Investor Sentiment

Also supporting a near-term bounce in stocks is the widespread and excessive pessimism that is being seen. Both the AAII and Investors Intelligence surveys show more bears than bulls (although curiously, bulls on the AAII survey actually ticked higher this week – a lot of would be contrarians it seems). Active money managers continue to get more defensive. The NAAIM index dropped to 26% this week, and at least one-quarter of respondents have zero percent or less exposure to stocks.

Market Breadth

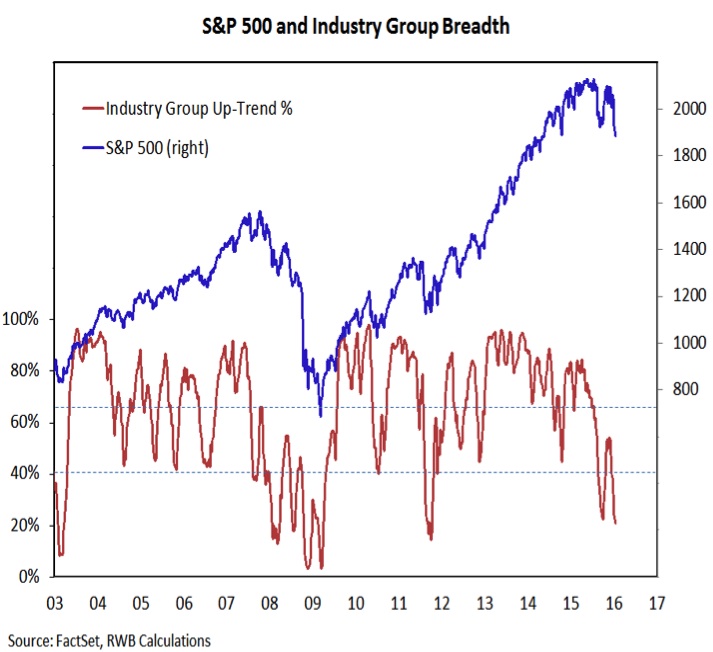

While stocks could rally off of their recent lows, there is little evidence from a market breadth perspective that such a rally could be sustained or that a meaningful low is in place. At best, we are at the beginning of a bottoming phase that will likely require a re-test of the lows. At that point, market breadth indicators could provide some positive divergences and shift the macro stock market outlook to a more favorable one.

At present, those signals are lacking. The percentage of industry groups in up-trends continues to move lower (and leadership at the industry group level is increasingly with large-caps).

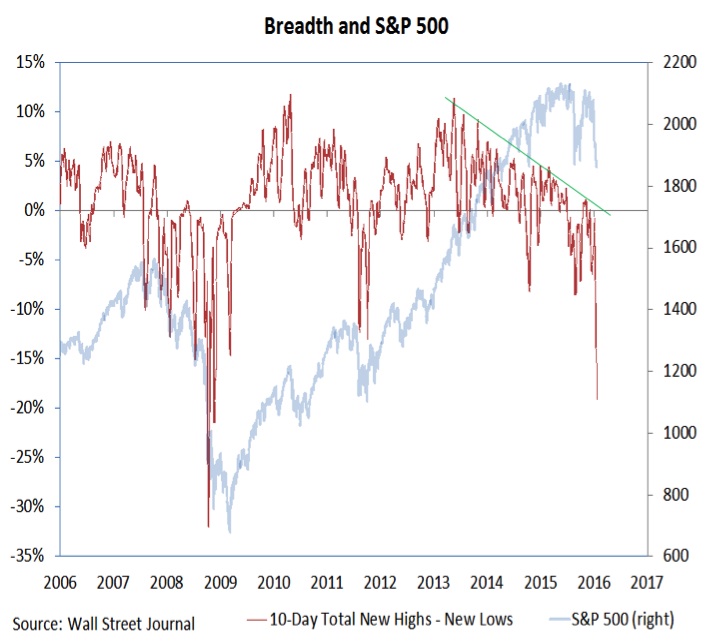

The failure of the individual stock to keep pace with the popular averages is a well-discussed theme. One way to visualize that is by looking at stocks making new highs versus new lows. This market breadth indicator has been in a down-trend since it peaked in 2013, and this week spiked lower. The average stock continues to fully participate on the down-side. The absence of a positive divergence here argues for caution and patience in advance of strong evidence that a sustainable rally has emerged.

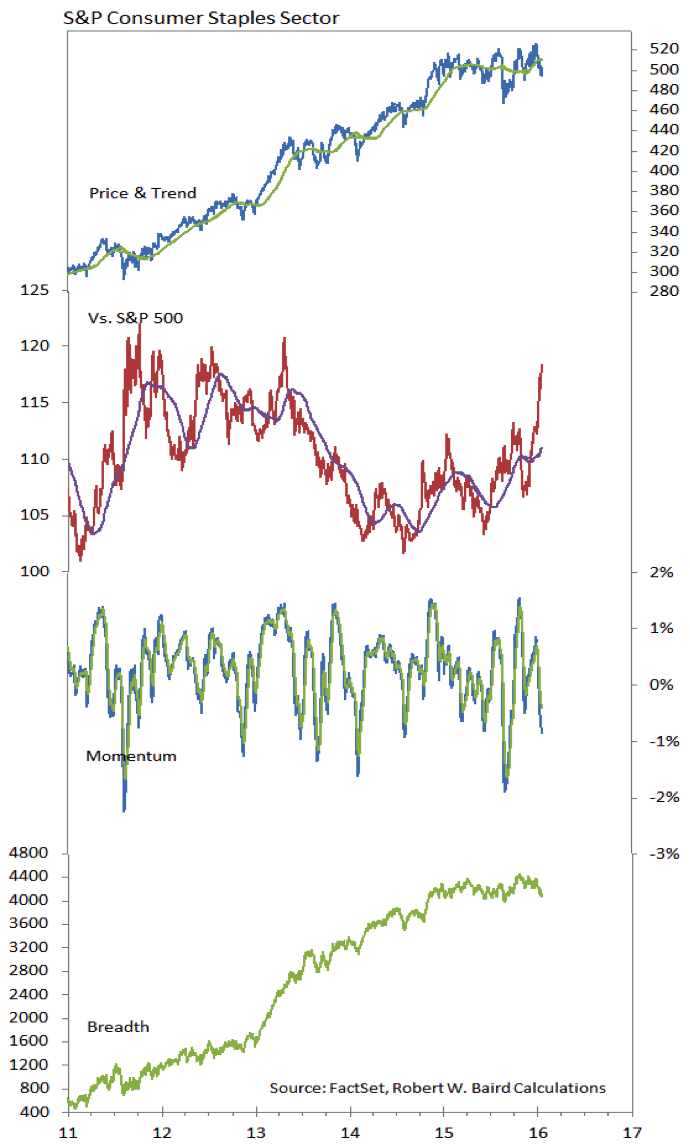

Consumer Staples Breaking Out On A Relative Basis

Consumer Staples continue to hold up well on an absolute basis and are breaking out relative to the S&P 500.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.