Insurance – One of the best ways for us to protect our portfolios from rising rates is to invest in Canadian life insurance companies. We have meaningful positions in Manulife and Sun Life in both the fund and in our other Canadian investment solutions.

Manulife is a globally diversified business, with less than a quarter of its revenues generated domestically. This gives it exposure to the synchronized growth we are seeing across the globe. Manulife’s Asian asset management business $20.00 has been flourishing, thereby supporting earnings growth. With only $19.00 19.0% of revenue originating in Canada, the company does have $18.00 increased foreign exchange risk.

Sun Life is more focused on North America, offers a larger yield than Manulife and has been a less volatile stock historically, which led us to own both names. Again, the largest risk to these holdings is that our call on rates does not play out as expected.

Diversified Financials – The two other positions that round out our Financial sector exposure are Lazard and Virtu Financial. Lazard is now the 6th largest M&A advisor in the world, behind only large blue chip players. We like exposure to the M&A thematic because deregulation and the need for consolidation in a digital era should foster more transactions. Virtu is an interesting company that provides liquidity in thousands of products across the global financial markets. Many of its competitors (the banks) have reduced exposure market making due to increased regulation in the wake of the global financial crisis. Unlike most companies, Virtu earns more when volatility spikes. The stock also has a low correlation to both the S&P 500 and the TSX. Both of these characteristics make Virtu a unique portfolio diversifier.

REAL ESTATE

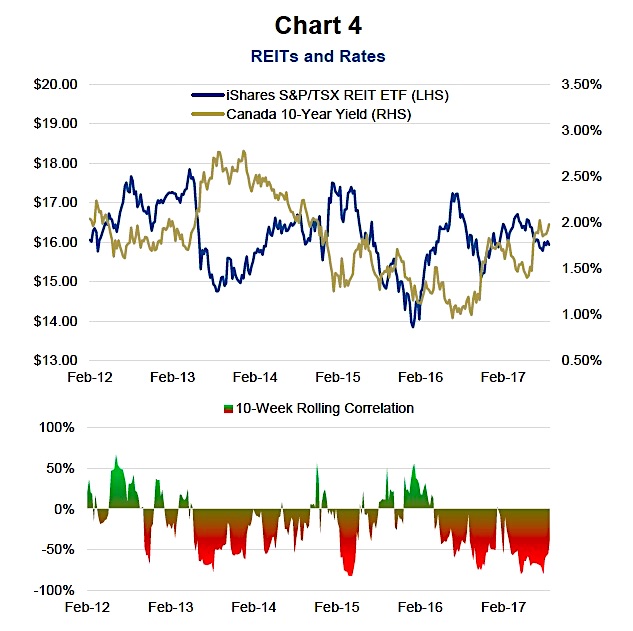

We find it challenging to allocate a meaningful amount of capital to this sector at this time for a few reasons. The Real Estate Sector (NYSEARCA:IYR) does poorly in a rising rate environment (Chart 4). We also believe that residential housing remains expensive and a risk. If there is a correction in Canadian housing, it would likely have a negative residual impact on all real estate to varying degrees. Currently, our only holding is Pure Industrial REIT. The stock has done well over the past year; but, we can still justify a modest position because of its 5% yield and its solid growth prospects.

UTILITIES

The Utilities Sector (NYSEARCA:XLU) is another sector that tends to underperform in a rising rate $10.00 environment. We have no exposure in the sector at this time. The valuations in this high-yielding, low-growth, defensive sector have -$5.00 ballooned as investors search for dividend yields as an alternative to bonds. We foresee that the multiple expansion that has occurred over the past few years will contract at some point, giving us a better opportunity to buy. That said, we are keeping our eyes on a few interesting plays that have exposure to the changing global energy mix.

TELECOM

Historically, Telcos have demonstrated a degree of interest rate sensitivity. Even so, the group trades more on fundamentals. The sector has some extremely firm tailwinds. Every day, more devices become connected. Moreover, the internet of things is only going to proliferate that growth. If broadband technology is what connects all of these devices then the providers of that spectrum, telcos, should be one of the largest beneficiaries.

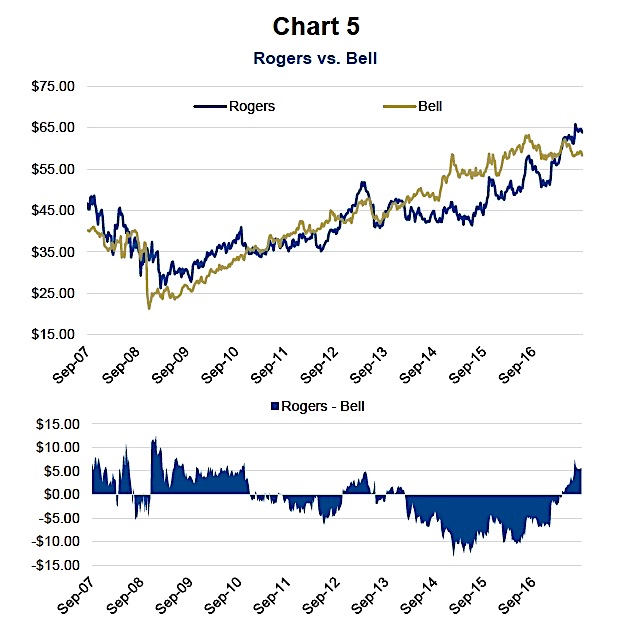

Pricing for mobile users is flattening. As such, it is purely a game of scale in our country. This benefits Rogers and BCE, the providers with the largest user bases and the biggest economies of scale. Rogers has vastly outperformed BCE so far this year. Still, there has been a historical tendency for divergences between the two stocks to correct and for the spread between them to revert back to equilibrium (Chart 5). Both companies are innovating and adapting in a quickly- evolving media and mobile market. We like the wide moats of both companies and will likely always have exposure to them in varying degrees. The biggest risk to these two companies is government intervention, which could affect them from both a pricing and a competition stand point.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.