Corn news and data reports / analysis for the week ahead:

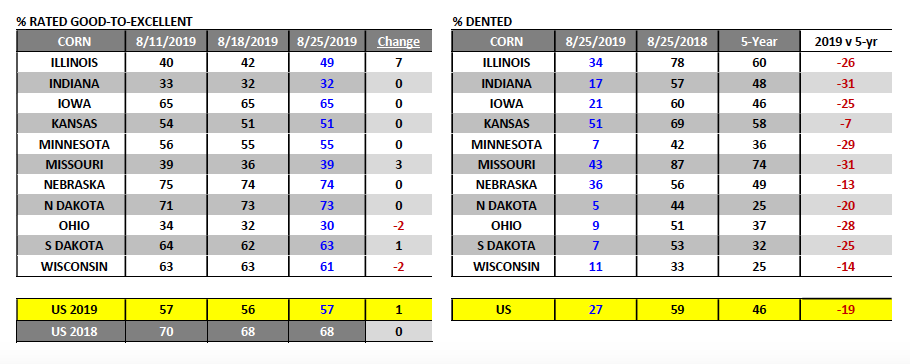

Monday’s Weekly Crop Progress report showed the U.S. corn good-to-excellent rating improving 1% week-on-week to 57% versus 68% a year ago. And Corn prices NYSEARCA: CORN remain suppressed.

Illinois’s rating jumped 7% to 49% good-to-excellent; however this was still well below its rating from a year ago of 76% good-to-excellent as of 8/26/2018. Missouri also enjoyed a counter-seasonal 3% increase in its good-to-excellent rating.

Meanwhile Iowa, Indiana, and Minnesota all had unchanged good-to-excellent ratings week-on-week. Iowa’s corn crop was rated 65% good-to-excellent versus 73% in 2018, Indiana 32% good-to-excellent versus 70% in 2018, and Minnesota 55% good-to-excellent versus 75% in 2018.

Also of note 71% of the U.S. corn crop was reported as being in the “dough” stage versus 91% in 2018 and the 5-year average of 87%. Just 27% of the U.S. corn crop was “dented” versus 59% a year ago and the 5-year average of 46%.

Current forecasts still suggest below-normal temperatures prevailing across the Midwest through September 10th; however a major frost event is not expected at this time.

Wednesday’s Weekly EIA report showed U.S. ethanol stocks falling to 22.982 million barrels, down from 23.367 million barrels the week prior.

This represented the lowest U.S. ethanol stocks figure since the week ending June 28th, 2019 (22.844 million barrels). Despite the stocks decline and recent reports of ethanol plants curtailing run-rates due to negative operating margins, U.S. weekly ethanol production actually increased week-on-week to 1.038 million barrels per day, which was also slightly higher than the 4-week average of 1.037 million barrels per day.

That said when should we expect to see the effects of ethanol plant slowdowns? I would assume this pattern will start to emerge in industry production figures as early as next week’s EIA stats, which will include data through the week ending 8/30/2019.

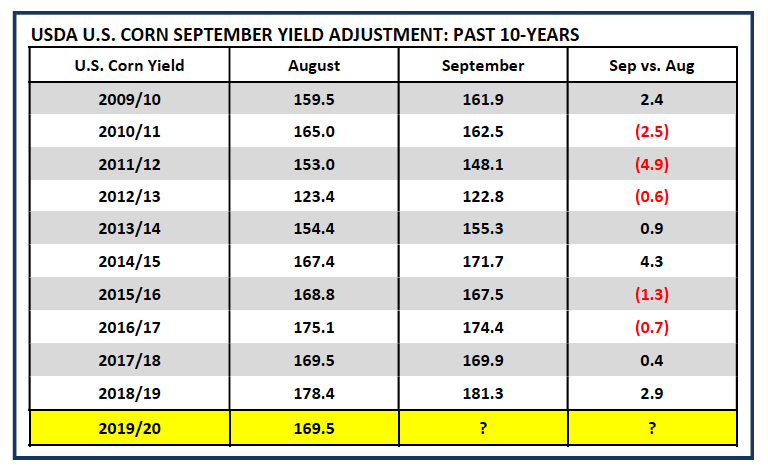

Traders are quickly shifting their attention to the September 2019 WASDE report, which will be released on 9/12. A couple key questions heading into that report are as follows:

- What sort of cut could the USDA make to its 2019/20 U.S. corn yield estimate in the September report, relative to its August forecast of 169.5 bpa? Over the last 10-years the largest August to September corn yield reduction has been -4.9 bpa in 2011/12. That would seem to suggest a yield decrease to 164.6 bpa is in play for the September 2019 WASDE report. This would equate to a total production decline of approximately 400 million bushels. Furthermore assuming no adjustments are made to 2019/20 carryin stocks and/or demand, U.S. corn ending stocks would fall to 1.781 billion bushels.

- Will the USDA make adjustments to 2019/20 U.S. corn carryin stocks and/or demand? I would say there’s a super strong probability the USDA will at a minimum increase 2019/20 U.S. corn carryin stocks in the September 2019 WASDE report. Why? Monday’s Export Inspections report showed crop year-to-date U.S. corn export shipments for 2018/19 at 1.842 billion bushels. The 2018/19-marketing year for exports ends on August 31st, 2019. That said in the August 2019 WASDE report the USDA was still forecasting 2018/19 U.S. corn exports of 2.100 billion bushels. Therefore that figure will have to come down in the September report, the only question being how much.

Can the September Crop report stop the bleeding in corn futures prices?

If the U.S. corn S&D could enjoy the full effect of solely a 4 to 5 bpa cut to the U.S. corn yield, I would say yes…corn futures would likely stabilize. The problem being however, the production losses will once again likely be mitigated due to continued cuts to both U.S. corn exports and ethanol-grind demand sectors. Bulls need to hope for an unexpected cut to harvested acreage in addition to a tangible yield reduction.

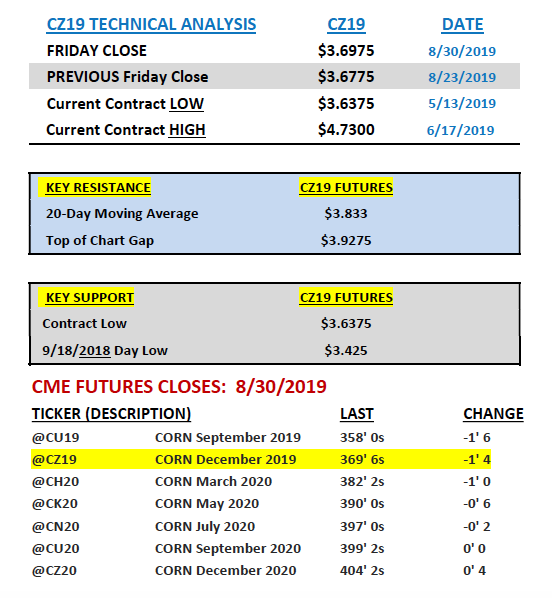

Itwas a fairly uneventful week in the corn market with December corn futures momentarily challenging the current contract low of $3.63 ¾ on Wednesday morning. The market tried to bounce on Thursday following a charity tweet by President Trump suggesting a “giant package” was coming for the ethanol industry. That rally however proved extremely short-lived with CZ unable to find enough buy paper to sustain a close back over $3.75 per bushel. CZ19 closed on Friday afternoon at $3.69 ¾.

Where does CZ go from here?I still believe December corn futures will at some point fill the gap back up $3.92 ¾, which was created after the August 2019 WASDE report. However the timing of such a move could be delayed until October if the September 2019 WASDE doesn’t show a measurable drop in 2019/20 U.S. corn ending stocks back under 1.8 billion bushels.

My current fear is that even if the USDA lowers its corn yield estimate 4 to 5 bpa (resulting in a 350 to 400 million drop in production), 2019/20 carryin stocks are likely to go up by as much as 100 to 150 million bushels (thereby offsetting a sizable percentage of the production decline). In fact since the February 2019 WASDE report, 2019/20 U.S. corn carryin stocks (or 2018/19 U.S. corn ending stocks) have increased 625 million bushels (see page 4).

The reality is had carryin stocks stayed static at the February forecast of 1.735 billion bushels, even with this year’s unexpected 90 million corn acres, 2019/20 U.S. corn ending stocks would currently be 1.556 billion bushels instead of 2.181 billion bushels. What caused the increases in carryin stocks? Primarily decreases to U.S. corn-ethanol demand and exports, which collectively added up to a 500 million bushel reduction in total demand. Demand losses have hurt the corn market more than anything else over the last 6 to 8-months.

At the moment I see CZ19 continuing to trade in a relatively tight trading range from $3.60 to $3.75, which is consistent with the 15-year price seasonal. Let’s hope the September 2019 WASDE report and/or the perceived threat of an early frost-freeze event jump start this market back to the upside in early September.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.