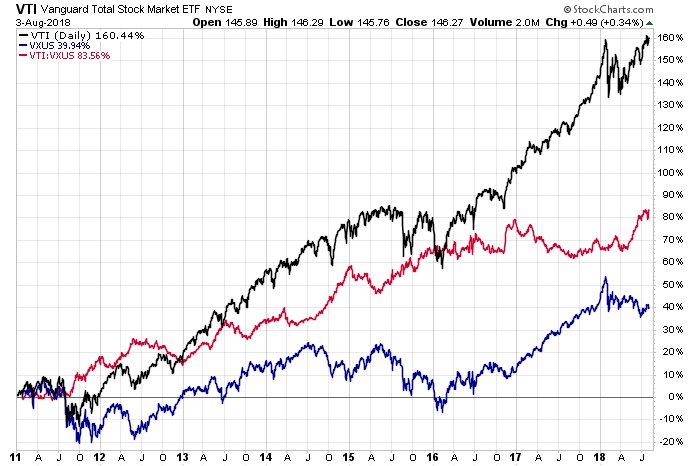

The US stock market continues to crush non-US stocks.

This is nothing new – the trend has been in place since early 2011.

Following the Great Financial Crisis, many well-known pundits and professional money managers were calling for a period of outperformance among international and emerging market stock markets.

While non-US stocks performed well from early 2009 through the spring of 2011, the last several years have been a stellar time for US equity market outperformance.

The Vanguard Total Stock Market ETF (VTI) is a cap-weighted proxy for the US stock market. The Vanguard All-World Ex-US ETF (VXUS) can be thought of as every other stock not domiciled in the USA (includes both developed and emerging economies).

I had a brief tweetstorm on these two ETFs over the weekend, and I thought it would be helpful to provide some context on the ETFs as well as the recent historical performance between the two.

Please feel free to reach out to me for questions and comments regarding the charts and commentary and thanks for reading! You can follow me on twitter: @MikeZaccardi

$VTI USA vs. $VXUS all-world ex-US since 2011

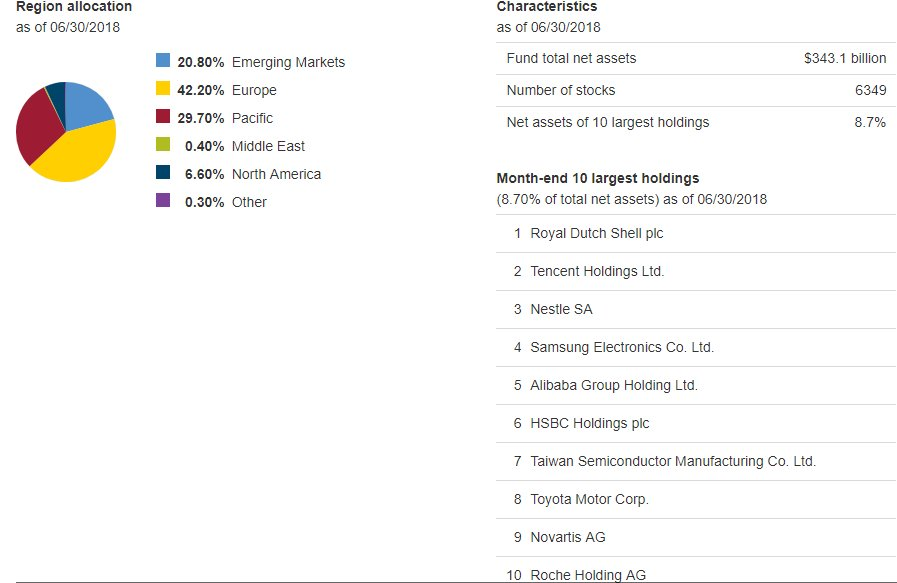

$VXUS Composition *Note that all information in remains 4 charts is sourced from Vanguard.

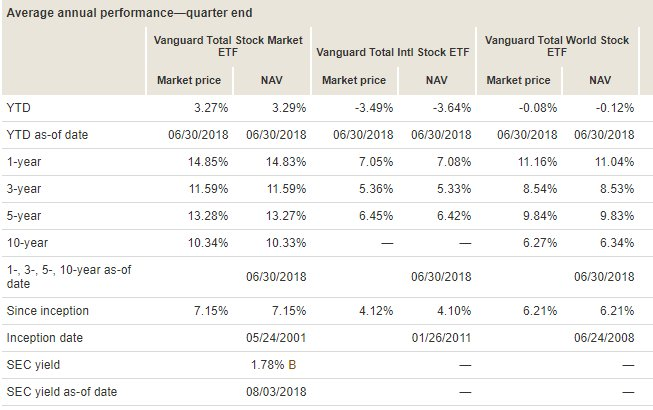

10 Year Extrapolated Annual Returns: $VTI (USA) +10.3% vs $VXUS (Non-USA) +3.0%

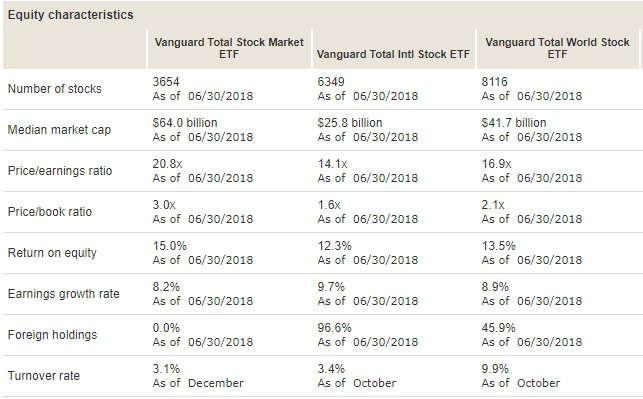

Median Market Cap:

$VTI $64B

$VXUS $26B

Price/Earnings (P/E)

$VTI 21x $VXUS 14x

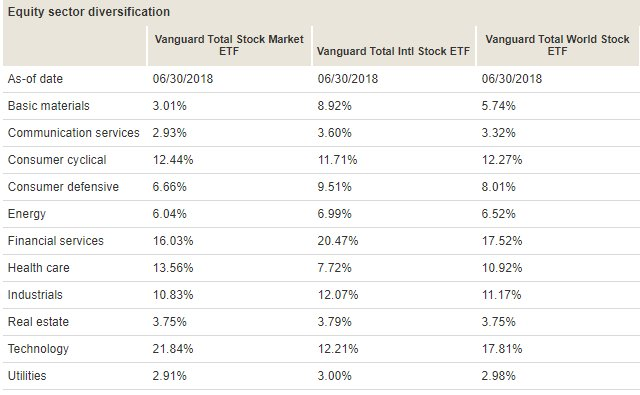

Sector Breakdown:

$VTI 22% in Tech

$VXUS 12% in Tech

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.