Weekly Market Outlook & Technical Review January 13th

In this research note, we will look at some key stock market indicators, the health of the S&P 500 Index (INDEXSP:.INX), and a handful of emerging themes that we are watching in our investing research:

Stock Rally Has Stalled – The S&P 500 remains in consolidation mode despite attempts to break out to the upside. Momentum is fading, and with optimism still widespread, some further near-term retrenchment in prices may be needed before a sustainable rally can emerge. Elsewhere, the Dow Industrials remain flummoxed by the 20,000 level and while the NASDAQ has started strong in 2017, it has been making new highs on narrowing breadth.

Tension Between Implications of Investor and Economic Optimism – Both investor and economic optimism remain elevated. While excessive investor optimism tends to limit near-term upside for stocks, surging economic optimism has historically been a tailwind for stocks.

Bond Yields Testing Support Levels – The rise in economic optimism comes as global economic data surprises to the upside. Bond yields, however, have retreated from their recent highs and are testing support levels that emerged as yields surged higher in the fourth quarter. Also at play is the excessive level of pessimism around bonds.

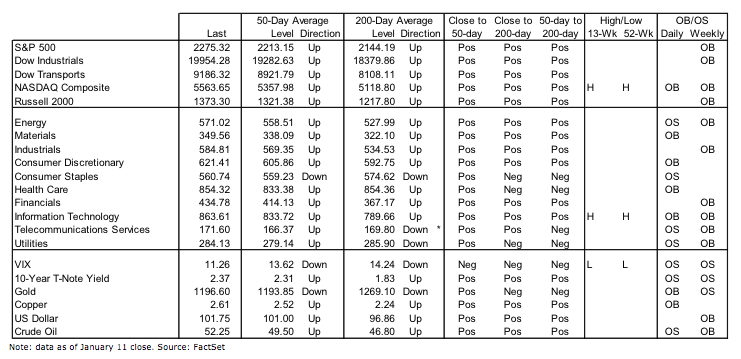

Stock Market Indicators:

S&P 500

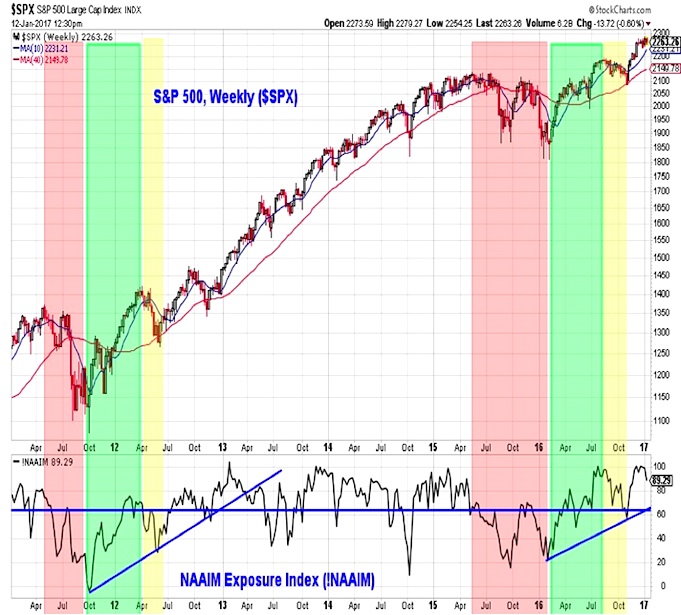

The cyclical up-trend that emerged off of the February 2016 lows remains very much intact. The rally that emerged in the wake of the November elections, however, appears to have run its course. After failing to sustain a breakout to new highs on the S&P 500, a further reset in price and momentum may be need before the next leg of the cyclical rally emerges. If the December lows fail to hold, look for support to build between 2180 and 2220.

Supporting the view that stocks could be due for a near-term pullback is the widespread investor optimism that has remained elevated even as stocks have gone nowhere over the past month. This week’s NAAIM data showed equity exposure among active investment managers slipping slightly. A reading closer to 60% (currently 90%) could suggest that optimism has been sufficiently unwound to support a resumption of the longer-term up-trend in stock prices.

continue reading on the next page…