Investing in an inflationary environment can be challenging. The markets have been volatile, but stocks have trended steadily higher with corporate earnings.

In stagflation, cash and bonds are usually below the rate of inflation, while certain stocks might not fare much better.

It is important to invest into assets that will keep up with the rate of inflation.

The US economy is in a state of stagflation and it’s been that way for quite some time now.

The recent rise in interest rates won’t bring us out any sooner either. We can debate about the merits of recession or no recession, but we are facing slow growth with elevated inflation levels for the forseeable future.

The Federal Reserve has been trying to bring down inflation, but their efforts can only address demand driven inflation.

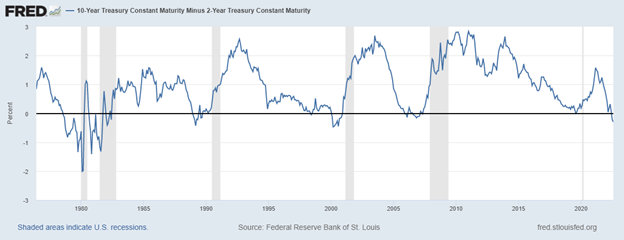

It will be interesting to see how the Fed navigates tightening in this stagflationary environment, particularly now that the yield curve is inverted which is normally a predictor of future recessions.

What we like in Time of Stagflation

Investor expectations of slowing economic growth world-wide have led to a decline in commodity prices in recent weeks, including oil, copper, wheat and corn, after those prices rose sharply following the Russian invasion of Ukraine.

Almost all economic indicators are weakening. We had two consecutive quarters of negative GDP growth, and elevated inflation will be the norm, or stagflation should be considered the “new’ normal.

Core inflation will be sticky and will stay us much longer than people think.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 403 now closest support with 417 resistance

Russell 2000 (IWM) 182.50-183.50 support-maybe move to 190 next

Dow Jones Industrials (DIA) 322-323 support now 331 next resistance

Nasdaq (QQQ) 308.55 support with resistance 319

KRE (Regional Banks) 60 key support-65 resistance

SMH (Semiconductors) 230 now pivotal support 237.50 some resistance

IYT (Transportation) The demand side tran sector cleared the base and now must hold 229.50

IBB (Biotechnology) 125 key to close aboveXRT (Retail) 62 now support to hold with 66.25 big resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.