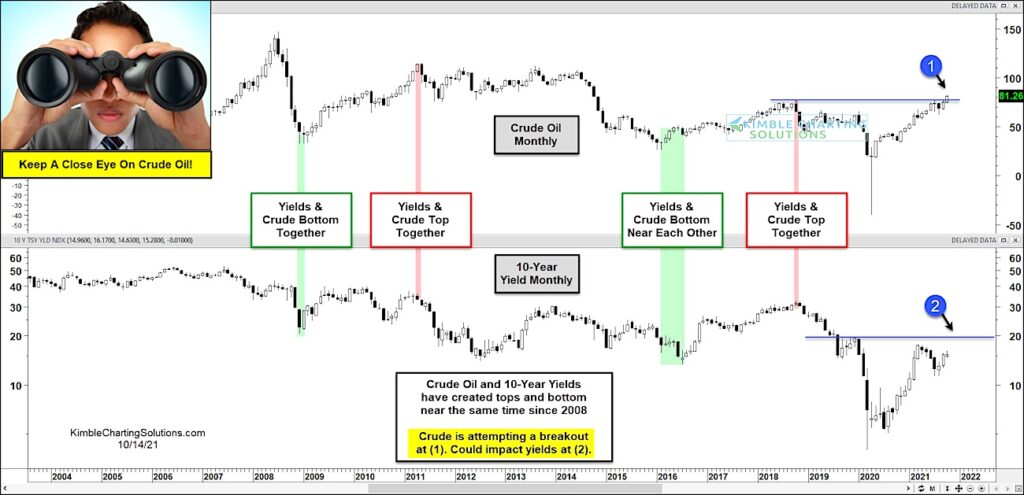

The chart below looks at a long-term comparison of the price of crude oil versus 10-year US Treasury Bond Yields (interest rates).

As you can see, crude oil and yields have topped and bottomed together on several occasions since 2008.

Currently, crude oil is breaking out above its last top at (1). If crude oil succeeds, it could impact bond yields at (2).

Are rising interest rates around the corner? Looks like investors might want to keep a close eye on Crude Oil at (1). Stay tuned!

Crude Oil Prices versus 10-Year US Treasury Bond Yields Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.