All of a sudden the timing of when the U.S. corn crop gets planted so as to optimize yield potential while also minimizing its exposure to heat during pollination takes on greater meaning.

The U.S. corn balance does not have carryin stocks this year of 2.1 to 2.2 billion bushels to offset a slightly below-trend U.S. corn yield aberration or insufficient planted acreage.

What could derail my aforementioned Bullish corn futures point of view?

Other than planted corn acreage coming in above 92 million acres, the most obvious is U.S. corn demand being cut 100 to 200 million bushels, which then defuses the stocks-to-use ratio comparisons to 2013/14.

And that is a very real possibility with the USDA estimating 2019/20 U.S. corn exports at 2.475 billion bushels at the Ag Outlook Forum.

That feels generously high with corn production now expected to rebound in 2018/19 in Brazil and Argentina. To me that is the greatest risk to supply-side Corn Bulls…

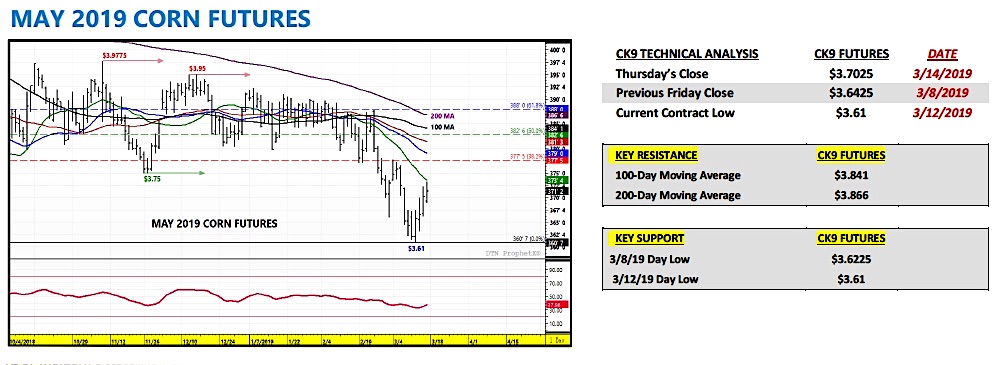

MAY 2019 CORN FUTURES TRADING OUTLOOK

May corn futures carved out a new contract low on Tuesday morning, dropping to a day low of $3.61 per bushel.

However since then corn prices have recovered approximately a dime. This begs the questions…has a March/April low in May corn futures now been established?

Obviously the March Prospective Plantings report on the 29thand the market’s reaction to it will have much to say about whether or not CK eventually makes another push toward the $3.60 level; however even if it does that’s still a break I’d want to own heading into Apr/May.

As of the market closes on Thursday afternoon (3/14) the Managed Money short in corn was estimated at close to -200,000 contracts. That’s a massive short heading into spring planting, regardless of a person’s market bias.

All the supply-side unknown’s for the 2019 U.S. summer growing season are in play for both corn and soybeans as we approach the month of April (i.e. exact acreage totals, spring planting, early summer weather, etc.)

The one glaring negative at the moment…U.S. corn export business has cooled off considerably. Weekly export sales in corn totaled just 14.6 million bushels for the week ending 3/7/2019.

Crop year-to-date U.S. corn exports sales were reported at 1.610 billion bushels; which now trails the previous crop year (2017/18) by 108 million bushels or -6.3%. Meanwhile estimates for Brazil’s 2018/19 corn production continue to inch higher with weather conditions stabilizing and production prospects looking more positive for Brazil’s second corn crop (safrinha). On Tuesday (3/12) Brazilian crop agency Conab raised its forecast for 2018/19 Brazilian corn production to 92.8 MMT versus 91.7 MMT in February and 82.0 MMT in 2017/18. Invariably South American corn supplies from both Argentina and Brazil will now start to displace a percentage of U.S. corn exports on a go-forward basis.

That said, I believe any lingering and potentially price negative commentary on U.S. corn exports will start to fade in comparison to what will be an ongoing weekly (and much more subjective) discussion on U.S. weather and weekly Crop Progress reports.

I’ve gone on the record several times over the last 4-weeks reaffirming my supportive forward view on corn futures (for May/Jun/Jul) due to a tighter 2019/20 U.S. corn balance sheet and that hasn’t changed. Keep in mind that over last 3-crop years (2016-2018) the calendar year day HIGH in December corn futures was made on or after May 22nd.

Therefore, as I said earlier all the supply-side unknown’s for the 2019 U.S. summer growing season remain in play. Strong topside technical resistance in May corn futures currently sits between the 100 and 200-day moving averages from $3.841 – $3.866. On price breaks, I expect the $3.60 level to hold on a closing basis and act as a price floor for the time being.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.