United Parcel Service (NYSE:UPS) traded 3% higher on Wednesday morning, after posting earnings that beat Wall Street expectations.

The company reported earnings per share of $1.94 and total revenue of $17.5 billion, above analyst estimates of $1.92 and $17.3 billion.

With regard to FY 2018, they reiterated their earnings guidance of $7.03-7.37, compared to estimates of $7.25 per share.

Explained CFO Richard Peretz, “UPS is focused on executing our strategic imperatives for improved efficiency and high-quality growth. We remain confident in our ability to achieve our full-year adjusted earnings per share target.”

While the company is enjoying substantial growth from ecommerce, it continues to face competition from companies such as FedEx and even Amazon. Having recently opened a new sorting facility in Atlanta, it remains to be seen if UPS can continue to modernize equipment and processes at fast enough to stay competitive.

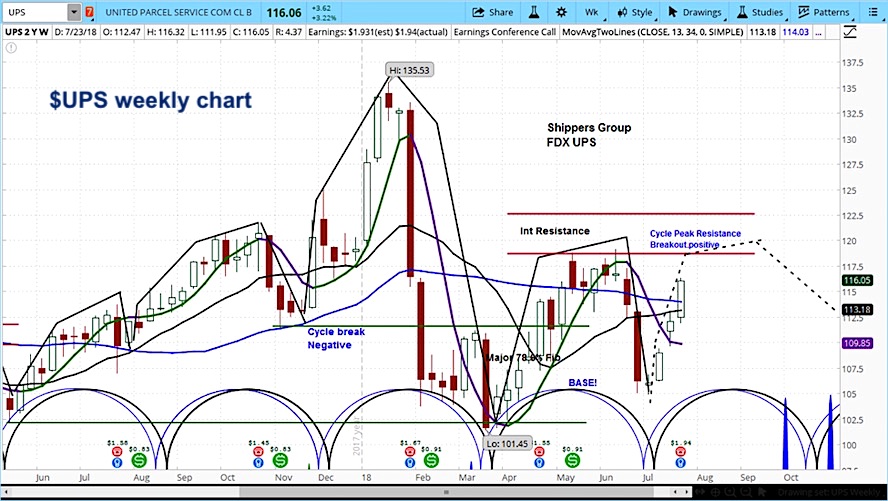

In analyzing the UPS market cycles, we can see that the stock is in the rising phase of its current cycle and is moving towards a resistance zone. Having built a perfect cycle base, breaking the last cycle’s high would be a positive indicator.

Our near-term objective is $119.

United Parcel Service (UPS) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.