Anchoring bias and regret aversion bias are two behavioural investment biases that can impact how an investor views existing holdings or positions. These can lead to preconceived notions or views on a company enduring, even when the available information has changed. Or the desire to not feel regret by crystalizing a negative outcome.

To combat these biases that exist in all of us, the Connected Wealth team periodically conducts what we call a “refresh”. Starting from a blank slate, each of the analytical team members independently researches each sector. If starting anew, how would you allocate money today to be best positioned for the future?

Each member also reviews every position, testing the thesis. Essentially, we answer the question: As of right now, where would you allocate capital, regardless of current allocations?

Additionally, for each company we conduct a pre-mortem. Cognitive dissonance, a behavioral bias, is a state of mind where you hold two or more contradictory ideas. The mind does not like to have inconsistent thoughts and tries to rationalize information to make thoughts consistent. However when investing, this can lead investors to miss or underweight information that is counter to your pre-existing view. A pre-mortem is a method to manage cognitive dissonance in a framework that is more constructive when investing. Pre-mortems require you to formulate how your existing thesis could be wrong, highlighting risks that could negatively impact the position.

We find this exercise very useful in our process and thought users of our services, other portfolio managers and investors may find the abbreviated output useful. Grouping sectors into three buckets: Interest rate sensitive sectors, Cyclical sectors, and Defensive sectors. This is the first installment looking at the Interest rate sensitive sectors and stocks.

Note that this research post was written with Chris Kerlow.

Introduction: A Macro Overview

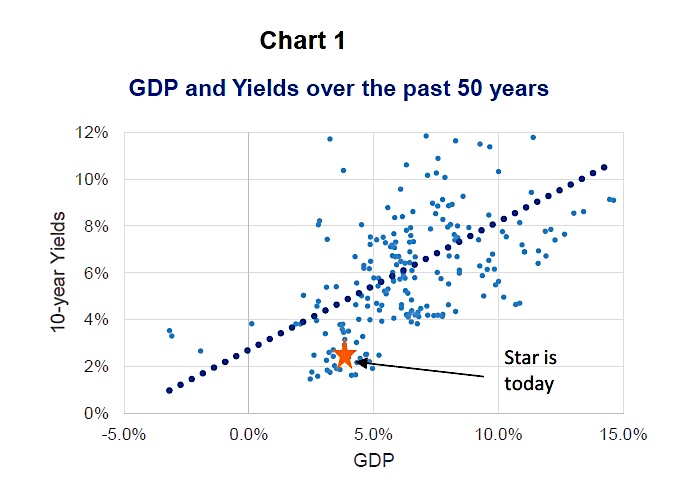

Interest rate sensitive sectors, Financials, Real Estate, Telecommunication Services and Utilities, tend to be the sectors more sensitive to changes in interest rates or bond yields. Our macro view is that economic data, both domestically and globally, is improving. While this improvement has yet to flow into the inflation data, it will follow in the quarters ahead. As a result, central banks have embarked on a tightening cycle, whether by ending quantitative easing or actually raising short term rates. We believe the longer yields in the bond market are underestimating the economic improvement and the trend in both short rates and longer yields will be to the upside (see Chart 1).

FINANCIALS

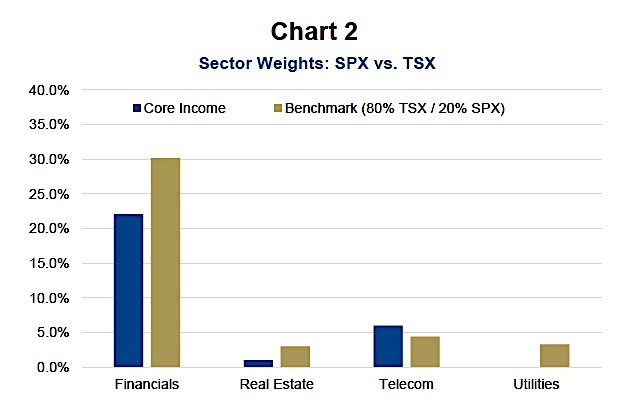

The Financials Sector (NYSEARCA:XLF) is comprised of three key groups – Banks, Insurance and Diversified Financials. Broadly speaking higher rates are a lift for this sector to varying degrees, as long as rates don’t move too far. We have a healthy 22% in Financials, a lower weighting than our benchmark which is skewed by the Financial weight in the TSX (Chart 2).

Banks – we like the banks, but don’t love them. The Bank of Canada has started raising rates due to improving economic growth. This is mostly positive for the Canadian banks which benefit from a healthy economy and potentially from improving net interest margins. Valuations are attractive in the 10-12x price to earnings range and dividend yields are great. Holding us back from loving them is the heavy reliance on the housing industry, which we view as a risk. Canadian home sales have accelerated over the past several years. As a result, mortgage origination has become a large part of the banks’ businesses and has created concerns about the level of household debt.

We are positive on the U.S. banks. After being in the penalty box for so long following the financial crisis, we believe we are nearing a period of rising return on equity and increased dividends. Again this group benefits from high net interest margins and we could see regulation softening. There are some risks, namely auto loans and the U.S. consumer may be tiring.

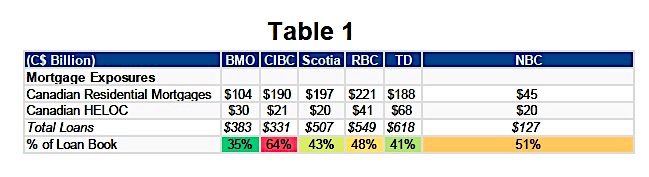

We continue to prefer TD, Royal Bank and the Bank of Montreal. Our most recent transaction was in BMO. We added to the name based on valuations and following underperformance relative to the peer group. All three of these banks have been growing their U.S. businesses, with TD and BMO focusing on retail banking and Royal more on capital markets. All three provide the fund with attractive 3.5+% yields and are committed to growing their dividends. They should continue to perform, so long as our economy continues to grow. That said, we would lower our allocation following a deterioration in the Canadian housing market. We also like the above names because they have lower exposure to housing relative to CIBC and National Bank (Table 1).

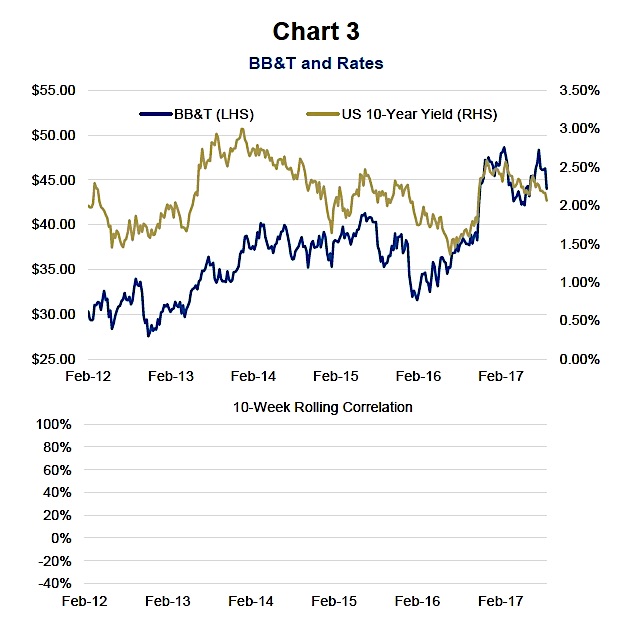

In the U.S., we own BB&T bank, one of the largest regional banks in the U.S. Historically, the company has had a positive correlation with rising rates (Chart 3). If economic data in the U.S. continues to improve in the 2nd half of the year and into 2018 then we would expect bond yields to rise and regional banks to perform well. The biggest risk to our thesis is if we are wrong on the direction of yields or that political impasse delays deregulation for banks.

Continue reading this article on the next page…