JANUARY 2020 WASDE, CROP PRODUCTION, and GRAIN STOCKS REPORT SUMMARIES:

The much-anticipated January WASDE and Crop Production reports were released on Friday offering the market much to consider as the USDA finalized its 2019/20 U.S. corn and soybean production figures.

Below are highlights, related news, and my analysis:

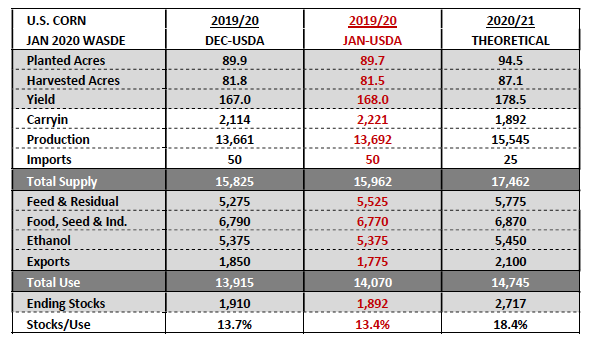

2019/20 U.S. corn production was revised to 13.692 billion bushels.

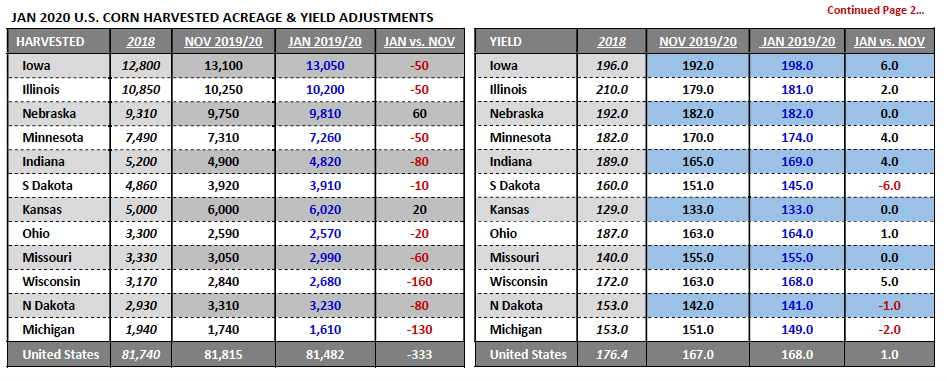

This was 31 million bushels HIGHER than the USDA’s last estimate in November and also 179 million bushels higher than the average trade guess. The USDA raised the U.S. corn yield 1 bushel per acre to 168 bpa while lowering harvested acreage 333,000 acres.

Several state corn yield adjustments were made including Iowa’s corn yield being raised to 198 bpa, up 6 bpa from November and also 2 bpa higher than a year ago.

Illinois, Indiana, and Minnesota also enjoyed yield increases, which meant that 4 out of the top 5 corn producing states in the country saw their corn yields go up from November to January. That said it should be noted that part of the yield increase in each of those 4 states was likely attributed to a harvested acreage decline. Total harvested acreage dropped 50,000 acres in Iowa, Illinois, and Minnesota with Indiana’s harvested acreage declining 80,000 acres versus November.

How did those states impacted by substantial corn harvest delays and an early frost fare in the upper Midwest?

North Dakota’s harvested acreage fell 80,000 acres while its corn yield decreased 1 bpa to 141 bpa. South Dakota experienced a nominal harvested acreage decline of just 10,000 acres; however its state corn yield was reduced 6 bpa to 145 bpa. Wisconsin and Michigan collectively endured a harvested acreage decrease totaling 290,000 acres. There were however states that saw their harvested acreage go up, offsetting some of the losses.

2019/20 U.S. corn ending stocks were revised to 1.892 billion bushels, down just 18 million bushels versus December and 135 million bushels HIGHER than the average trade guess.

The USDA raised Feed and Residual use 250 million bushels while lowering U.S. corn exports 75 million bushels month-on-month 1.775 billion bushels. I’m going to attribute the USDA’s increase to Feed and Residual use as a hedge against potentially over-estimating the 2019/20 U.S. corn crop in this report (not dissimilar to a 2018/19).

December 1, 2019 U.S. corn stocks were estimated at 11.389 billion bushels. This was BELOW the average trade guess of 11.511 billion bushels and also down nearly 550 million bushels from December 1, 2018. Corn Bulls were clinging to the corn stocks figure, as it was the only mildly supportive figure released by USDA/NASS on Friday.

What are my lasting impressions of the USDA’s January figures on corn?

I thought the USDA’s U.S. corn S&D adjustments were largely Bearish other than the aforementioned “lower than expected” Dec 1 corn stocks figure. However I view the Dec 1 corn stocks estimate as having a greater impact on basis values versus futures prices. The reality is as we project forward to 2020/21 on paper it appears U.S. corn ending stocks could exceed 2.7 billion bushels in the USDA’s initial 2020/21 U.S. corn S&D forecast this May. This implies a revised U.S. corn carryin stocks forecast of 1.892 billion bushels and then also incorporates the USDA’s November 2020/21 “Baseline” planted acreage (94.5 million acres), yield (178.5 bpa), and usage projections (total demand of 14.745 billion bushels).

The world corn numbers were also largely Bearish in the January WASDE report. 2019/20 Argentina and Brazil corn production estimates were unchanged at 50 and 101 MMT respectively. Ukraine corn production was also static at 35.5 MMT. Therefore all the 3 major, non-U.S. corn exporters are still on pace for record to near record corn crops.

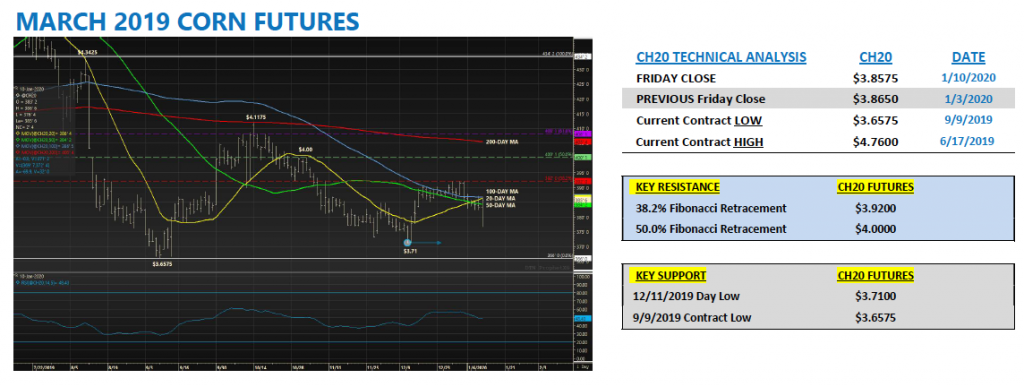

MARCH 2020 CORN FUTURES TRADING OUTLOOK (chart should read “March 2020 Corn Futures”)

March corn futures recovered after an initially selling-off after the release the January Crop Production report; however week-on-week CH20 still closed down ¾-cents per bushel.

What’s next for the corn market?

Therein lies the problem for Corn Bulls. I’ve stated for the last several weeks that Corn Bulls needed a sharply lower 2019/20 U.S. corn production figure from the USDA in the January 10 Crop Production report and they simply didn’t get it. There was virtually nothing supportive in either the USDA’s Jan WASDE, Crop Production, and/or Grain Stocks reports. As I said earlier the lower than expected Dec 1 corn stocks estimate will likely have a greater impact on corn basis levels than on futures prices. Illinois, Indiana, and Ohio all showed substantial year-on-year declines in Dec 1 corn stocks, along with South Dakota in the Western Corn Belt. That said expect those 4 states in particular to continue to see basis values trade at a premium to the last 5-years.

However overall…outside of the possibility of the U.S-China “phase one” trade deal igniting a resurgence in U.S. ethanol exports to China, I don’t see much of anything for Corn Bulls to grasp onto regarding fundamental price support for at least the next 3-months.

It’s likely going to take a significant problem with Brazil’s safrinha corn crop, which is still approximately a month away from being planted. Therefore the corn market is entering a period without a major storyline. And markets without a story tend to drift sideways to lower over time…

Keep in mind over the last 5-years (2015 – 2019), March corn futures have only closed over $3.90 on one occasion during the months of February and March; and that was on February 9th, 2015 ($3.91 ¼).

With 2020/21 U.S. corn carryin stocks currently estimated at a more than adequate 1.892 billion bushels and 2020/21 U.S. corn planted acreage expected to increase approximately 4.5 million acres, I’m not sure what changes the calculus in 2020.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.