It’s always nice to see the equity markets make new all-time highs. Journalists are happy because it draws more attention and views, traders rejoice in the rise in their portfolios, and consumers get a warm feeling as they associate the stock market with the economy. However, when I see we have a new high one of the first things I do is look for confirmation. We can’t forget that the stock market is truly a market of individual stocks. How many of those stocks also made new highs? How many were advancing? Was momentum strong? What about volume? Which sectors helped lead things higher? These are the questions I ask.

It’s always nice to see the equity markets make new all-time highs. Journalists are happy because it draws more attention and views, traders rejoice in the rise in their portfolios, and consumers get a warm feeling as they associate the stock market with the economy. However, when I see we have a new high one of the first things I do is look for confirmation. We can’t forget that the stock market is truly a market of individual stocks. How many of those stocks also made new highs? How many were advancing? Was momentum strong? What about volume? Which sectors helped lead things higher? These are the questions I ask.

I discussed many of these topics in my Technical Market Outlook on Monday as well as my post from a few weeks ago, We Haven’t Seen a Market Top Yet. However, there is currently one chart that I think is extremely important, and could ‘unlock’ the bear market that many traders have been pining for and that the market internals have been attempting to warn us of.

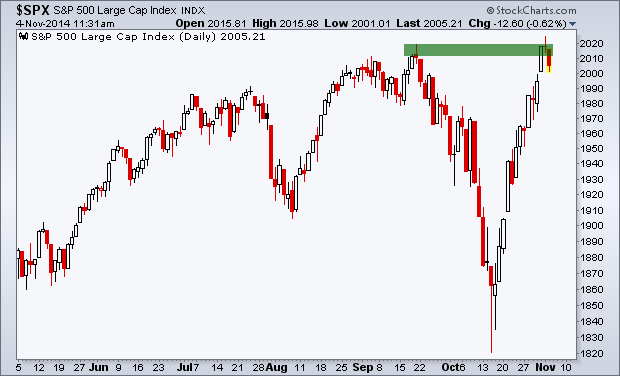

Below is simple chart of the S&P 500 (SPX) over the past six months. I’ve put a green box around the prior high, including the closing and intraday levels. The markets inability to stay above this high is very concerning to me, and could be creating a false break. If the bulls are unable to keep the SPX above the prior high, the idea that stocks will rally into year-end may not come to fruition.

S&P 500 (SPX) Daily Chart

There are many similarities to the current market environment compared to 2007. We have breadth, as measured by the Advance-Decline Line putting in a series of lower highs as fewer stocks participate in the rally. Momentum, as measured by the Relative Strength Index, on a weekly chart has also created a bearish divergence with a grouping of lower highs. Like in July 2007, the S&P 500 dropped down to its 50-week Moving Average before rallying to a new high. Unfortunately, as in October 2007, the bulls couldn’t maintain control and price fell lower – eventually breaking through the prior support of the long-term Moving Average.

I didn’t think the September high was the peak for the year, as we hadn’t seen enough damage done to the internals (breadth and momentum) yet. But at this point, we may now have. I’m now watching to see if the psychologically important 2000 level holds for the S&P 500. It seems like traders, both professional and retail like round numbers as their levels to watch (don’t ask me why). A break and follow-through past SPX 2000 may just be what the bears need to carry things lower.

While I prefer to be positive and bullish, the way the market is acting right now, it is hard to make that argument. There just seems to be too high of a level of positive sentiment with traders pointing to strong seasonality, mid-term elections, and Japanese stimulus as reasons to ignore deteriorating market internals. I hope we see price hold above 2000 and is able to regain the September high. But if it doesn’t, then things may get ugly. We’ll see what happens.

Follow Andrew on Twitter: @AndrewThrasher

You can also read more on Andrew’s Blog.

The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.