This article was written by colleague Christine Short, VP Research, Wall Street Horizon.

Executive Summary

- ESG trends are becoming more important among S&P 500 executives

- Younger investors are more likely to invest with ESG in mind

- There are possible flaws in the ESG movement to consider

- Wall Street Horizon’s corporate event data keeps investors tuned-in to the latest trends and thematic investments

- Two upcoming ESG conferences bear watching while ESG Leaders are set to report earnings in the next month

ESG is now a common term on Wall Street

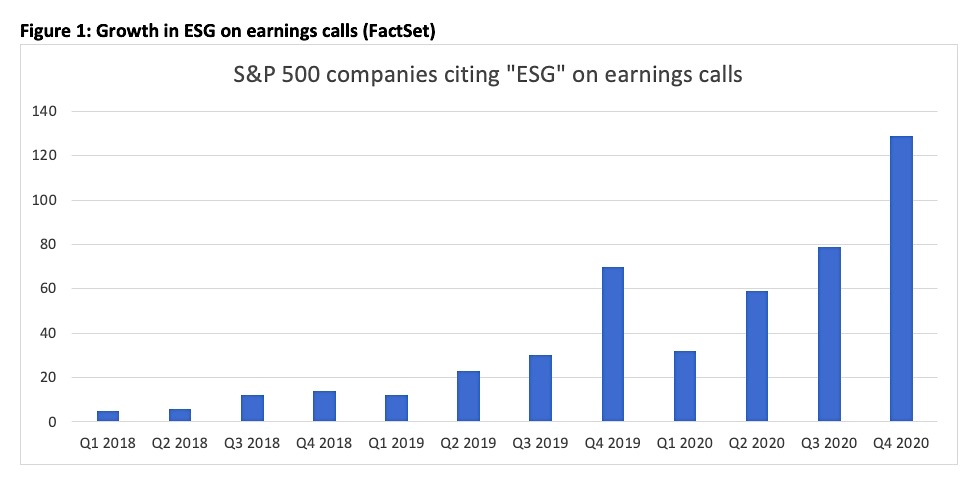

ESG (environmental, society, and corporate governance) continues to move up on corporate managers’ and investors’ priority lists. Each earnings season, we see that more CEOs are mentioning ESG. FactSet tracks this data[i] and found that Q4 2020’s reporting season featured more than a quarter of the index’s constituents cited ESG on conference calls.

Figure 1: Growth in ESG on earnings calls (FactSet)

Profiting from ESG

But how can firms benefit from the ESG trend? And perhaps more importantly, how can a trader capitalize? It all has to do with the ESG factor and firms’ new plans to improve their ESG metrics. Data shows that companies who score well on ESG metrics tend to perform better than stocks with low scores.[ii] Still, there are critics of the movement and the supposed ESG factor’s outperformance.

The critics will say…

Many critics of ESG claim it is mainly virtue-signaling among corporations that remain focused solely on maximizing near-term profits. Another common criticism from stock market participants is that much of the ESG factor’s outperformance in recent years can be attributed to sector weights in popular ESG ETFs (for example, tech stocks have performed better than energy stocks over the last ten years for reasons other than ESG). Finally, it is perhaps ironic that some of the best-performing equities in recent decades have been found in low ESG niches like tobacco and defense stocks[iii]. While there may be holes in the ESG thesis, there’s no doubt investors are taking a stance.

Still, evidence from McKinsey & Company shows that firms with better ESG scores tend to exhibit lower costs of capital[iv]. So higher ESG metrics mean lower costs. That gets the attention of executives if nothing else will.

Investor Interest

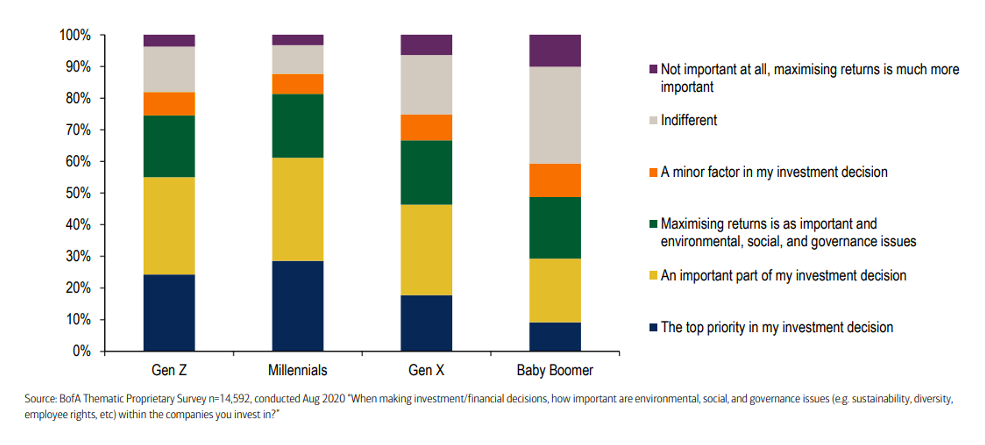

It’s not just the C-Suite. Investors are increasingly interested in putting money with companies “doing good” regarding ESG issues. In general, the younger the investor, the more likely it is that she or he prefers to have investments in stocks with high ESG scores.

Bank of America Global Research[v] finds that Gen X & Gen Z, in particular, are focused on ESG. As assets transition from the Baby Boomer generation to Gen X to Millennials to Gen X & Z, ESG will only grow in relevance. So investors must stay aware of the latest developments in the space.

Figure 2: When making investment/financial decisions, how important are environmental, social, and governance issues (e.g. sustainability, diversity, employee rights, etc.) within the companies you invest in? (Bank of America Global Research)

Using Wall Street Horizon Event Data to improve your ESG investment strategy

We’ve demonstrated the “what?”, but what about the “so what?” and how can Wall Street Horizon’s corporate event data help?

Investors looking to learn more about the latest ESG trends can look no further than the upcoming reporting season set to kick off later this month. Important conferences will also shed light on what corporate managers are doing with assets to align values with dollars. By staying in the know with the latest corporate events and data releases, traders can spot the patterns before the big news sites report them.

Conferences to monitor

Below are two investor conferences Wall Street Horizon has on our radar for clients. ESG trends mentioned could have market-moving impacts on stocks that do business in areas like clean energy, cyber security, data privacy, and workplace safety.

Happening this week is the EnerCom Environmental, Social, and Governance Summit[vi]. This conference will be a hybrid event hosting 100-150 participants with a webcast to a larger registered virtual audience on April 6. A full virtual day of presentations and panel discussions ensues on April 7. The summit will emphasize Corporate Social Responsibility and looks to shape the ESG conversation in the energy-heavy Dallas, Texas area. Many major companies are slated to present, including Devon Energy (DVN), Goodrich Petroleum (GDP), Pioneer Energy (PXD), Northern Oil and Gas, Inc. (NOG), Suncor Energy (SU), Range Resources (RRC). Away from energy, Wells Fargo (WFC) presents Wednesday morning.

Interestingly, the SASB (Sustainability Accounting Standards Board), an independent nonprofit group that sets industry ESG standards, will present on Wednesday morning. This presentation could shed light on emerging ESG scoring and reporting metric standards.

The Wood & Company First Annual ESG: “Prague Spring Symposium” Virtual Event takes place May 17-18[vii]. The Monday-Tuesday Zoom conference will highlight how ESG factors are becoming an essential non-financial aspect of investment decision making. The event aims to provide an informative environment conducive to productive discussions between corporates and investor ESG teams and educational webinars with ESG experts and officials. This ESG-focused event follows Wood’s EM Energy & Commodities April conference and precedes its E-Commerce Prague Spring Symposium.

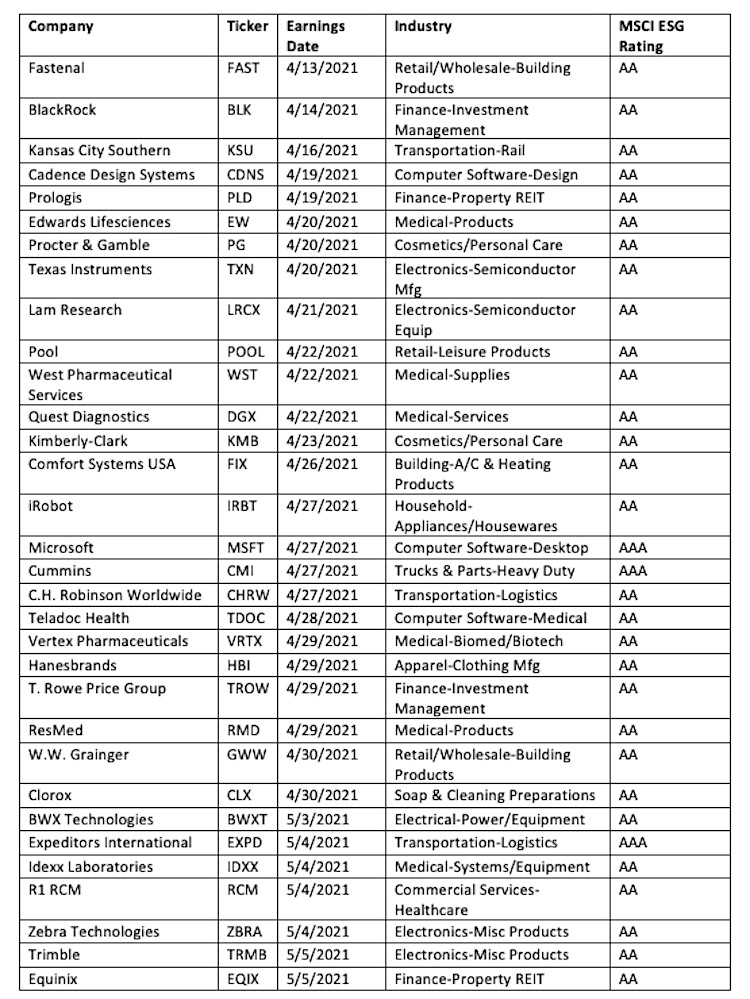

Upcoming Earnings Dates of ESG Leaders

MSCI developed an ESG scoring methodology to help investors identify ESG risks and opportunities[viii]. ESG Leaders are defined as those earning an AA or AAA rating. Using Wall Street Horizon’s corporate event data, below is a chronological list of upcoming earnings dates among big-name ESG Leaders.

Conclusion

COVID-19 was merely a pebble on the road toward an increasing focus on ESG among market participants. Corporate managers seek to lower costs & reduce risk, and tomorrow’s investors have “doing good” top of mind. Portfolio managers must acknowledge the trend and stay on top of the latest developments. Wall Street Horizon’s corporate event data, including conference data and details, helps money managers stay abreast of the latest ESG trends.

[ii] https://www.ussif.org/performance

[iii] https://blogs.cfainstitute.org/investor/2020/09/16/the-esg-performance-paradox/

[vi] https://www.enercomdallas.com/companies-2-2/

[vii] https://events.wood.cz/PragueSpringSymposiumESG

[viii] https://www.msci.com/documents/1296102/1636401/msci_esg_ratings_factsheet+2017.pdf/61e32c80-57fe-4fd9-9965-db951bd559cb

About Christine Short

Christine Short is focused on publishing research on Wall Street Horizon event data covering 8,500+ global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

About Wall Street Horizon

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data including earnings calendars, dividend dates, option expiration dates, splits, investor conferences and more. Covering 8,500 companies worldwide, we offer more than 40 corporate event types. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.