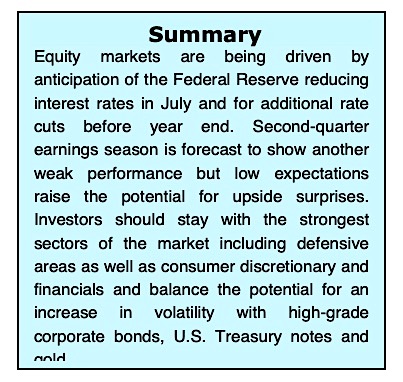

Stocks are being driven in large part by the premise that the Federal Reserve will lower interest rates at their next meeting of the Federal Open Market Committee on July 31.

Federal Reserve Chairman Jerome Powell, in his testimony to Congress last week, stated the case for lowering the federal funds target rate by 0.25 basis points noting persistently low inflation, slower global growth, and U.S. China trade tensions.

The markets are also being inspired by an economy that continues to show steady growth in jobs, solid consumer spending and low interest rates.

Second-quarter earnings season will begin this week. Analysts are estimating that second-quarter earnings for the S&P 500 (NYSEARCA: SPY) will be down 3.0% from a year earlier.

If that does indeed occur, it will mark the first time the index has reported two straight quarters of year-over-year declines in earnings since the first and second quarters of 2016, according to FactSet. Low earnings expectations set up the possibility that announcements may surprise on the upside and provide a bounce in the stock market.

However, investors will be weighing the good economic news and low interest rates against the earnings announcements, global slowdown and trade tensions. Over the weekend White House Trade Advisor Peter Navarro said that the trade battle between the U.S. and China is in a “quiet period” and that talks will resume in the near future.

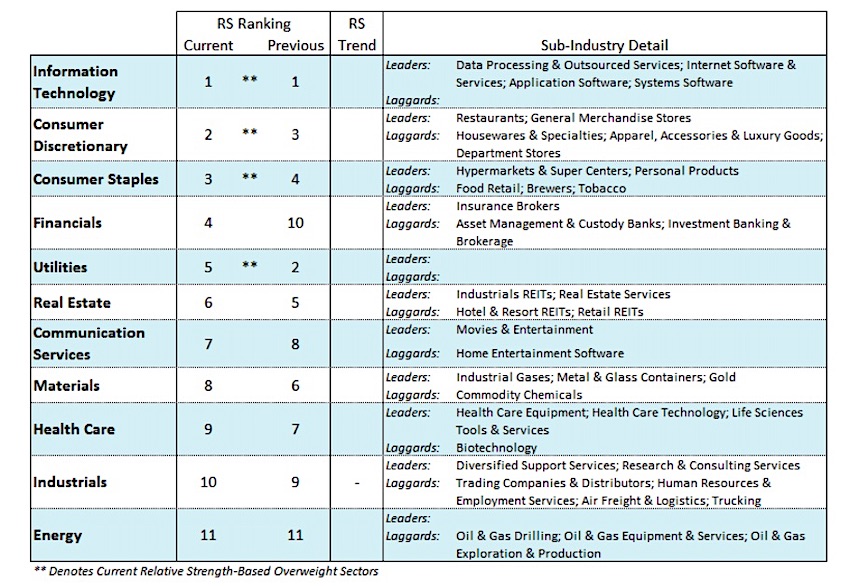

I think investors stay with the strongest sectors of the market which include defensive sectors of consumer staples and utilities as well as consumer discretionary and financial sectors.

Additionally, I think now is a good time for investors to assess their risk tolerance and to consider good-quality corporate bonds and U.S. Treasury notes as well as gold help to balance risk and volatility. If the Federal Reserve cuts its target rate, this could cause the dollar to fall and gold tends to move in the opposite direction of the dollar.

The technical outlook has improved in terms of market breadth. The percentage of S&P 500 stocks trading above their 50-day moving average climbed above 85% last week with the percentage trading above the 200-day average at 75%, matching the September 2018 level. More importantly, the Dow Industrials and NASDAQ reached new highs confirming the new high by the S&P 500 Index.

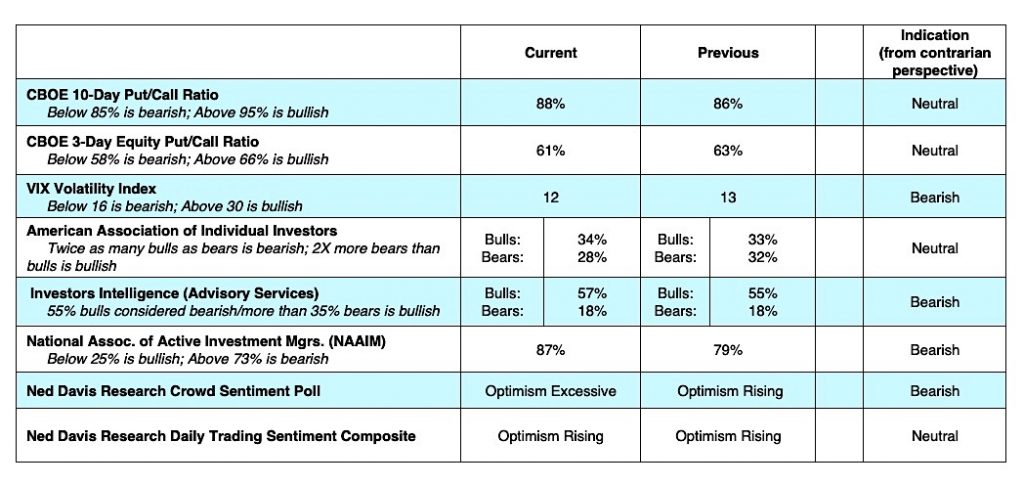

The current rally, however, has attracted increased investor optimism although not yet to levels considered ominous from a contrary opinion perspective. However, a move by the CBOE Volatility Index (12.4) below 11 and or a rise in bulls among the advisory services to 60% (currently at 56%) would suggest near-term caution.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.