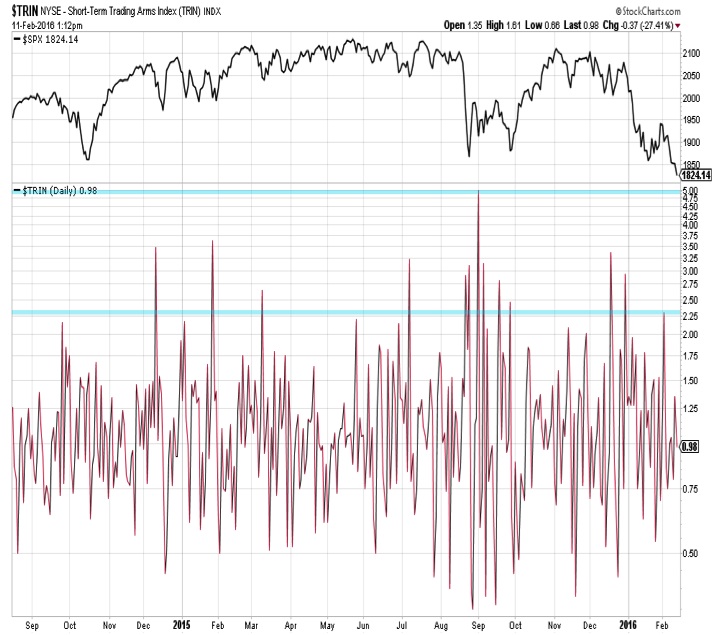

TRIN Stock Market Indicator

Evidence of capitulation would come from the TRIN. This reflects that ratio between advancing/declining issues and upside/downside volume. As stocks were bottoming last summer, we saw multiple TRIN readings above 2.5 and even saw one as high as 5. That sort of indiscriminant selling is indicative of capitulation. We have not seen anything that approaches that in the current circumstance. Two or more days of elevated TRIN readings would suggest that a sustainable low is coming into focus.

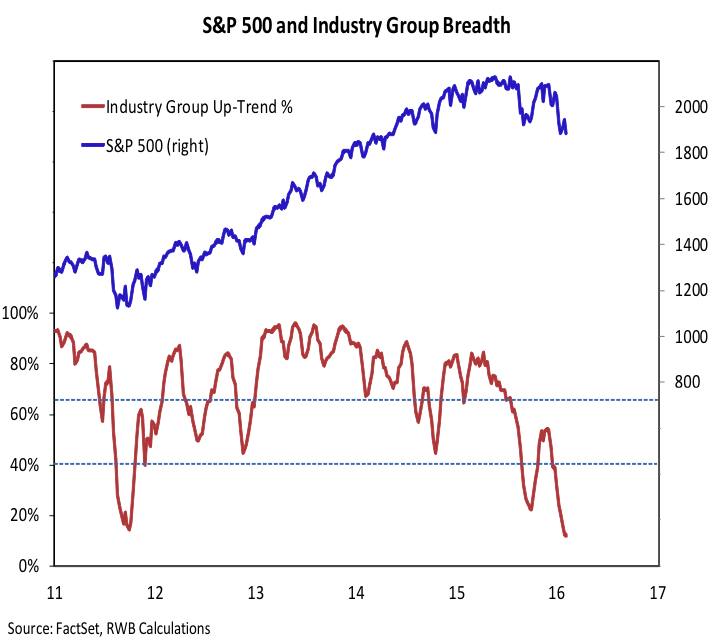

Market Breadth

After a low is in place, we would expect to see strong buying demand, represented by two days of 10-to-1 (or better) upside over downside volume. While those conditions could clear the way for a sustained counter trend move toward the 50-day or 200-day average, we would need to see significant improvement in market breadth trends to grow more confident that the cyclical lows are in place. Missing from the rally off of last summer’s stock market lows was sustained improvement in market breadth. For a brief time market breadth looked good, but the initial moved produced no follow-through. That helped provide the set-up for this year’s weakness and that trend needs to change.

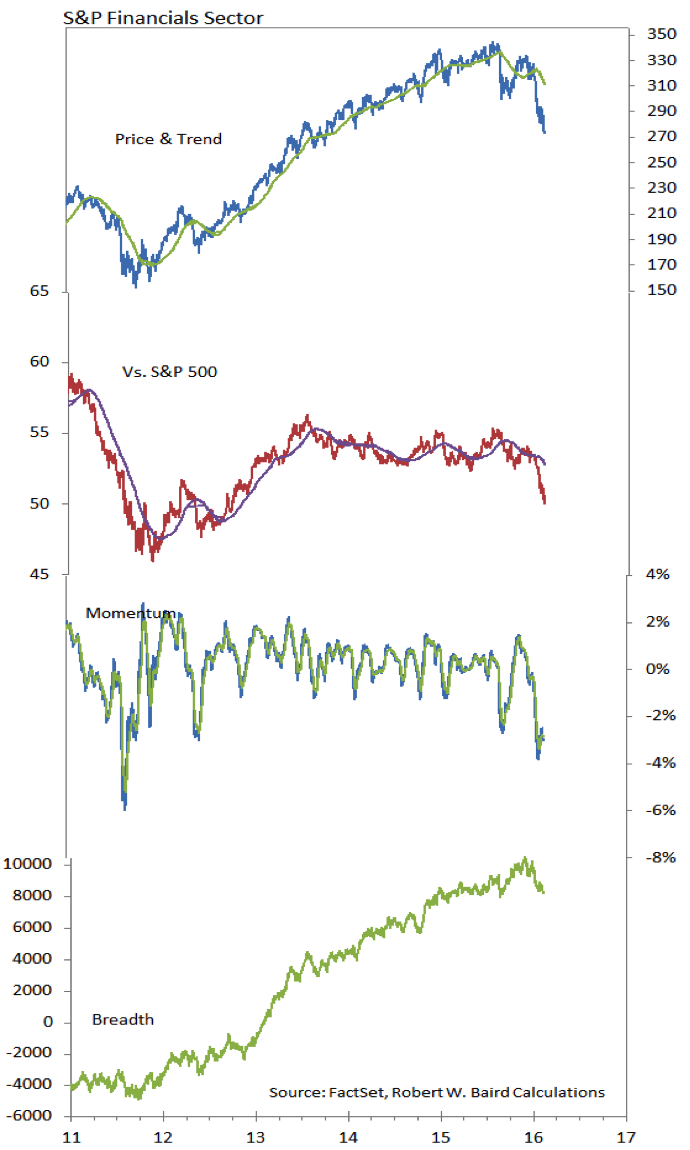

Financials Sector

The financials sector continues to lose relative strength and that is typically a harbinger of weakness in the overall market. Financials tend to lead the popular averages, and now they are leading stocks to the downside. Breadth is now starting to confirm the weakness seen from a price perspective.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.