The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- The state of the consumer is mixed with some companies reporting declining sales trends while others say spending is solid

- Back-to-school shopping season is underway, and investors anxiously await results and guidance from retailers in the electronics, clothing, and furnishing areas

- The National Retail Federation expects a new record in total sales, though down from 2021’s robust total once inflation is considered

What is the state of the consumer? There are signs that wealthier groups are weathering the current inflationary storm just fine while the bottom quintile of income-earners struggle to meet the rising cost of living. High grocery bills, soaring rents, and still elevated prices at the pump put a strain on Americans’ budgets just as the all-important back-to-school shopping season gets in full swing.

Increased Credit Card Spending

Back on July 21, shares of AT&T (T) tumbled after the telecom giant said some of its customers were beginning to fall behind on their monthly bills.¹ But then we heard a sanguine tone from a host of major credit card companies. Mastercard (MA), Visa (V), and American Express (AXP) commented that card spending was robust. Mastercard’s CEO said on its earnings call, “Increasing inflationary pressures have yet to significantly impact overall consumer spending but we will continue to monitor this closely.” It seems Wall Street is living and dying by each data point and even corporate anecdote as to how spending is holding up.

A Tale of Two Consumers

This so-called Jekyll and Hyde consumer commentary, as coined by Bank of America analysts, indicates how fragile the landscape is following two quarters of negative GDP growth. Pundits argue whether we are in a true recession. The data show consumption, while slowing, is still positive. Moreover, June’s Advance Retail Sales data was slightly better than analysts expected, though still below the headline inflation rate.² We will know a lot more over the next few weeks as more sales data arrive both at the macro level and with specific companies.

Record Sales Expected

Homing in on the back-to-school season, the National Retail Federation (NRF) released its 2022 Back-to-School Trends report. The trade association notes profound spending over the last two years with 25 straight months of retail sales gains. Of course, higher costs amid the economic slowdown causes consumers to switch to cheaper alternatives and hunt down coupons, according to the NRF. Back-to-school items are often seen as necessities, so while these sales may be strong, the concern is that it may result in lower spending in more discretionary categories. Overall, the NRF expects the typical family with children from elementary through high school to spend $864, on average, this season, up from $849 last year. In total, $36.9 billion is expected to be spent on back-to-school items. “Back-to-college” spending should sum to $73.9 billion vs $71.0 billion in 2021. After inflation is considered, those totals are negative year-on-year.

Soft Electronics Spending

Investors must look to what companies report over the coming weeks to see how the data verifies. Four key categories are electronics, clothing & accessories, shoes, and dorm & apartment furnishings. Electronics is the most important area – and there is already some uncertainty there. Just take a look at what Best Buy’s (BBY) CEO had to say in a company update on July 27: “As high inflation has continued and consumer sentiment has deteriorated, customer demand within the consumer electronics industry has softened even further, leading to Q2 financial results below the expectations we shared in May.”³ Microsoft (MSFT) also worried about the retail space in its quarterly report, citing worsening PC sales.⁴ And who can forget Walmart’s recent bombshell profit warning.⁵

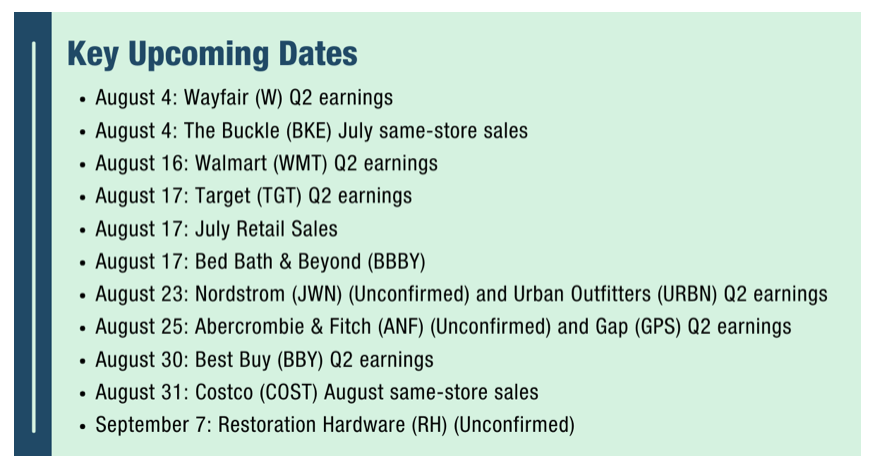

Retail Earnings & Events Timeline

August kicks off with a pair of key monthly same-store sales data. Then comes major retailer earnings reports as well as the July Advance Retail Sales data point on August 17. The back half of the month and early September feature quarterly results from electronics, clothing, and furnishing retailers. Let’s dive into some of the key dates and reports traders should keep on their calendars.

On the corporate conference calendar, Wall Street Horizon’s data show four consumer-related events:

- August 31: DNB Nordic Consumer Conference

- September 6: Barclays Global Consumer Staples Conference

- September 7: Goldman Sachs 29th Annual Global Retail Conference

- September 13: Piper Sandler Technology and Consumer Growth Frontiers Conference

The Bottom Line

The second quarter earnings season has generally been better than expected so far, but we have yet to hear from important retailers. There is extra anxiety with recent comments from Walmart and Best Buy and the back-to-school shopping season is a true test of the consumer. Traders must monitor key dates in the weeks ahead to manage risk at both the macro and micro levels.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.