Energy plays have some of the best chart setups right now from a momentum breakout standpoint.

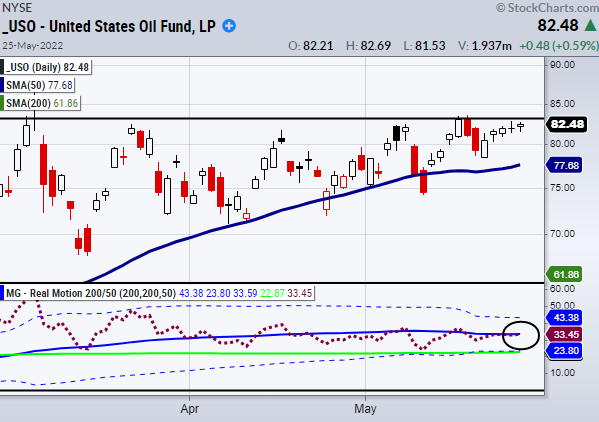

A perfect example of this can be seen in the above chart of the United States Oil Fund (USO).

Currently, USO has been consolidating within an upward trend near its key resistance area from $82 to $83.

Additionally, at the bottom of the chart, we can find our RealMotion (RM) momentum indicator.

Though it is sticking close to the 50-Day moving average (blue line), it has yet to clear back over.

With that said, the best buy signal would be for both price and momentum to clear their resistance levels at the same time.

This would confirm that price along with momentum is in agreement since USO’s price is already trading over its 50-DMA.

If able to breakout, this could boost already strong energy companies even higher.

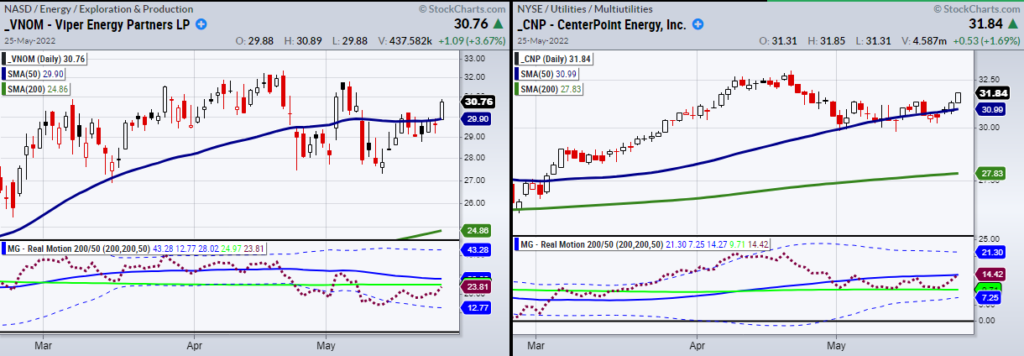

Energy companies with similar setups are Viper Energy Partners (VNOM) and Centerpoint Energy (CNP).

Both cleared recent consolidation and have momentum either breaking or on the verge of breaking a major moving average.

Furthermore, these could be interesting picks, especially if USO clears and holds over $83.

With the Fed setting investors’ expectations for more 50 basis point rate hikes, safety plays through energy companies look to have more upside potential.

Stock Market ETFs Trading Analysis:

S&P 500 (SPY) 397 pivotal. 380 minor support.

Russell 2000 (IWM) 168 support.183 resistance.

Dow Jones Industrials (DIA) 322 resistance to clear and hold.

Nasdaq (QQQ) 285 minor support.

KRE (Regional Banks) 62.17 to clear.

SMH (Semiconductors) 215 support. 239 resistance.

IYT (Transportation) 223 needs to hold.

IBB (Biotechnology) 116.68. to clear and hold.

XRT (Retail) Large comeback day. 58 support.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.