With the lack of a buyable stock market dip dominating the financial news (see: WSJ’s “Markets’ Steady Climb in 2017 Defies Historic Odds“), many traders are waiting for an opportunity to enter the market on the long side and participate in what is shaping up to be a low volatility melt-up.

But without a pullback to make traders feel like they are getting a good deal, how can they find a good entry? And even more perplexing, are they at risk of buying at a market top?

Numerous timing methods and buy/sell indicators exist to help traders determine if a market is trending, if it is overbought and if it is at risk of pulling back. But most are derivative of price and many require some discretion.

If you’re looking for a measure of the options buying habits of actual market participants, you may want to consider the VXST to VIX trading ratio (or CBOE Short-Term Volatility Index – INDEXCBOE:VXST to CBOE Volatility Index – INDEXCBOE:VIX).

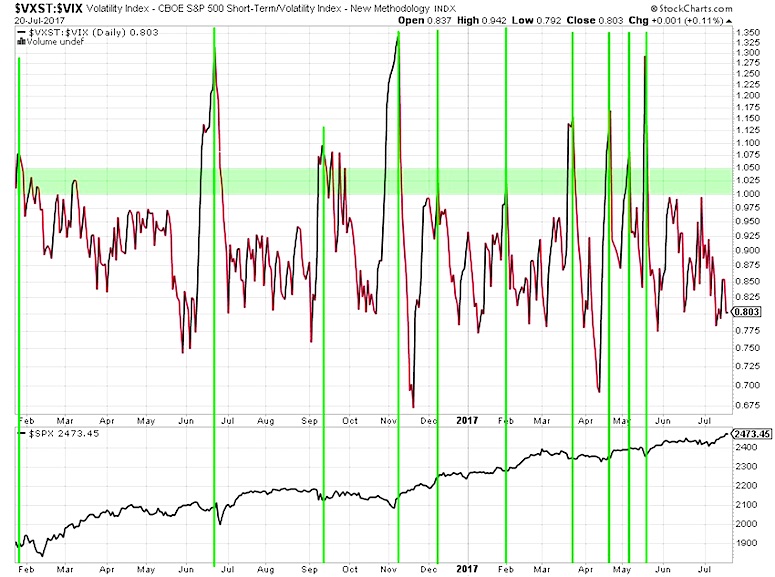

VXST / VIX Volatility Ratio Chart (with Buy Signals)

While no single market indicator or ratio can tell the full picture, the ratio of short term VIX futures (9 days) to longer term VIX futures (30 days) provides traders with a concrete, quantifiable way to understand how professionals are positioning themselves. When the mood shifts to risk off, the ratio typically pops above the 1.0 level (see green region on chart below). As volatility mean reverts, a drop below the 1.0 level often coincides with a rise or at least increased stability in the equity markets (as measured by the S&P 500 index, SPX).

Used in combination with methods, this ratio can provide traders with favorable long equity entry points. For traders that are unwilling to wait for a spike in the ratio, levels can be identified as “safe zones” to provide traders with the increased confidence that they are not buying into a market that is at immediate risk of a pullback.

Thanks for reading.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.