Say what you will about the equity markets, some of which appear overvalued and are pricing in a lot of good news (mainly the U.S. equity market). You could even say there are some small equities bubbles out there.

But one thing is for certain: the economic outlook for 2021 is looking pretty good and has a lot of momentum.

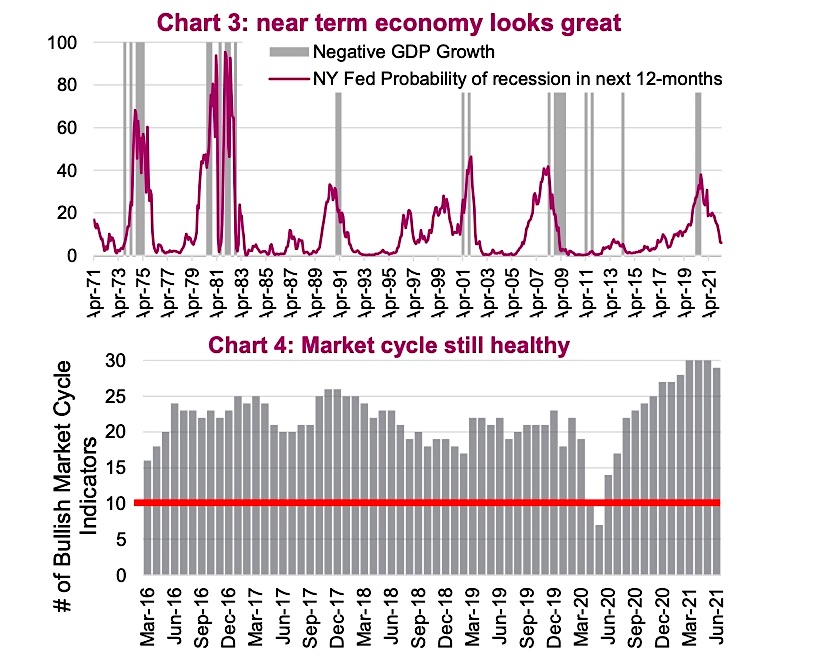

The global COVID-19 case counts are coming down, unprecedented stimulus remains largely in place, economies are re-opening, and there is pent-up demand by citizens to spend some of those savings – all good for the economy. With this kind of momentum, even with some softening of late, has the probability of a recession in the next 12- months down to 5%.

For comparison, this gauge from the NY Federal Reserve was rising at an accelerating pace during 2019 into early 2020 – an accurate alarm bell for the last recession. Typically, 5% is the lower bound for this index, implying a very low likelihood of a recession anytime soon. (Chart 3)

Even if we do see a pullback in equities, which we would argue is overdue, this would be a buying opportunity given the low probably of a recession. Historically, pretty much any material drawdown in the equity market is a buying opportunity as long as it isn’t coinciding with a recession. Unfortunately, we don’t know a recession has started until months after the fact, but safe to say there isn’t one in the works today.

Supporting this ‘low recession probability reading’ is our Market Cycle indicators. We did see a slight dip from last month, 30 to 29 bullish, but this is still very high and elevated. (Chart 4)

The vast majority of economic indicators remain bullish of a continuation of the market cycle. The only negatives remaining are valuations in the equity market, emerging market momentum and energy demand.

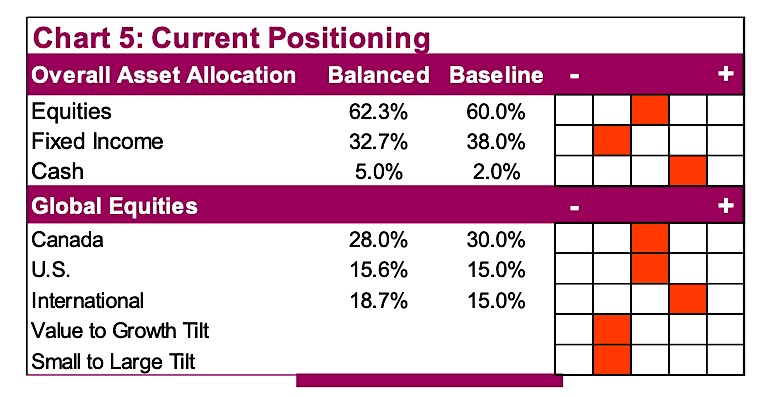

Position-wise, our thoughts have not changed over the past month. We remain a tiny overweight in equities, underweight in bonds and overweight in cash. The cash balance is earmarked as opportunistic capital if / when the market corrective phase hits.

Within equities we have a market weight in both Canada and the U.S. with an overweight International. We are more cautious for the U.S. market and have this capital tilted towards value / dividend payers and less exposed to the megacap tech. International markets, and Canada, are not cheap by historical standards but are still not overly expensive. Relative to the U.S. market, international is cheap on a relative basis, providing a buffer on a pullback and upside potential should this historically high spread narrow.

We remain constructive on the market cycle looking out a year+. However, given the advance we have seen this year, we would encourage some profit-taking to raise cash for the potential pullback, as well as taking advantage of the highly valued Canadian dollar to do some non-Canadian buying.

Written by Craig Basinger, CFA.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.